- As part of a plan to boost the U.S. steel industry, and in addition to new tariffs targeting metals imported from China, the Biden administration recently launched a trade investigation into Chinese shipbuilding.

- Biden wants to bring the manufacturing of ocean carriers back to the U.S., but maritime analysts tell CNBC it has not been economically viable since the 1980s when the Reagan administration pulled subsidies to make vessels.

- U.S.-made vessels are as much as four to six times more expensive than competition and lack of demand is an obstacle in an oversupplied ocean freight market.

President Biden wants to bring shipbuilding back to the U.S., but it won't be easy for a domestic manufacturing industry that has been miniscule since the 1980s.

The recent announcement by the Biden administration of a new trade investigation into China's dominance of the ship manufacturing sector — linked to its broader industrial policy to rival China and boost the U.S. steel industry — is at odds with economic reality, according to maritime industry analysts. They tell CNBC that Biden's shipbuilding talk is more campaign promise than reality, and it isn't economically viable for domestic shipbuilding to be competitive globally.

The Biden administration is correct that China has not played fair.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

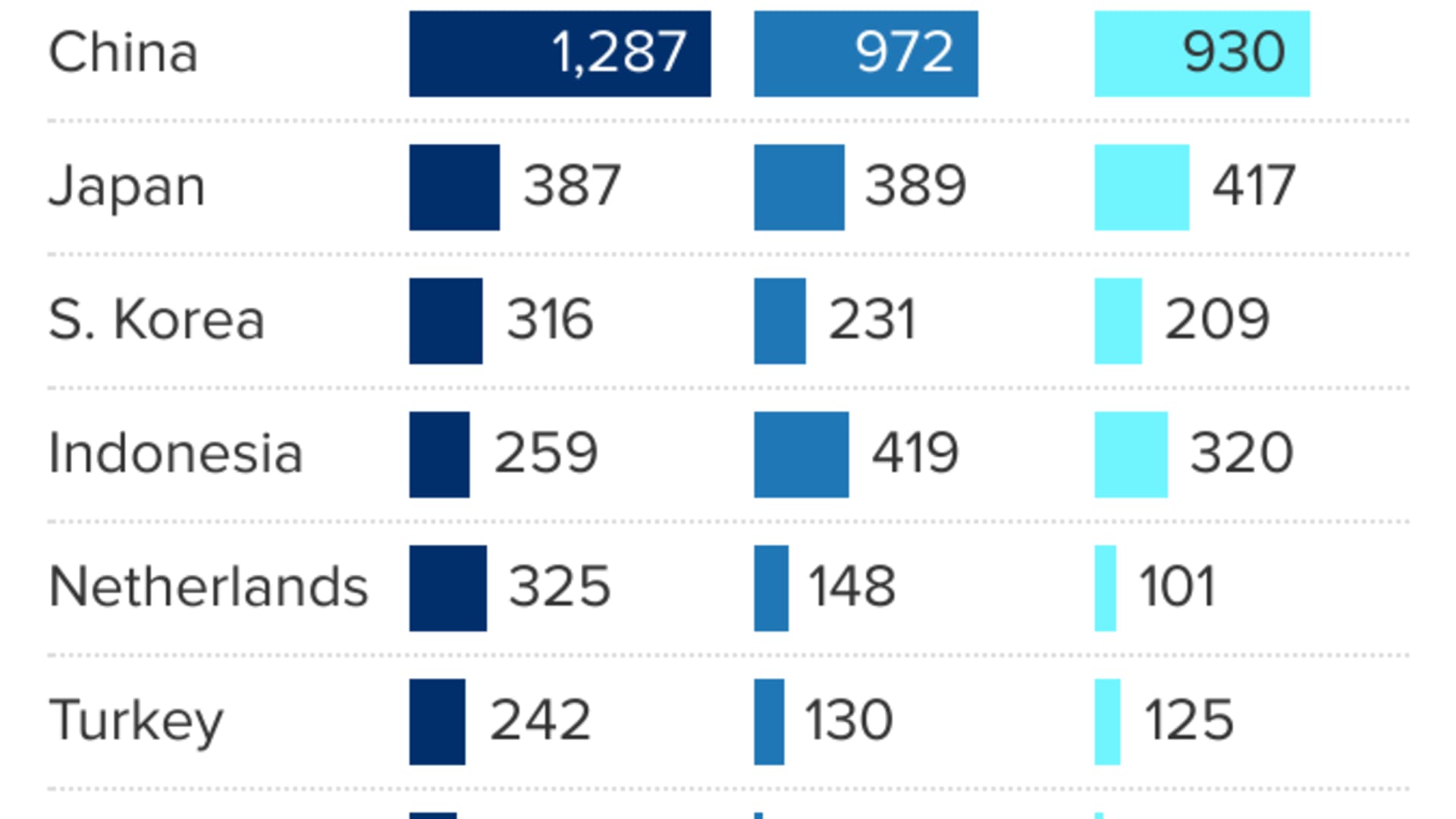

"From a historical perspective, over the last two decades, China has been increasing and subsidizing their shipbuilding business to make this happen," said Ben Nolan, maritime and energy infrastructure analyst at Stifel. But he said the nations that could rival China in shipbuilding are Asian competitors. "The reality is it's Japan and South Korea being hurt by this. They are the top shipbuilders, and build thousands of more commercial ships than the United States," Nolan said. The U.S., meanwhile, has lacked the economies of scale over the last century to be competitive in shipbuilding.

In the 1970s, U.S. shipyards were building about 5% of the world fleet, equating to 15-25 new ships per year. In the 1980s, the Reagan administration pulled government subsidies to support shipbuilding, in keeping with its free-market principles. Shipbuilding subsequently dropped to around five ships per year, which is approximately the current rate of U.S. shipbuilding.

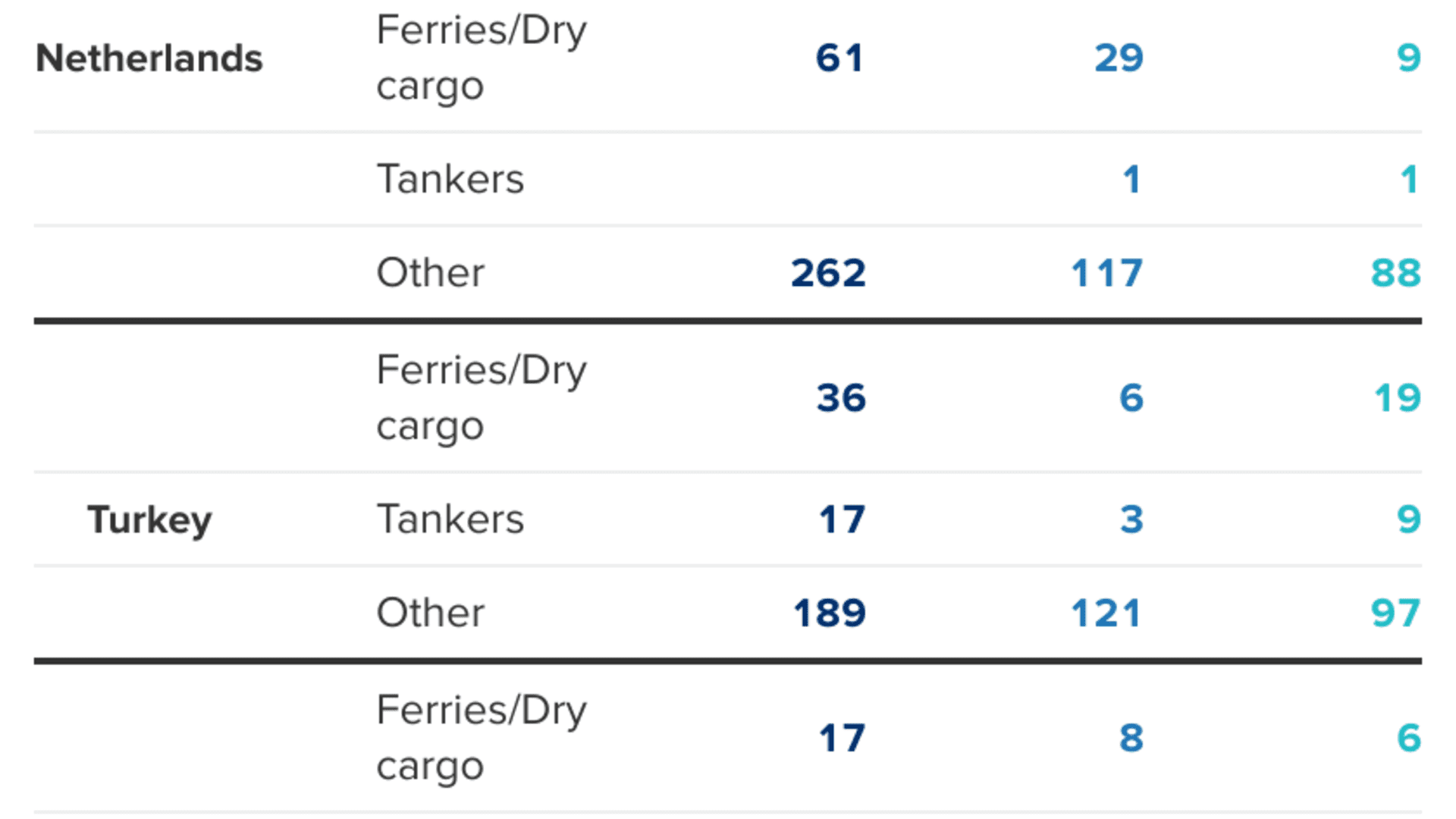

According to data from S&P Global for CNBC, the United States manufactures a minuscule number of vessels compared to China, Japan, and South Korea.

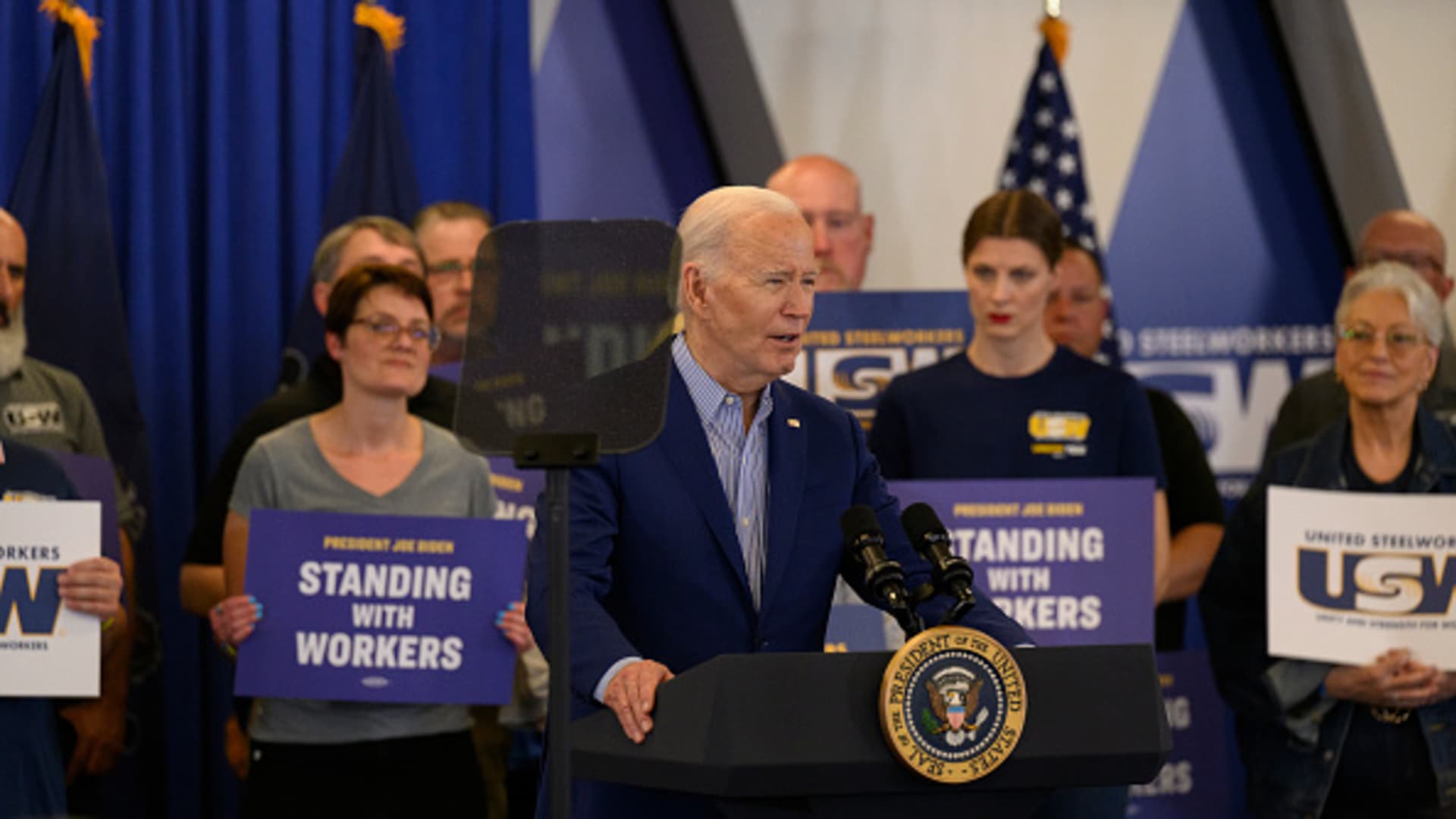

The Section 301 of the Trade Act of 1974 investigation by the Office of the U.S. Trade Representative comes after five national labor unions, including steel representatives, launched a petition on March 12 requesting the U.S. probe the policies and practices of China's maritime, logistics, and shipbuilding sectors.

Money Report

China's Ministry of Commerce slammed the Section 301 probe, saying it "firmly opposes" the U.S. investigation and calling the move a "mistake on top of a mistake."

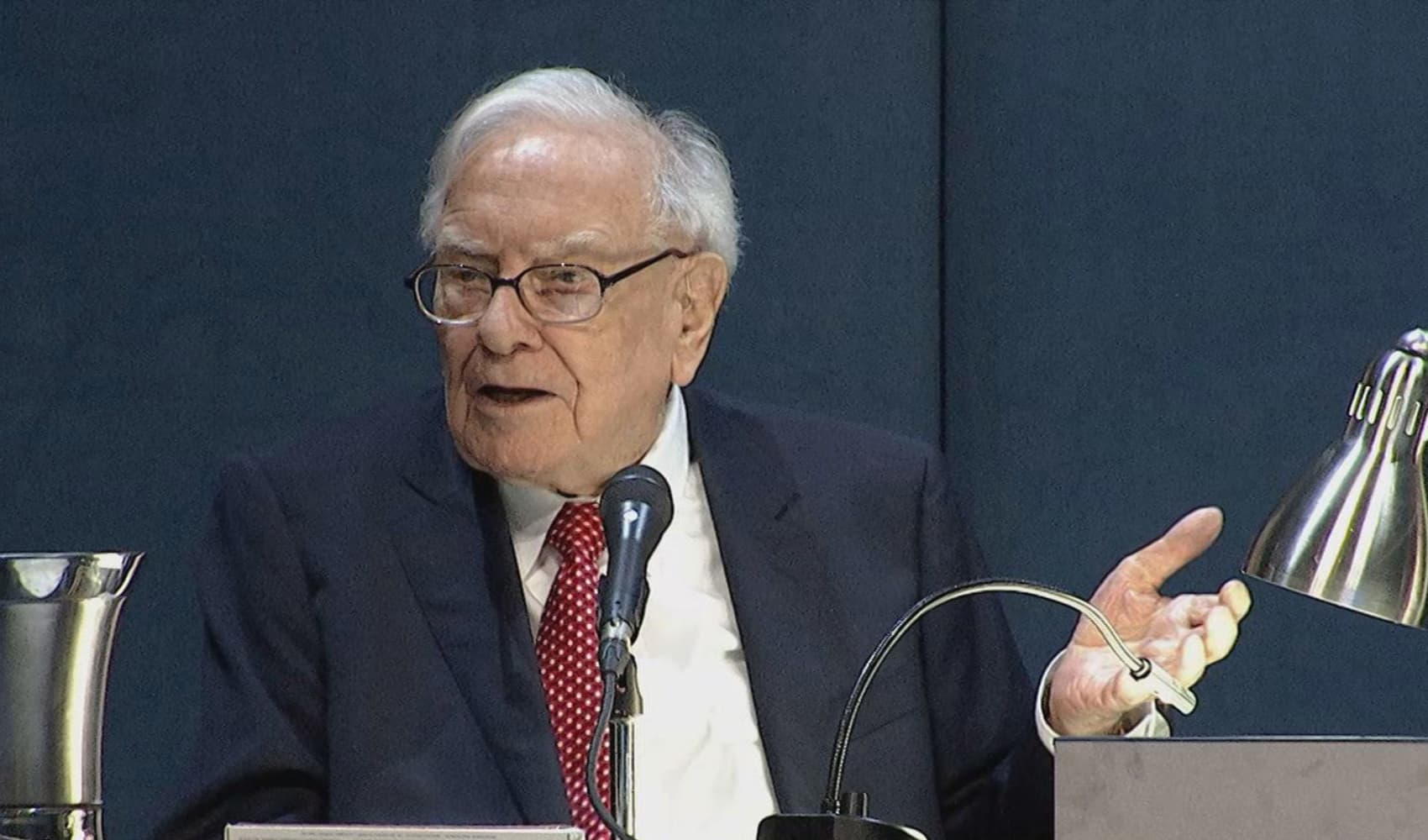

Biden strategy — the president recently visited the headquarters of the United Steel Workers union in Pennsylvania, and separately, his administration has moved to block the acquisition of a U.S. steel company by Japan's Nippon Steel — is pure politics, according to Nolan.

"Biden's announcement seems to be pandering for union votes," Nolan said. "We are not talking microchips. The fact is China can build ships a lot cheaper than we can, just like we have seen over the last three decades companies turning to Bangladesh, China, and other Asian countries to manufacture tennis shoes and clothing. They are the economically viable choice."

China, Japan and South Korea do not only dominate the sector for massive container vessels used for freight transport around the world. These three Asian nations also make tankers and dry bulk vessels. Analysts say Japan, in particular, is known throughout global markets for the quality of its steel and vessels that reportedly last longer than the competition.

The White House referred a request for comment to the USTR, which did not respond by press time.

According to analyst estimates, the price tag on these foreign-made freight vessels is at least four times less than U.S.-made ships, which are also significantly smaller, meaning they carry less freight.

In November 2022, Matson Shipping, a Jones Act shipping company — it moves cargo on U.S.-made and crewed vessels pursuant to the 1920 federal law — ordered three vessels from the Philly Shipyard with a carrying capacity of 3,600 twenty-foot equivalent units (TEUs). The cost for each was reported at $330 million. According to Darron Wadey, an analyst at shipping consultant Dynamar, CMA CGM ordered 16 vessels from China's COSCO and OOCL at the same approximate time, vessels with a carrying capacity of 24,000 TEUs, and a cost between $240 million-$250 million each. "So not only were these vessels $80-$90 million cheaper than the Matson units, but they were 6-7 times bigger," Wadey said.

The economics of vessels with higher build prices and less carrying capacity don't add up, Wadey said. To make the vessels commercially viable, ocean carriers need competitive return on investment metrics tied to container freight rates.

"In 2023, Matson's revenue divided by containers carried worked out to around $3,000 per TEU," he said. "For global operator Hapag-Lloyd, with access to cheaper tonnage and operating worldwide, the revenue per TEU was $1,600."

In effect, Hapag-Lloyd can charge less and still make money, while the smaller U.S.-made vessel has to charge higher freight rates to generate a profit. U.S. vessels also have to be out on the water many more years to generate an ROI that makes economic sense, leading to a much longer "economic lifecycle" for U.S.-made ships.

Wadey said Matson "almost always" sends the oldest containerships for recycling. In 2023, it scrapped a 1979 ship; in 2021, it sent a 1971 ship to scrap — 44 and 52 years, respectively. By comparison, the average age of scrapped ships in 2023 was 27.

Over time, vessels will need more repairs and will not be as efficient as more modern ships on the water. Meanwhile, the price of container shipbuilding is expected to continue to increase because of inflation, while ocean freight rates are returning to pre-pandemic levels.

"Inflation for shipbuilding is likely to be sticky because of the higher costs of capital, labor, and equipment," Wadey said. "The costs for United States shipbuilding – indeed in all developed economies –will always be higher because labor and materials are higher."

Analysts tell CNBC around 40% of shipyard construction is labor, and the single biggest problem is finding enough people to go into the shipyards — recruiting and retention. Pay and benefits would need to go up, but Nolan tells CNBC there is a Catch-22: given the high costs of labor and capital, companies cannot make vessels without the orders.

"You need a lot of people to produce vessels at a large scale and to be fair, U.S. labor is going to be expensive, and your materials per unit are going to be more expensive. Given the choice, when you look at the bottom line and shareholders, you would go for a lower cost option," he said.

Subsidies would have to be reinstated indefinitely to offset the costs and make U.S. shipbuilding competitive, according to analysts.

According to the federal Maritime Administration, there are currently 154 active private shipyards in the United States, across 29 states and the U.S. Virgin Islands. There are more than 300 shipyards engaged in ship repairs, or capable of building ships, but not actively engaged in shipbuilding. The majority of shipyards are in the coastal states, but also on major inland waterways such as the Great Lakes, the Mississippi River, and the Ohio River.

The largest shipbuilding company in the United States is Huntington Ingalls Industries' Newport News Shipbuilding, effectively a government contractors. It serves as the sole provider of U.S. Navy aircraft carriers and is one of two providers of U.S Navy submarines. According to analysts, the military represents 90% of the overall revenue of domestic shipbuilding, and without subsidies and demand, there is no commercial case to build vessels.

Increasing the size of the U.S. Navy is one way to increase shipbuilding. In July 2023, the U.S. Navy released the Battle Force Ship Assessment and Requirement (BFSAR) report that called for a future fleet of 381 manned ships by 2042. There are presently 294 manned ships. The report stated the 381 ships were necessary to meet the future demands of warfighting and campaigning. It generally takes five to 10 years to make a major Navy vessel.

However, the statement does not match the Biden administration's defense budget, which has not endorsed a future size of the Navy, according to naval affairs specialists. Under the Administration's five-year defense plan, the Navy in 2029 will have a total of 291 manned ships after both vessel deliveries and retirements.

At the Surface Navy Association's 36th National Symposium in January, Ronald O'Rourke, a specialist in naval affairs for the Congressional Research Service, said that increasing the Navy's shipbuilding account without increasing the Navy's overall budget to pay for the related costs of supporting a larger fleet would not make the Navy bigger.

"It would instead make the Navy younger, increasing average ship capability and reducing average ship maintenance cost, but the fleet wouldn't be substantially bigger," he said. "I don't see much evidence that the administration has explicitly endorsed a new force-level goal for a fleet in the size range indicated by the Navy studies," O'Rourke said. "The administration over the last three years has had numerous opportunities to do this, but I don't see much evidence that the administration has actually done that."

One place where the Biden administration could have explicitly endorsed a larger force-level goal, he said, was the October 2022 National Defense Strategy report, "but that document included no force-level figures for the Navy or any other part of the military, and no force-sizing metric" for determining U.S. military force-level goals.