All three major averages notched record closes on Friday, rebounding from the previous session's losses over concerns of a slowdown in global economic growth.

Stream San Diego News for free, 24/7, wherever you are with NBC 7.

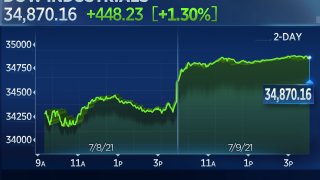

The Dow Jones Industrial Average rose 448.23 points, or 1.3%, to a record close of 34,870.16. The S&P 500 bounced by about 1.1%, closing at an all-time high of 4,369.55. The technology-heavy Nasdaq Composite rose just shy of 1% to close at a record of 14,701.92.

The S&P 500 earned its sixth week of gains in seven.

Get top local San Diego stories delivered to you every morning with our News Headlines newsletter.

Friday's comeback brought all three majors averages into the green for the week. The Dow rose 0.2% for the week. The S&P 500 and Nasdaq gained 0.4% and 0.4% since Monday, respectively.

The stocks that led the losses on Thursday, reopening plays and banks, notched gains on Friday. Bank of America jumped about 3.3%, leading a bounce in financial shares. Royal Caribbean popped 3.6% and Wynn Resorts gained close to 2%. American Airlines and United Airlines both gained more than 2%.

The small cap benchmark Russell 2000 rallied more than 2% on Friday.

Money Report

Shares of General Motors gained 4.8% after Wedbush said the stock is a buy and could jump more than 50% as investors realize the extent of its tech and electric vehicle evolution.

Big Tech stocks' gains were capped on Friday as President Joe Biden signed a new executive order aimed at the competitive practices by the sector's giants. Amazon fell 0.3% after hitting a new all-time high on Thursday.

The yield on the 10-year Treasury rebounded 7 basis points to 1.36%, easing concerns about an economic slowdown (1 basis point is 0.01%). Falling yields have mystified investors lately, with the 10-year yield falling to 1.25% at its low on Thursday.

Thursday's losses, which saw the Dow drop nearly 260 points, came as the proliferation of the highly infectious delta Covid variant also fueled worries about the global economic comeback. The Olympics announced a ban of spectators at Tokyo's summer games as Japan declared a state of emergency to curb the spread of coronavirus.

"Our central case has been for a choppy July" with the S&P 500 falling as low as 4,100, wrote Tom Lee, Fundstrat's head of research, in a note to clients Thursday night. "While this is a possibility, we think there is a chance [Thursday] marked the peak of [the] 'growth scare' and if this is correct, equities might be shifting toward a broader risk on."

Further, the latest jobless claims report released Thursday indicated a potential slowdown in the labor sector.

"The market is solidly mid-cycle and with that typically comes a 10-15% index level correction. We expect such a correction will create buying opportunities given a still strong growth backdrop," Mike Wilson, Morgan Stanley's chief U.S. equity strategist, told clients. Wilson favors financials, healthcare and materials.