This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

In 2021, Leila Kartforosh was doing important Covid-19 research as a microbiologist at the Centers for Disease Control and Prevention — but she wasn't happy with her career.

The 28-year-old's work was crucial for tracking the spread of the disease, but she didn't find it as interesting as the research she was doing before the pandemic.

And while she had a master's degree in microbiology, she was only earning $67,000. To get a raise she'd have to get a PhD, which meant going back to school and taking on more student debt, which she didn't want to do.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

So in March 2022, she quit to start a new career in sales.

Despite being close to paying off the $82,200 in debt that she had incurred while studying microbiology, Kartforosh is confident she made the right choice by switching fields. "I was very eager to make this jump in my career and I knew it was somewhat risky, but what could be the worst that could happen?" she tells CNBC Make It.

Money Report

Kartforosh now works as a certified consultant specializing in customer management software Salesforce in Decatur, Georgia, earning $60,000 per year. It's less than what she was making before, but the role comes with a 10% bonus and the potential to eventually earn six figures. She also earns $15,000 through her YouTube channels and blog, which brings her total annual earnings to about $81,000.

A reckoning with student debt

Kartforosh's path into microbiology was partly born out of circumstance: As an undergrad, she wanted to be a dentist, which led to majoring in biology at Georgia State University.

However, three years into college, Kartforosh realized that dentistry wasn't really for her. She didn't want to switch majors so late in the game, so she finished her degree in biology.

In 2015, the year she graduated from Georgia State, she went back to school to earn a master's in environmental microbiology. Her tuition was covered through a research program at the university, but she still needed to take out student loans to cover living expenses.

After graduating with her master's degree in 2016, she had a stretch working various jobs before landing her position as a microbiologist at the CDC in 2018.

By then, Kartforosh had accrued $82,200 in debt, including $48,400 in student loans. The rest of the debt was from a mix of credit cards, car payments and money that she owed her sister.

Nearly a quarter of her total debt was for car payments she couldn't afford. She had co-signed an auto loan with her then-boyfriend, who eventually stopped making payments. Kartforosh says the loan was the "worst financial mistake" she's ever made.

"I did end up taking this person to court. I was garnishing their wages at one point," she says. "It cost me a lot of money, but it also affected me mentally quite a bit. The whole ordeal was very stressful."

A turning point with her debt

Kartforosh grew up in Georgia in what she describes as a middle-class family, but didn't learn much about money as a kid. "We definitely had everything that we needed, but it was very normal for my family to have debt," she says. "That is something that I carried into adulthood."

By 2018, Kartforosh says she had "so much debt that I couldn't afford to live" and that she was overdrafting her checking account, "going into further debt every single month and stressing constantly about finances."

That's when she started to educate herself about personal finance by watching YouTube videos, listening to podcasts and reading blog posts. She decided to get serious about paying off her debt and started tracking every dollar she spent or earned in meticulous spreadsheets that she constantly updated.

In 2020, Kartforosh did a "no spend year." She spent money on necessities like groceries and rent, but cut out all discretionary spending, including clothes, shoes, books, tech upgrades and home decor. It sounds extreme, but Kartforosh says it was relatively easy because "there was a pandemic going on and there wasn't much to do."

By 2021, she was bringing in $1,000 to $1,500 per month through her blog and YouTube channels, either from ads, sponsorships, financial coaching or tips via Venmo, for a total of roughly $15,000 for the year, which helped her pay off more debt.

Kartforosh says she's currently on pace to be debt-free by the end of the year.

How she spends her money

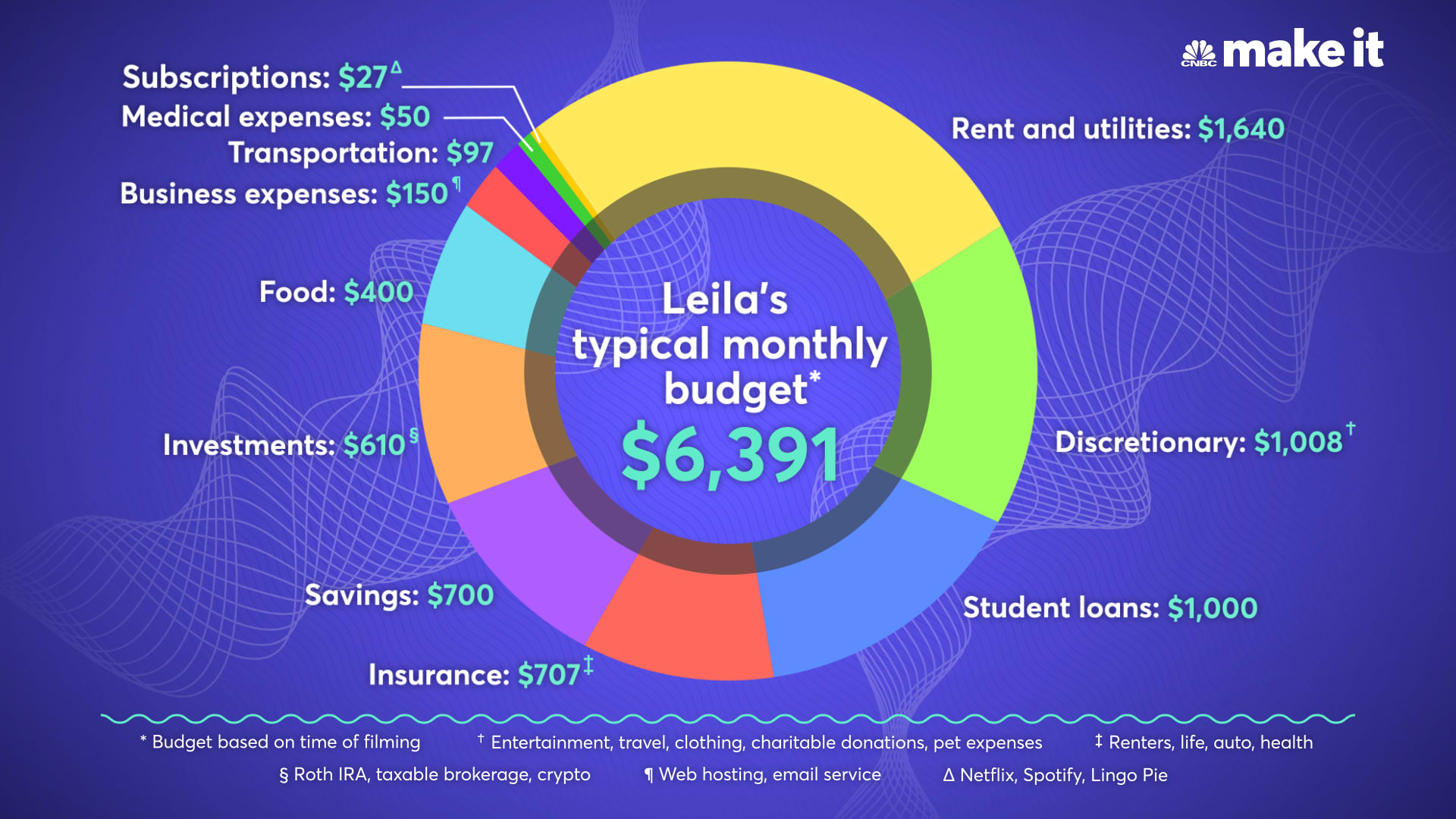

Here's a look at how Kartforosh spent her money in January 2022:

- Rent and utilities: $1,640

- Discretionary: $1,008 includes entertainment, travel, clothing, charitable donations and pet expenses

- Student loans: $1,000

- Insurance: $707 for renters, life, auto and health

- Savings: $700 for both an emergency and a new car fund

- Investments: $610 toward a brokerage account, Roth IRA and cryptocurrencies

- Food: $400 on groceries and dining out

- Business expenses: $150 on web hosting and email services

- Transportation: $97 for gas and license registration

- Medical expenses: $50 for medication

- Subscriptions: $27 for Netflix, Spotify and Lingo pie

Although she's focused on paying off her student loans, Kartforosh believes it's "important to invest while paying off debt." She has around $5,600 in brokerage accounts, $9,000 in her Roth IRA, and $515 invested in cryptocurrency.

With her new job, Kartforosh says she will also start contributing to a 401(k), up to 6% of her earnings, to take advantage of employer matching contributions.

Kartforosh saves $1,000 a month to put toward her student loans, but is waiting to actually pay off the balance when the student loan freeze ends. As of February, she had about $13,900 saved up, which, if paid, reduces her remaining student debt to $22,100.

She's willing to splurge on travel and experiences, but cuts costs in other places, including forgoing manicures and pedicures and cutting her own hair.

In her spare time, Kartforosh makes content for her YouTube channel, reads and spends time with her boyfriend, either watching Netflix or going to the gym together. Exercise and wellness are two of her passions.

Looking ahead

Kartforosh's immediate goal is to be debt-free by the end of 2022. After that, she wants to save up and purchase property, either to live in, rent out or flip.

She also wants to be financially independent by 45. "For me, that means having $1 to $2 million invested so that I know I could retire early," she says.

Kartforosh isn't actually interested in retiring early though — rather, she wants to have enough money to have a more flexible work situation where she can work when she wants and stop when she wants.

In the meantime, she's focused on her new career: "I felt really excited about being able to shift careers without having to go back to college or having to spend a lot of money and invest in a very expensive program. It's like having a fresh start in my career journey."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don't miss: This 42-year-old quit his job with $1.2 million. Here's why he started working again 2 years later