- GIC, which is among the world's largest investors, painted a rather bleak picture of the global environment.

- "Years of concerns over deflation have turned into worries of elevated inflation, forcing economic policymakers to reverse stimulus policies," said Chief Executive Lim Chow Kiat in the report.

- The fund's portfolio recorded an annualized dollar nominal rate of return of 7% over a 20-year period ending March 31, 2022, the fund said in its annual report published on Wednesday.

Singapore's sovereign wealth fund GIC reported stable returns for the year but warned of "profound uncertainties" as investors face worries about inflation, pandemic risks and geopolitical challenges.

The fund's portfolio recorded an annualized dollar nominal rate of return of 7% over a 20-year period ending March 31, 2022, GIC said in its annual report published on Wednesday.

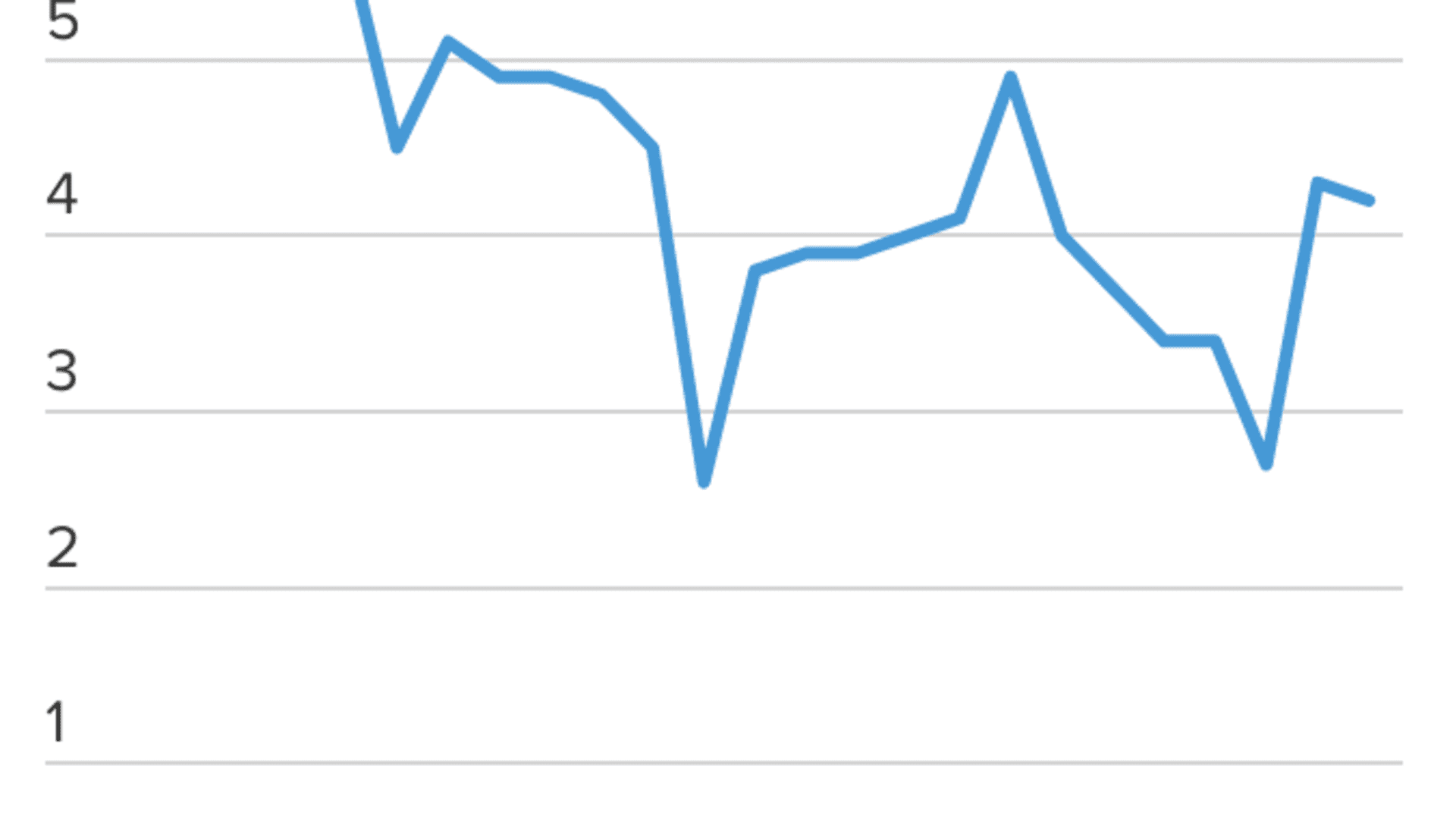

It also achieved an annualized rolling 20-year real rate of return of 4.2 % for the period ending March 31, after stripping away inflation. GIC doesn't publish annual results.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

Still GIC, which is among the world's largest investors, painted a rather bleak picture of the global environment.

"Years of concerns over deflation have turned into worries of elevated inflation, forcing economic policymakers to reverse stimulus policies," said Chief Executive Lim Chow Kiat in the report.

"At the same time, the clock for the climate crisis is ticking, pandemic risk lingers on, and geopolitical conflicts and domestic political schisms are growing. There are no easy choices for policymakers and business leaders, and in turn, for investors."

Money Report

Rising inflation

GIC — a private firm wholly owned by Singapore's government — manages Singapore's reserves together with the Monetary Authority of Singapore and state investor Temasek Holdings. The fund said the shift to a higher inflation environment will have significant investment implications.

"High inflation not only reduces real returns immediately, but its adverse impact on economic stability raises the risk premia on financial assets," Lim noted.

As a result, the CEO said he expects portfolio diversification to be "more challenging as few assets are spared from the effects of worsening inflation and slower economic growth."

GIC said its diversified portfolio and cautious investment stance helped cushion its performance from the market correction that occurred in early 2022.

"Given these uncertainties, we have doubled down on our core investment principles — diversify our portfolio, take the long view, and emphasize preparing rather than predicting," Lim said in the report.

Amid the global shift to a low-carbon economy, the fund announced it has set up a dedicated office focusing on sustainability, to ramp up focus on that front.

The new office will deepen research into critical issues and integrate sustainability further into all its investment and corporate processes, GIC said as part of the release of its annual report.