Here are the most important news, trends and analysis that investors need to start their trading day:

- Futures drop after worst day for Dow, Nasdaq since 2020

- Jobs growth accelerates in April: Nonfarm payrolls better than expected

- Oil jumps as EU considers Russian crude sanctions; bitcoin sinks

- FDA limits use of J&J's Covid vaccine over blood clotting risks

- Under Armour sinks after issuing weak guidance, unexpected loss

1. Futures drop after worst day for Dow, Nasdaq since 2020

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

U.S. stock futures turned positive and then negative again Friday after of the government's strong April jobs report. The 10-year Treasury yield moved higher Friday, above Thursday's trip above 3.1%, a high back to November 2018. Rising bond yields Thursday sparked a stock market plunge that wiped out the prior day's strong Federal Reserve relief rally and then some.

- The Dow Jones Industrial Average lost 1,063 points, or 3.1%, on concerns the Fed's tightening cycle to slow the economy won't get inflation under control. The tech-heavy Nasdaq fell nearly 5% to its lowest closing level since November 2020, falling further into a bear market. Both of those declines broke three-day winning streaks and were the worst single-day drops since 2020.

- The S&P 500 fell nearly 3.6% for its second worst day of the year. The S&P 500 and the Dow were in corrections.

2. Jobs growth accelerates in April: Nonfarm payrolls better than expected

The Labor Department on Friday morning reported a better-than-expected 428,000 nonfarm jobs were added to the U.S. economy in April. The unemployment rate last month held steady at 3.6%. A slight dip had been expected. Average hourly earnings in April rose a slightly less-than-expected 0.3% month over month and matched estimates with a 5.5% year over year gain.

- The report shows that jobs remain tight even as inflation remains high. Contributing to Thursday's stock market sell-off was the government's first-quarter report showing the steepest decline in worker productivity in 75 years and soaring labor costs.

3. Oil jumps as EU considers Russian crude sanctions; bitcoin sinks

U.S. oil prices rose roughly 1.5% on Friday, around $110 per barrel, shrugging off concerns about global economic growth as proposed European Union sanctions on Russian oil raised the prospect of tighter supply. West Texas Intermediate crude, the American benchmark, and the Brent crude global benchmark were both on track for second straight weekly gains.

Bitcoin fell below $36,000 on Friday, one day after Wall Street's nosedive. The world's largest cryptocurrency, touted by proponents as an inflation hedge, remained correlated to the Nasdaq, falling or rising in tandem with tech stocks. Bitcoin has dropped nearly 50% from its all-time high of more than $68,000 in November, with risk assets slammed in 2022 by rising inflation, Russia's war in Ukraine and tighter Fed policy.

Money Report

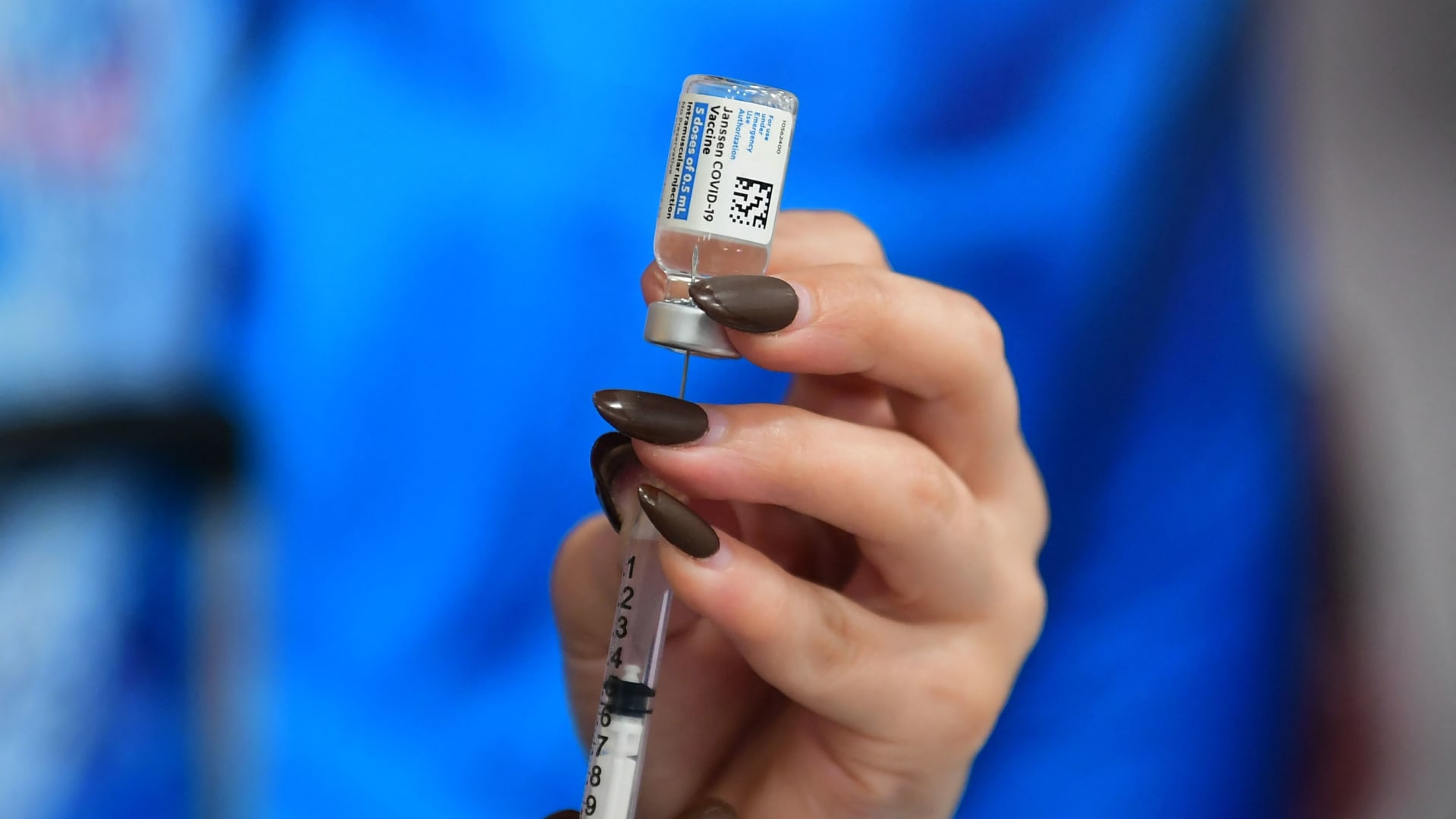

4. FDA limits use of J&J's Covid vaccine over blood clotting risks

The Food and Drug Administration has decided to limit the use of Johnson & Johnson's Covid vaccine for adults due to the risk of a rare blood clotting syndrome. The J&J's vaccine is one of the three cleared for use in the United States. The FDA said Thursday the J&J shot can be administered in cases where Pfizer or Moderna Covid vaccines are not accessible or if an individual doesn't want to get the other shots. The U.S. health agency said its analysis of the risk of clotting issues after receiving the J&J vaccine warrants limiting the authorization.

5. Under Armour sinks after issuing weak guidance, unexpected loss

Under Armour shares dropped more than 15% in Friday's premarket, shortly after the sneaker and apparel maker issued a disappointing outlook for fiscal 2023. In its just ended March quarter, Under Armour reported an unexpected loss and sales that came in below Wall Street estimates. Global supply chain challenges and another round of Covid lockdowns in China put a dent in demand. A number of international corporations, including Apple and Estee Lauder, have warned in recent days that a drag from China's Covid controls will hit their businesses.

— CNBC's Hannah Miao, Jesse Pound, Tanaya Macheel, Vicky McKeever, Jeff Cox, Patti Domm and Lauren Thomas as well as Reuters contributed to this report.

— Sign up now for the CNBC Investing Club to follow Jim Cramer's every stock move. Follow the broader market action like a pro on CNBC Pro.