Andy Nguyen from San Diego regrets attempting a U-turn that ended up with him ramming his car into a light pole in Oxnard, California. The crash knocked down the pole, took out a chunk of his car and set off the airbags.

“It hurts," Nguyen recalled, showing NBC 7 some of the pictures he took of the accident. "It really disorients. The adrenaline kicks in as you get out of the car."

Nguyen said he immediately called his insurance company, National General, to file a claim. An adjuster returned his call and got the details of the crash, but then the questions got a bit strange, he said.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

“ ‘Who else lives in your home?’ " said Nguyen, explaining that he answered that he lived with his parents, 20-year-old brother and 14-year-old sister. "She asked for their birthdate, and I provided it like I provided the first time to my broker."

Denied Claims

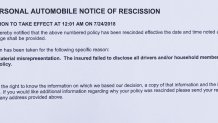

Nguyen thought his insurance would cover the $12,000 in damages he caused to the city property, but he was wrong. A couple of weeks later, he was sent a rescission notice. At that moment, he realized why the adjuster asked him who else lived at home.

"I felt like they stabbed me in the back."

Andy Nguyen

Local

“I was mad," Nguyen said. "Are you kidding? I was mad, I felt like they stabbed me in the back."

What happened to Nguyen is similar to what Sergio Preciado of San Diego said he went through after causing a car accident off Interstat 805.

Preciado called NBC 7 Responds after National General denied his claim and rescinded his policy because he did not disclose he had a 20-year-old son living at home. He had to pay $5,000 for the damages he caused to the vehicle.

“What does he have to do with it," Preciado said. "He wasn’t driving. He wasn’t with me. He was at home or school. I don’t know where he was, but he didn’t have a license, he didn’t drive when it happened."

Both Nguyen and Preciado were returned the premiums they paid for their policies, but the money they got was far from enough to cover the cost of their crashes.

Lawsuit against National General

"They always have this ace in the hole, in their back pocket, that they could pull out at the end of the day to potentially get them out of a claim,” attorney Justin King told NBC 7.

King represents Nguyen and nearly 300 other drivers in a lawsuit he filed against National General, accusing the insurance company of unfairly denying claims. He is currently trying to certify it as a class action lawsuit.

The complaint claims there are only two places in the digital application where household members are brought up. The first one is under the Drivers Tab.

“And that is deceiving because, to a layperson, going through the digital application with their broker, they’re going to be asked, ‘Who are the drivers of your vehicle?’ because that’s what the page says,” King said.

The second place in the digital application where household members are brought up is under the Insured’s Information. According to the lawsuit, it populates the page with names associated with an address.

“It’s not enough, because those systems don’t always populate somebody who may live in the house,” said King, adding that the page doesn’t give the option to add someone who may have been missed.

A different page asks whether all household members over the age of 14 have been disclosed. If you answer “no” the application process simply stops instead of allowing you to add information, said a National General director of product management in a recorded deposition.

“It doesn’t take you to some page to add them," King said. "It just won’t underwrite the policy, so it has to be answered with a 'yes,' and they premarked the answer with the 'yes.' They don’t pre-mark very many other answers in the digital application."

A National General adjuster who was also deposed testified that she and her colleagues were trained to find out who lives at home when working a claim, regardless of the facts.

“And they ask them to seek this information so that they can then rescind the policy and say, ‘You didn’t disclose that you lived with these household members back when you applied for the policy,’” King said.

The attorney clarified that he believes this is no flaw in National General’s system and that they know what they’re doing.

“I believe this is intentionally done," King said. "I believe these are smart people at these corporations, they’ve set up this digital application, they’ve set up this process, there is a lot of money at stake."

NBC 7 Responds reached out to National General Insurance and its parent company, Allstate Insurance, multiple times but never received a response. In court filings, they issued a general denial of all allegations in the lawsuit.

Brokers surprised by denials

“Have just a little bit of shame,” said Marisol Alvarez, who is a licensed insurance broker who owned her own company and is an expert witness in King’s lawsuit.

Alvarez explained that National General came onto her radar several years ago as a quality, low-cost option for her clients.

“It was great until we started having claims,” Alvarez said, adding that, initially, she and other brokers took the brunt of the policyholders’ anger after they were denied coverage.

Alvarez recalled scrambling to find answers.

“After awhile, it started becoming clear about this — this 14-year-old household-member clause," Alvarez said. "For my 20 years, I hadn’t seen anything like it.”

Alvarez explained that the industry standard had always been to name 16-year-olds who might be driving an applicant’s vehicle. She added that no other company she’s ever worked with denied coverage to her clients because of someone living at home who wasn’t even in the car.

“You rated the risk based on the driver and the vehicle, so what is the problem?” Alvarez asked. “Who are you that you need to know who lives where? You’re not insuring the whole household.”

The broker said National General never informed her or her team of these possibilities for coverage denial.

“And I spoke with marketing reps on various occasions, and they never said, 'Be careful, because if that happens, we’re not going to pay any claims,' ” Alvarez said.

NBC 7 Responds shared the lawsuit with the California Department of Insurance (CDI) to get its thoughts on the allegations. The agency sent the following statement:

CDI is not a party to the lawsuit, and we cannot comment on the allegations made in the filing. To protect consumer confidentiality, we also cannot comment on consumer complaints.

Nguyen said he wishes CDI was involved and would look into National General's way of doing business.

“They’re just trying not to cover me,” Nguyen said, asserting that this strategy by National General puts a stain on the auto insurance industry as a whole.

“It’s pretty cutthroat, to be honest, because people get insurance to make sure they’re protected,” Nguyen said.