Phil Mickelson isn't the first pro golfer to hold the belief that the taxes in California are too high.

Tiger Woods, the world's third highest-paid athlete, moved from California for that very reason, he said Tuesday at the Farmer's Insurance Open.

The remarks Woods made were in response to Mickelson's suggestion that "drastic changes" were in store for him because of changes in federal and state taxes.

When asked what his reaction was to Mickelson's criticisms, Woods said he agreed with his fellow golfer, but acknowledged that the issue could have been explained more delicately.

"I moved out of here back in '96 for that reason," Woods said of the taxes. "I enjoy Florida, but also I understand what he was, I think, trying to say. I think he'll probably explain it better and in a little more detail."

According to Forbes, Woods was the highest-paid athlete in the world from 2001 until last year when he was unseated by boxers Floyd Mayweather Jr. and Manny Pacquiao.

Woods now makes just under $60 million. In 2009, the financial magazine wrote he would be the first professional athlete to make over a billion dollars -- before taxes.

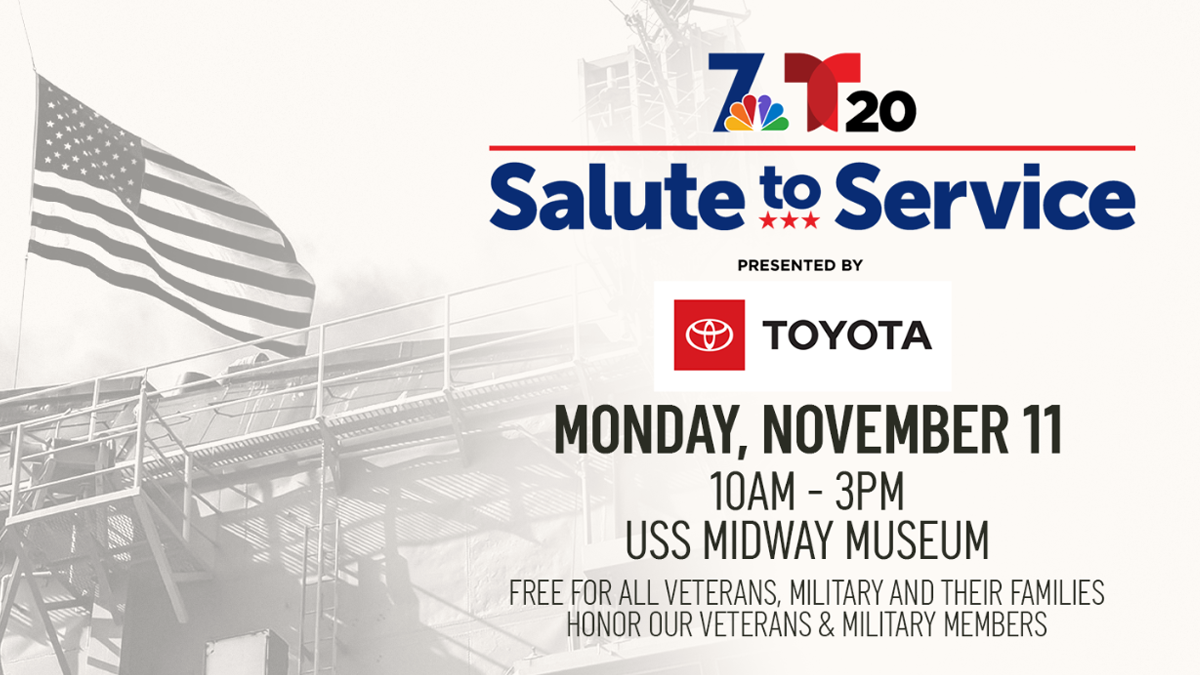

Local

Mickelson, a Rancho Santa Fe resident, told the Associated Press that federal and state taxes tap now into more than 60 percent of his income.

"If you add up all the federal and you look at the disability and the unemployment and the Social Security and the state, my tax rate's 62, 63 percent," Mickelson said. "So I've got to make some decisions on what I'm going to do."

Mickelson later apologized for his comments, saying he should have kept his opinions on taxes to himself.