U.S. stocks rose Tuesday, a day after the major averages snapped a three-session decline, as traders awaited key inflation data slated for release later in the week.

The Dow Jones Industrial Average advanced 317.02 points, or 0.93%, to close at 34,261.42. The S&P 500 rose 0.67% to end at 4,439.26. The tech-focused Nasdaq Composite gained 0.55% to 13,760.70.

Salesforce's stock rose nearly 4% after the company announced it would increase prices across the board in August. Activision Blizzard's shares jumped 10% after a federal judge denied the Federal Trade Commission's request for a preliminary injunction to stop Microsoft's acquisition of the video game company. The decision meant that the two companies were closer to completing their deal.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

The June consumer price index report set for release Wednesday, as well as the June producer price index due out Thursday, will shed light on whether the decline in inflation has continued, and create the backdrop for future direction of interest rates. Economists polled by Dow Jones expect the index rose 3.1% last month on a year-over-year basis.

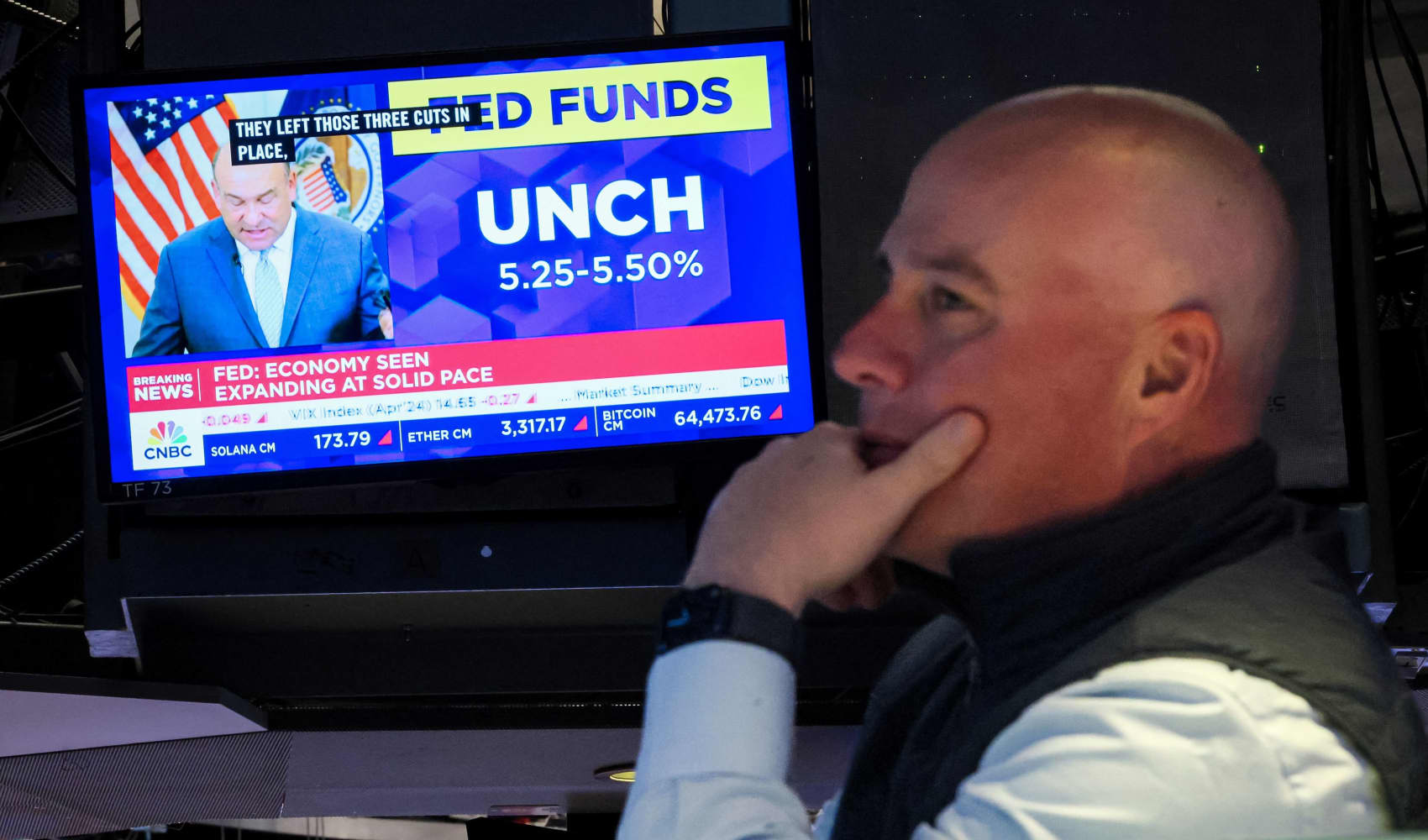

Investors have penciled in another quarter-point increase at the Federal Reserve's July 25-26 meeting. But they are undecided about what the central bank will do at its September meeting after last week's continued robust jobs data raised concern that policymakers will revert to raising rates following the June pause.

"I think [on Wednesday] you're going to see further evidence that the CPI-measured inflation is continuing its descent. And a lot of that was because of the impacts of Covid. But that's not good enough for the Fed. The Fed worries about there being [a] wage price spiral," said Brent Schutte, chief investment officer at Northwestern Mutual Wealth Management Company.

Money Report

"I think there's going to be a recession, because the Fed [will] keep going until they see the labor market crack and until wage [growth] goes well below 4%," Schutte continued.

Second-quarter earnings season kicks off later this week with results from "systemically important financial institutions" such as JPMorgan Chase, Wells Fargo and Citigroup, plus BlackRock, PepsiCo and Delta Air. Dow component UnitedHealth reports Friday.

Lee este artículo en español aquí.

Stocks close higher Tuesday

U.S. stocks closed in the green Tuesday.

The Dow Jones Industrial Average traded 317.02 points higher, or 0.93%. The S&P 500 and the Nasdaq Composite rose 0.67% and 0.55%, respectively.

— Hakyung Kim

RBC analysts turn more positive on U.S. cyclical stocks generally, and financials specifically

RBC Capital Markets analysts have upgraded U.S. financial stocks as a group, lifting them to overweight from market weight, reversing an earlier downgrade that was made in the wake of the failure of Silicon Valley Bank in March.

As part of the same call, RBC said it was most positive in the U.S. on health care and energy stocks, in addition to financials. U.S. financial and energy stocks sport "attractive valuations" at the group level, as do communication services stocks, RBC said.

"On Financials, our upgrade is driven by our analyst team's optimistic performance outlook and our own work indicating that valuations are attractive, dividend yields are compelling and earnings and sales revisions (though still slightly negative) have shown some signs of improvement," a report out Monday from RBC Capital head of U.S. equity strategy Lori Calvasina said. The flow of investment dollars into financials has "also been positive. And it's worth noting that the sector tends to serve a cyclical function in portfolios as it tends to lag when ISM manufacturing is falling and outperform when it's rising. We suspect that if confidence in a 2024 economic recovery gathers steam, financials will benefit."

— Scott Schnipper, with reporting by CNBC's Michael Bloom

WTI Crude settles at the highest level since May

WTI Crude settled up 2.5% at 74.83, marking the highest level since May 1, when it settled at 75.66. However, WTI Crude still is down 6.7% year to date.

Brent crude settled 2.2% higher at 79.4, at its highest level since Apr 28. The commodity is down 7.6% in 2023.

— Hakyung Kim, Gina Francolla

Markets have been seeing a shift to 'FOMO,'" says CFRA Research

Although Wall Street has been anticipating a recession for months, a market rally in the first half has delayed a contraction.

"I think what's happening is that more and more people are sort of throwing in the towel. And what we're seeing is a shift from 'Oh, no to FOMO,'" said CFRA's chief investment strategist Sam Stovall.

"People [are] really scared about what could be happening with the market, [but] the market just keeps going up," Stovall continued. "I think people are putting money to work that had been on the sidelines."

— Hakyung Kim

S&P 500 sees 9th longest streak without new high

It's been 378 trading days since the S&P 500 has hit a new all-time high. That's the ninth longest stretch going back to 1950.

In more than seven decades, there's only been eight instances when the S&P 500 traded without notching a new high for longer than the current 378-day streak, according to data analyzed by Hi Mount Research. The longest streak last 1,897 days, falling between the mid-1970s and early-1980s.

Despite not notching a new high, it's still been a strong period for the index this, with 2023 bringing the best first half of a year since 2019.

— Alex Harring

Energy stocks outperform Tuesday, rising 2%

Energy stocks were the leading advancers in the S&P 500 Tuesday, with the sector last trading 2.2% higher during afternoon trading. The broader index was last up about 0.3%.

APA, Halliburton and Schlumberger N.V. were the outperformers. They were up nearly 6%, 4.8% and 4.2%, respectively.

Eight out of 11 S&P 500 sectors were last trading in positive territory in the index. The three decliners were consumer staples, information technology and health care.

— Sarah Min

Investors should not expect a 'standard recession,' according to UBS

As Wall Street debates at which point the economy will enter a recession — with some analysts saying there may be no recession at all — UBS says it may happen differently than what many expect.

"We should not expect a standard recession in this unorthodox cycle; e.g., the manufacturing sector has already mildly contracted and could start recovering by year-end. The economy may instead experience rolling recessions across different segments," Jason Draho, UBS's head of asset allocation Americas, wrote in a Tuesday note.

He added that some of the factors delaying the widely-expected recession include the fact that monetary policy is not yet restrictive enough to cause a contraction, while fiscal policy is marginally expansionary and fueling investment.

"The net result could be a very modest recession overall with unusually low job losses, an outcome very similar to a soft landing. Such a recession is unlikely to start long before the end of the year," said Draho.

— Hakyung Kim

Mega-cap stocks may not see long-term trends change from Nasdaq 100 adjustments, Wells Fargo says

A rebalance of the Nasdaq 100 aimed at reducing the concentration on Big Technology stocks does not necessarily change the entire outlook for mega-cap names, according to Wells Fargo.

The index, which is seen as representative of the performance of growth stocks, will undergo changes before the market opens on July 24 to "address overconcentration in the index by redistributing the weights." But that doesn't mean analyst Christopher Harvey's forecast for how these large stocks will fare needs to be entirely thrown out.

"We believe this liquidity event dents—but does not break—the longer-term uber-cap trend. In our view, similar to 2000, an aggressive Fed that pushes the US into recession is what ultimately undoes the uber-cap and 'new economy' trades," he said in a note to clients. "As long as the economy remains in a malaise (i.e., not a recession), rather optimistic valuation premiums and growth estimates are difficult to refute."

Microsoft, Apple, Nvidia, Amazon and Google parent Alphabet are among stocks Harvey expects to see the largest weight decreases as a result of the changes to the index.

— Alex Harring

KeyBanc Capital Markets hikes Nvidia price target, cites datacenter growth

KeyBanc Capital Markets sees more upside in store for Nvidia, viewing the stock as one of the best positioned to benefit from booming demand for generative AI servers.

"Robust demand is not only coming from cloud but also enterprise and from AI startups," wrote analyst John Vinh in a Monday note.

"Delays associated with AMD's MI300 are likely to free up incremental capacity in 2H23, while we believe NVDA has secured enough capacity (CoWoS) to quadruple its datacenter revenues in 2024," he added

The fresh $550 target implies more than 30% upside from Monday's close. Shares have rallied 190% so far this year.

— Samantha Subin

Industrials sector has the 'most compelling valuation,' says Harris Financial Group

As investors hope the market rally will broaden in the second half of 2023, Harris Financial Group is particularly bullish on the industrials sector.

"I think industrials definitely present the the most compelling valuation," said managing partner Jamie Cox. He is particularly optimistic on Rockwell Automation, which has surged almost 70% over the past 12 months.

He added that industrials names, and to a lesser extend consumer staples, will start to see increasing margins as inflation starts to wane.

"Input costs [will] decline at pretty rapid rates [and] labor force costs are being somewhat stable," said Cox.

He continued, "And so your margins are going to increase. And I think you'll see that in industrials, I think we'll see that it's stable. ... I think we're seeing either the early stages of, or some really clear indications that that's going to be the case for the next couple quarters."

— Hakyung Kim

Nasdaq 100 will undergo a 'special rebalance' following tech rally

The rapid rise of a few already massive tech stocks this year is causing Nasdaq to make unusual adjustments to its popular growth index.

The company announced on July 7 that it will do a special rebalance of the Nasdaq 100 Index, which will take effect before the market opens on July 24.

The company said a special rebalance can be used to "address overconcentration in the index by redistributing the weights."

While the index is already rebalanced on quarterly basis, Nasdaq tries to keep the five biggest stocks below a 40% combined weighting in one rebalance per year designated as the annual adjustment, according to the firm's methodology. The five biggest stocks appear to be over that threshold currently, according to the holdings of the Invesco QQQ ETF, which tracks the index.

Read more about the rebalancing here.

— Hakyung Kim, Jesse Pound

Shutterstock, Newell Brands stocks making the biggest moves midday

Here are some of the stocks making the biggest moves during midday trading:

- Shutterstock — Shares of the stock image, video and music provider jumped 10% after Shutterstock announced a six-year, expanded partnership with OpenAI, the maker of ChatGPT.

- Newell Brands — Shares of the consumer goods company jumped more than 10% after Canaccord initiated its coverage with a buy rating. The Wall Street firm said better days are ahead with new management at the helm, and it also expects modest top-line growth.

- Zillow — Zillow popped nearly 11% after Piper Sandler upgraded the real estate stock to an overweight rating, saying that new initiatives and improvement in the housing market could help boost shares more than 30%.

Read more on the stocks moving here.

— Samantha Subin

Activision Blizzard shares jump more than 11%

Shares of Activision Blizzard surged 11.3% Tuesday after a federal judge in San Francisco denied the Federal Trade Commission's motion for a preliminary injunction to stop Microsoft from completing its acquisition of the video game company. The two companies have been trying to complete their $68.7 billion deal by July 18.

Microsoft shares traded down 0.4% Tuesday.

Read more about the deal here.

— Hakyung Kim, Jordan Novet

12 S&P 500 stocks hit all-time highs

Twelve S&P 500 stocks were at record highs in Tuesday's session:

- O'Reilly Auto

- Fiserv

- AmerisourceBergen

- Eaton

- WW Grainger

- Howmet Aerospace

- Ingersoll-Rand

- PACCAR

- Parker Hannifin

- Snap-On

- ON Semiconductor

- Iron Mountain

A group of other stocks were also trading at highs not seen in more than a year, including Hilton, Lowe's, Norwegian Cruise Line and Ralph Lauren. General Electric and Westinghouse Air Brake Tech both traded at levels not seen since 2018.

On the other hand, biopharmaceutical stock Bristol-Myers hit a low not seen in more than a year as investors parsed its latest drug trial data.

— Alex Harring, Chris Hayes

Netflix stock could be overheated heading into earnings, Mark Mahaney says

Netflix stock could be overheating as the company is set to report second quarter earnings next week, according to Evercore ISI's Mark Mahaney.

"Buyside expectations, however, are almost certainly higher than Street, with the market likely looking for more like 4MM-5MM Subs in Q2 and a similar to modestly higher level in Q3, which creates expectations risk," the analyst said.

Netflix will report second quarter results on July 19.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Can weight loss drugs live up to the hype? This study raises some questions about real world use

Wall Street sees blockbuster sales ahead for a new class of weight loss medications that include Novo Nordisk's Wegovy, but an analysis conducted by pharmacy benefits manager Prime Therapeutics for Reuters suggests real world performance won't be as rosy as clinical trials suggest.

Patients who take these drugs can gain back some or all of the weight they lose once they stop taking the medication, which can cost more than $1,000 a month. In the study, only about one-third of patients were still taking a GLP-1 a year after the initial prescription, Reuters reported. What's more, total health-care costs for the group rose sharply, the report said.

In clinical trials, only 6.8% of patients discontinued treatment after a year, mainly due to gastrointestinal problems. The study didn't determine why the real-life patients ended therapy. Possibilities include side effects, but could include high out-of-pocket costs or restrictions imposed by health insurers.

Drug makers have been petitioning for coverage by suggesting that the treatment will lower health-care costs over time, but several years of data will be needed to prove this out, Prime Therapeutics told Reuters.

Novo Nordisk shares were down 2% in trading Tuesday.

—Christina Cheddar Berk

Bank of America upgrades US Bancorp, sees strong earnings growth

Shares of US Bancorp rose more than 3% Tuesday after Bank of America upgraded the stock to buy from neutral.

Analyst Ebrahim Poonawala said in a note to clients are overly concerned with US Bancorp's plan to build up its capital base and overlooking earnings strength and valuation.

"USB's scale, earnings defensibility and strong execution should drive superior EPS growth and stock outperformance, with shares trading at 8x 2024e EPS or 2x [price-to-earnings] discount vs. PNC Financial (PNC) / Wells Fargo (WFC)," Poonawala wrote.

The analyst also noted that US Bancorp has below-average exposure to commercial real estate.

— Jesse Pound

Shutterstock jumps 10% following announcement of expanded OpenAI partnership

Shutterstock rallied 10% Tuesday after the photography platform announced an expansion of its partnership with OpenAI.

In a new six-year agreement, OpenAI secured a license for additional Shutterstock training data that includes images, videos and music libraries. Shutterstock now has priority access to the newest OpenAI technology. The two companies will collaborate on bringing generative artificial intelligence capabilities to mobile users of GIPHY, which Shutterstock recently acquired.

Despite the rally, the stock is still slightly below flat on the year.

— Alex Harring

Bank of America lists American Express as top pick on resilient consumer spending

Bank of America listed American Express as a top pick Tuesday and reiterated a buy rating on the stock thanks to strong consumer spending.

"AXP is our top pick in the sector due to its super-prime and high income cardmember base, which is better protected from inflation pressure," BofA analyst Mihir Bhatia said.

American Express stock has added more than 16% since January.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Muted forecasts for upcoming earnings 'obfuscate underlying strength,' says Goldman

As companies begin to announce their second-quarter earnings this week, Goldman Sachs says revisions and early posted results "point to a strong earnings season."

"Historically, analysts cut forecasts into earnings season, only for companies to top lowered estimates," analyst Jonathan Golub wrote in a Tuesday note. "2Q's downward revisions have been much less severe than in both 1Q and 4Q, and early reporters (18 companies so far) have surprised by a healthy 5.5%."

Golub added that "weak 2Q [earnings] forecasts obfuscate underlying strength." Excluding the energy and materials sector, which Goldman forecasts will contract by 45.1% and 28.2%, respectively, the firm says growth will rise to 1.4%.

— Hakyung Kim

Stocks open higher Tuesday

U.S. stocks opened in the green on Tuesday.

The Dow Jones Industrial Average gained 126 points, or 0.3%. The S&P 500 added 0.17%, while the Nasdaq Composite rose 0.3%.

— Hakyung Kim

Goldman Sachs keeps T-Mobile as a top pick among telecommunications stocks

Goldman Sachs reiterated a buy rating on T-Mobile stock in a Tuesday note, thanks to buybacks taking shape faster than expected.

"We believe that TMUS likely sustained a fast pace of share purchases during the quarter, especially in June when the shares were pressured by media reports that Amazon may enter the wireless market," analyst Brett Feldman said.

T-Mobile stock is down roughly 1% so far in 2023.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Dollar index hits 2-month low

The dollar index weakened to 101.666 Tuesday morning, marking its lowest level since May 11, when it hit a low of 101.304.

The Euro traded at 1.1026 against the dollar, its highest level since May 8, before dipping negative against the dollar.

The Pound touched a high of 1.2934 against the dollar, which its strongest level against the dollar since April 22, 2022, when it traded as high as 1.3035 against the dollar.

— Hakyung Kim, Gina Francolla

Salesforce shares jump almost 4% Tuesday premarket

Software company Salesforce's shares gained 3.8% Tuesday during premarket trading. The company announced it would raise prices by about 9% across its cloud-based offerings, which include Sales Cloud, Service Cloud and Marketing Cloud.

Similar price increases will go into effect for other offerings, including its engagement platform and Tableau. The price increases are set to take effect in August.

— Hakyung Kim

Stocks making the biggest premarket moves

Here are some of the names making moves before the opening bell:

- JetBlue Airways — The airline stock lost about 2% following a downgrade by Evercore ISI to underweight. The firm cited the recent sharp rally in shares and balance sheet concerns for the call.

- Amazon — Shares of the ecommerce giant added 0.8% as Amazon kicked off its two-day Prime Day summer sale. Wells Fargo also added Amazon to its Signature Picks list, citing better expectations for Amazon Web Services, Prime Day revenue growth and a risk-reward that is still favorable.

- 3M —The stock rallied 2% after being upgraded to neutral from underperform by Bank of America. The bank said 3M has positive catalysts ahead related to litigation settlements, restructuring and the planned spin-off for the health care business.

Read the full list here.

— Michelle Fox

Jefferies upgrades 'best-in-class' JPMorgan Chase

Jefferies upgraded its rating on JPMorgan Chase stock to buy from hold on Tuesday, thanks to a strong balance sheet and higher fees.

"While JPM has been an absolute and relative outperformer in 2023, its combination of balance sheet strength, strong liquidity positioning, and best in-class earnings generation potential continue to position the bank well," analyst Ken Usdin said.

JPMorgan Chase stock ahs climbed more than 8% so far this year.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Piper Sandler upgrades Zillow, forecasts more than 30% upside

Piper Sandler upgraded Zillow stock on Tuesday thanks to the company's Premier Agent product and a potentially improving housing market outlook.

"We like the setup for ZG driven by: (1) continued Premier Agent share gains, and (2) product optionality & new initiatives, and (3) a bottoming in the housing macro with sequential improvements forecast through '24," analyst Thomas Champion said.

Zillow stock has climbed nearly 50% so far in 2023.

CNBC Pro subscribers can read the full story here.

— Brian Evans

Treasury yields fall as investors weigh economic, monetary policy outlook

U.S. Treasury yields declined on Tuesday as investors assessed what could be next for Federal Reserve monetary policy following remarks from central bank officials and ahead of key economic data.

At 4:00 a.m. ET, the yield on the 10-year Treasury was trading four basis points lower at 3.9660%. The 2-year Treasury yield was last down by more than two basis points to 4.8409%.

— Sophie Kiderlin

Fed officials point to more rate hikes needed ahead

Fed officials highlighted the need for more rate hikes in order to bring inflation down to the central bank's target, according to a number of speeches on Monday.

Mary Daly, president of the Federal Reserve Bank of San Francisco, said at a Brookings Institute event, "We're likely to need a couple more rate hikes over the course of this year."

Meanwhile, Cleveland Fed President Loretta Mester, who is not a voting member on the Fed's policy-setting committee this year, also voiced the need for rates to be higher.

"In order to ensure that inflation is on a sustainable and timely path back to 2 percent, my view is that the funds rate will need to move up somewhat further from its current level and then hold there for a while as we accumulate more information on how the economy is evolving," she said at an event in San Diego.

Fed Vice Chair for Supervision Michael Barr meanwhile laid out a plan to order more capital for large U.S. banks, speaking at the Bipartisan Policy Center in Washington D.C.

"We need to be skeptical about the ability of bank managers or regulators to anticipate all emerging risks," Barr said, according to a transcript. "Events over the past few months have only reinforced the need for humility and skepticism, and for an approach that makes banks resilient to both familiar and unanticipated risks," he said.

— Jihye Lee

Japan snaps up foreign debt at highest pace since 2010: Nikkei

Japanese investors purchased 14.6 trillion yen ($103 billion) worth of foreign debt on a net basis during the first half of this year, according to Nikkei.

This is the highest amount for a six-month period in 13 years, and topped the previous high of 13.47 trillion yen in the second half of 2010.

Citing data from the country's ministry of finance, Nikkei said the investors bought medium- to long-term overseas debt, with Japanese banks the main buyers.

American bonds made up much of the purchases, Nikkei reported, with over 11 trillion yen in net purchases of medium- to long-term U.S. debt from January to May.

— Lim Hui Jie

China to extend support to real estate sector: Xinhua

China will extend two financial policies supporting its real estate market to the end of 2024.

In a notice, the People's Bank of China referred to a 16-step guideline last November that was released to beef up policy support for the housing sector. The country will now extend relevant policies to the end of the year.

Xinhua reported that the purpose of the move is to "guide financial institutions to continue deferring loan payments for real estate enterprises, while propping up financial support for the real estate enterprises to ensure the delivery of housing projects."

— Lim Hui Jie

WD-40 shares pop in after hours trading

WD-40 Company popped 4.7% in extended trading Monday after the maker of lubricants and rust removers reported fiscal third-quarter results. WD-40 posted $141.7 million in total net sales, a 15% increase from the prior year.

CEO Steve Brass said in a statement, "I am happy to share with you that after two quarters of flat-to-down sales, we have returned to solid top line growth in the third fiscal quarter."

— Sarah Min

Barclays raises S&P 500 price target to 4,150

Barclays has raised its 2023 price target on the S&P 500 price target to 4,150 from 3,725.

"We think equities would remain range bound through year end, and do not see the Tech-centric rally broadening to the rest of S&P. We would tactically add to secular growth exposure," analyst Venu Krishna said in a note Monday. "That being said, history suggests Big Tech and Rest of Tech could retrace in the near term as markets get skittish around the very low breadth of the rally, which we would view as a tactical entry point."

The broad market index ended Monday at 4,409.53.

The firm also increased its 2023 full-year earnings estimate to $218 from $200.

— Tanaya Macheel

Stock futures open little changed

U.S. stock futures were little changed on Monday night.

Dow Jones Industrial Average futures dipped 2 points, or 0.01%. S&P 500 declined 0.01%, while the Nasdaq-100 futures rose 0.02%.

— Sarah Min