Here are the most important news, trends and analysis that investors need to start their trading day:

- Wall Street to open higher after back-to-back Dow gains

- Fed chief Powell set to participate in IMF economic event

- Two major U.S. airlines forecast profits down the line

- Tesla beats on earnings, revenue; Musk mum on Twitter bid

- Pershing Square's Bill Ackman dumps big Netflix stake

1. Wall Street to open higher after back-to-back Dow gains

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

U.S. stock futures rose Thursday, with the Nasdaq set to join the rally, ahead of an afternoon panel discussion including Federal Reserve Chairman Jerome Powell. First-quarter earnings reports drove premarket moves, with Tesla soaring 7% after better-than-expected results and American and United surging 11.5% and 8.5%, respectively, after the airlines forecast profits ahead. The Dow Jones Industrial Average advanced 0.7% on Wednesday for a second straight day of gains. The S&P 500 dipped but basically ended flat. The Nasdaq lost 1.2% as Netflix cratered 35% on subscriber concerns. The streaming giant fell another 1.5% in Thursday's premarket.

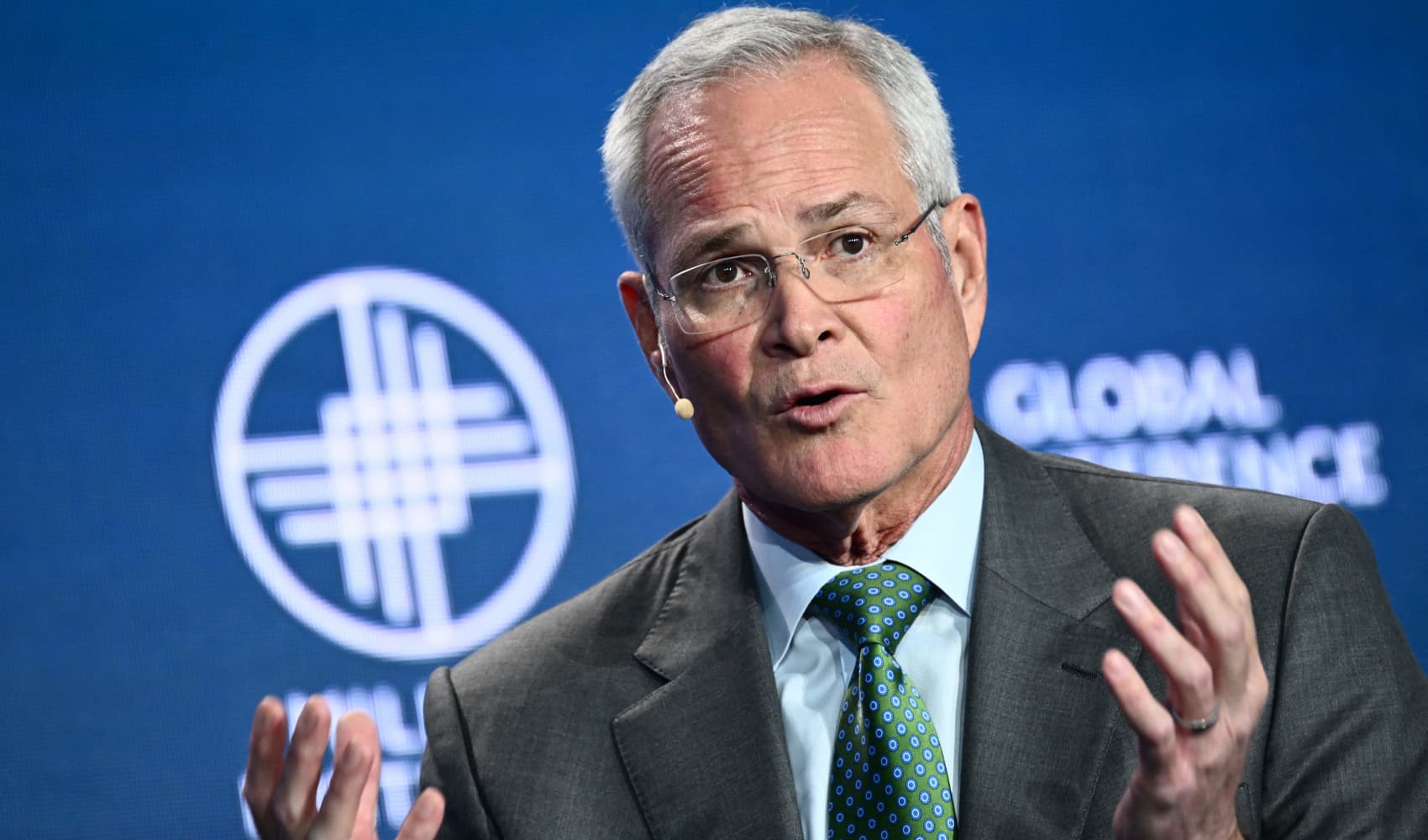

2. Fed chief Powell set to participate in IMF economic event

The 10-year Treasury yield rose Thursday but remained below Tuesday's more than three-year high of 2.94%. Investors are hoping for more clarity from Powell on the Fed's plans for additional interest rate hikes this year after a number of regional central bank presidents, even a couple of doves, have recently called for an accelerated tightening cycle to fight inflation. Powell is set to join an International Monetary Fund debate on the global economy, starting at 1 p.m. ET. Before the opening bell Thursday, initial jobless claims came in slightly higher than estimates at 184,000 for the week ended April 16.

Money Report

3. Two major U.S. airlines forecast profits down the line

American Airlines on Thursday forecast second-quarter profit as strong travel demand helps it cover its soaring fuel costs. That's driving the stock higher in the premarket. American said it had a loss of $2.32 per share in the first quarter, which was smaller than expected. Revenue also beat estimates. The carrier said it paid $2.80 per gallon for fuel in the first quarter, up 65% from last year. American stopped hedging fuel after oil prices cratered in 2014.

After the closing bell Wednesday, United Airlines said it lost an adjusted $4.24 per share in the first quarter, slightly more than expected. Revenue also missed. But driving the stock higher, United joined Delta in saying it expects to turn a profit in 2022 for the first time since before the Covid pandemic as bookings rise and passengers appear willing to pay more to fly. Delta, Southwest and JetBlue shares were also being pulled higher in the premarket.

4. Tesla beats on earnings, revenue; Musk mum on Twitter bid

Tesla's jump in premarket trading came after the electric auto maker late Wednesday reported first-quarter earnings and revenue that beat estimates. Revenue growth was driven in part by an increase in the number of cars Tesla delivered and a rise in average sales prices. The company posted record quarterly automotive margins of 32.9%. On the post-earning call, management said Tesla lost about a month of "build volume" at its Shanghai factory due to the Covid lockdown of China's biggest city. CEO Elon Musk, who was on the call, made no mention of his bid to buy Twitter.

5. Pershing Square's Bill Ackman dumps big Netflix stake

Pershing Square dumped its entire stake in Netflix on Wednesday following the streaming service's disappointing quarterly report, founder and CEO Bill Ackman said in a letter to shareholders. Ackman disclosed his purchase of more than 3.1 million shares of Netflix in January. He became a top 20 shareholder in Netflix after buying a dip in the stock earlier this year. "One of our learnings from past mistakes is to act promptly when we discover new information about an investment that is inconsistent with our original thesis, Ackman wrote. "That is why we did so here."

— CNBC's Hannah Miao, Vicky McKeever, Peter Schacknow, Leslie Josephs and Lora Kolodny contributed to this report.

— Sign up now for the CNBC Investing Club to follow Jim Cramer's every stock move. Follow the broader market action like a pro on CNBC Pro.