"My parents’ heating bill — for the same square-foot house as mine in San Diego — and their heating bill's, like, maybe $500, and they're using their heat you know, 24/seven ... and it's negative 19 [degrees]"

San Diego County resident Kimberly Anthony

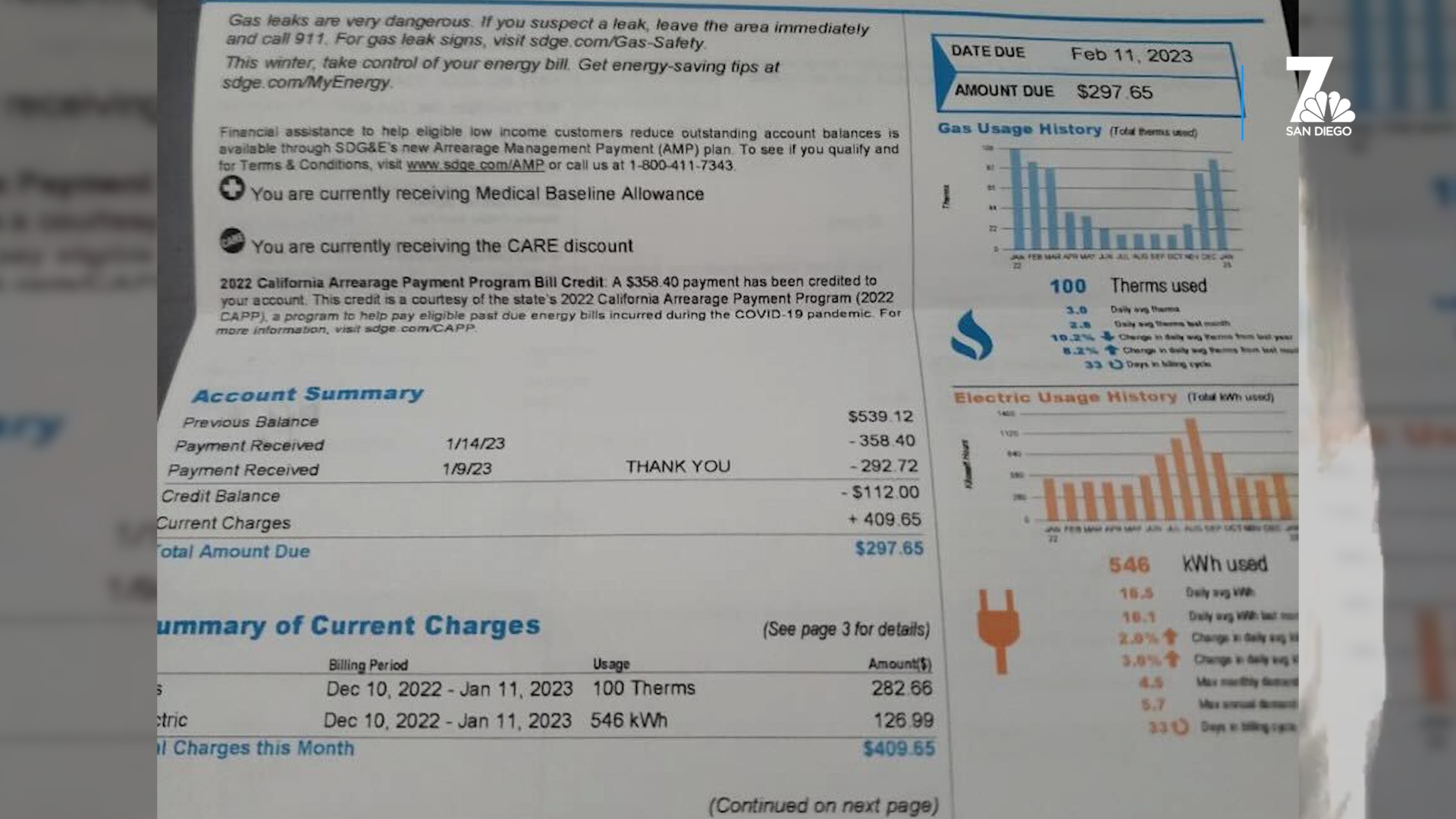

Anthony, a mother of two young children, was back home in Buffalo, New York, recently for a visit with family during the deepest of Arctic deep freezes when she started to get hot under the collar. Turns out her $500 monthly bill from San Diego Gas & Electric was similar to the ones relatives were receiving back east during one of the worst cold snaps in memory.

The hospice nurse is just one of nearly 1.5 million local businesses and residents who got repeated unhappy surprises the last couple of months when they went out to their mailboxes only to discover sizable, in many cases, shocking bills from SDG&E. Anthony Wagner, a spokesman for the utility, told NBC 7 that San Diegans who are in arrears to SDG&E are more than $200 million in the hole. He also said that one-third of its customers are enrolled in some sort of plan to defray their bills, with about 50,000 of them signed up for payment plans — 336,000 locals have accounts that are more than 30 days past due, he said.

In an effort to examine the situation and its causes, NBC 7 spoke with an energy expert and San Diego community members, all of whom shared what ballooning energy costs mean to them in an economic environment in which they're already feeling the squeeze.

For the Spring Valley mom, it's a tipping point.

"Our bills weren't really over 200, 250 bucks," Anthony said. "It didn't make sense to put solar in. And now when I got my $500 bill in February, I was like, 'Oh my gosh, is this…? This is what the solar people were saying: Something was going to happen in January.' I just didn't think it was true."

Winter's Supersize Sticker Shock

Everybody, from the wealthy to the poorest among us, has been prey to inflation in the past year, feeling the squeeze as rates soared as high as 7.7% year-to-year. The situation with SDG&E, which has a little over 900,000 gas meters in homes and businesses, hits different. The spikes were enormous, even for this so-called "non-recession" inflation.

The utility knew the spike hikes were coming. First, in October, it warned consumers to expect a $28 increase in electrical costs month-over-month.

In retrospect, that increase is quaint in comparison to what was coming, a glance back at more innocent times. Following that was a one-two power punch of bills in December and, especially, in January when the price of a "therm" — that's "a unit of heat equivalent to 100,000 Btu or 1.055 × 108 joules," according to Dictionary.com — nearly doubled from the month before. In December, natural gas cost $2.55 a therm for SDG&E customers, according to the utility. In January, the number soared to $5.11 per therm.

According to the utility, more than 90% of the increase in the overall gas rate is driven by the market price for natural gas — the amount SDG&E pays suppliers to buy it on behalf of its customers. SDG&E says it doesn't charge a markup for natural gas, maintaining that if the utility pays $1 for natural gas in the commodity market, that's what customers pay — plus $1.65 per therm ($1.56 for SDG&E directly and 9 cents for a public purpose program) for delivering the commodity to consumers. And those add up, by the way. Natural gas is not just used for heating and cooking, it's also used to generate 40% of the country's electricity, so when the price of natural gas soars, it also raises the price of electricity. So why did prices shoot so high in California? Several analysts point to three issues: reduced storage, pipeline problems and chilly weather.

In addition, wholesale natural gas prices are regional and change daily. In January, California’s gas prices were four, five and almost six times higher than much of the U.S. for days. In fact, some other parts of the country, there was extra natural gas — so much that some producers were paying others to take it off their hands. So, how did we get here?

San Diego's city council inked a 10-year franchise agreement with SDG&E in 2021. Turns out the utility was the only outfit to bid on the franchise. The agreement called for climate equity goals like investing in solar-energy rebates in historically underserved neighborhoods, as well as worker protections and accountability measures for bi-annual audits. The deal replaced a 50-year agreement the city had with SDG&E.

Now, in the wake of those exploding envelopes, officials are probing what, exactly happened, and if the costs borne by consumers were not just shocking but maybe something more than just San Diego's relationship with its government-sanctioned monopoly.

Gaslighting or Gas Costs?

California imports about 90% of its natural gas from other places — Texas, Wyoming, sometimes even Canada — in pipelines thousands of miles long and 3 feet wide that bring the odorless gas into the state. Then, SoCalGas, a regional distributor, distributes the gas through its own set of pipelines, which eventually connect to homes.

The skyrocketing price of natural gas started, in part, eight years after the closest natural gas storage facility to San Diego County failed. A well from Southern California Gas Co.’s Aliso Canyon Natural Gas Storage Facility leaked in 2015, sending about 97,000 tons of methane into the atmosphere. The blowout is considered the largest methane leak in recent U.S. history and as a result of the disaster, the California Public Utilities Commission capped the amount of gas that could be stored at the Porter Ranch-area facility.

Sempra Energy, which owns SDG&E, bids on gas in the U.S. and Canada open market, then resells it to customers without a markup.

"So I think [consumers] should understand that they're not making a profit even though the price of natural gas goes way up," said Fletcher Miller, who is a professor of mechanical engineering at SDSU, where he is also the director of the Combustion and Solar Energy Lab. "They make money on delivering it, but not actually on the scale of the commodity itself."

That's because the price of natural gas is regulated by the California Public Utilities Commission (CPUC), but the regulatory agency doesn't set the price. That depends on the market value, Miller said.

"They simply say that the price has to be whatever the company pays for it, but they're not actively engaged in trying to lower or control that price in any way," Miller said. "It really is a market-driven price, and we're competing with other states and now even other countries" to get it.

So what could affect natural gas prices? As we already said: It could be affected by the amount of natural gas that can be stored. It can be affected by disruptions in natural gas pipelines or distributors. And it could be affected by, plainly and simply, more use during colder winters.

Of course, there is the possibility of market manipulation of the commodity itself, but there is no evidence at this time to suggest that is the case. That, however, has not stopped California Gov. Gavin Newsom and others from calling for an investigation.

"Those who have been in California a while remember when the electricity market was, in fact, manipulated by Enron and Duke Energy," Miller said. "It led to the recall of our governor and the election of Arnold Schwarzenegger. So these are huge political issues, there's no doubt. I don't know what they're going to find when they examine the gas industry, but it sounds like they're going to take a closer look at it."

It's worth noting that most of California's natural gas consumption comes from generating that 40% of the state's electricity.

"And that's not something that, you know, you're paying in your gas bill, you're paying out in your electric bill," Miller said. "So it's a little bit more removed. You don't maybe notice it quite as much."

Miller suggested one obvious way to reduce natural gas consumption: use less.

"The only thing that can really match natural gas is, in fact, renewable energy," Miller said. "We're around 33% now, renewable energy in California, and, I think, if we want to alleviate natural gas, you know, high prices, one way for anything is just to start using less of it. Rates will come down. I think more solar for water heating and for electricity would be a great way out of this."

Miller practices what he preaches: His Ocean Beach home is entirely solar — even his water heater and his electric vehicle are charged by the sun.

"These last few, we have essentially no energy bill in our house," Miller said.

Lows and Highs: A Natural-Gas Timeline

- San Diegans were first warned in October 2022 about imminent price hikes. SDG&E said it requested approval from the California Public Utilities Commission to green-light a rate increase for January.

- In December 2022, the utility company noted that wholesale natural gas prices increased by 19%. A report from the National Gas Intelligence agency blamed low storage inventories, frigid winter temperatures on the West Coast and factors impacting supply and demand as causes for the spike.

- As 2022 came to a close and celebrations welcoming 2023 were thrown, new gas and electric rates were introduced on Jan. 1. SDG&E said the cost per a therm had more than doubled from $2.36, in January 2022, to $5.11 in January 2023.

- To help customers struggling with sticker shock, SDG&E announced in mid-January that it would make $1 million available in assistance funding, which would be distributed via the utility's Neighbor-to-Neighbor program.

- At the end of January, SDG&E announced that the commodity price of natural gas decreased by 68%. Officials from the utility noted customers wouldn’t see the change reflected in their bills immediately, though.

- To help offset the high bills, the California Public Utilities Commission (CPUC) approved a motion on Feb. 2 for SDG&E to apply the California Climate Credit to customers earlier than it normally does. San Diegans got a $43.40 natural-gas credit applied to their most-recent bill.

How Much Does SDG&E Have in the Tank?

Well, the utility's parent company, Sempra, recently reported that SDG&E posted $234 million in earnings — most of which is profit, other than some relatively nominal expenses — in the fourth quarter of 2022, up $18 million from the previous year, and reported $915 million in earnings for 2022, a spike of $96 million from the year prior.

Those figures don't include the big winter bills San Diegans have incurred this year, of course.

So, how does the utility make its money? According to SDG&E, fluctuations in natural-gas prices don't add to its coffers. Instead, it charges that $1.65 per therm off the top, a rate set by the CPUC. But it does benefit when the price of a kilowatt hour of electricity goes up. For example, during one recent month, a kilowatt hour cost consumers about 55 cents, 40 cents of which was for the transmission rate.

The outcry after the big bills started rolling in was loud and countywide, and the utility company quickly began to offer assistance to some, starting with an offer of $1 million in relief on Jan. 10, followed on Feb. 27 by a much sweeter offer.

"… SDG&E will fund a new $10 million program to support local nonprofit, community-based organizations (CBOs) that provide essential services to vulnerable customers," SDG&E said in a news release. "The company is also immediately increasing funding for its Neighbor-to-Neighbor bill assistance program to $6 million while doubling the amount of financial support available to each qualifying customer and expanding eligibility to ensure more customers can take advantage of the program."

The N2N assistance is available as $300 in one-time grants to help offset past-due bills for SDG&E customers who need help paying bills and aren't eligible for the federally funded Low-Income Home Energy Assistance Program.

Wagner, the spokesman for SDG&E, emailed NBC 7 to say that "[year] to date, N2N has assisted about 130 customers by providing more than $35,000 in financial aid." Unfortunately, that assistance, while available — "There is approximately $6M in the N2N program to help," according to Wagner. Consumers who need help can all 2-1-1 to sign up or go here for more information about assistance from San Diego Gas & Electric.

So, yes, SDG&E is making bank on the backs of consumers — it is in business to make a profit, after all — but in this case, it seems that the villain in the big-bill story are the forces combining to drive the commodity prices up.

Investigations in the Pipeline

So, how are things looking in the future? In the short term, your most recent gas bill may have gotten your heart racing. Analysts say that’s because utilities are usually about a month behind in passing wholesale prices on to consumers. Taking some sting out of that information, though, are climate credits being applied to the most recent bill as well as next month's, as well as a third at the end of the year. In total, many Californian energy customers will receive about $160 in relief. The schedule for those credits was accelerated at the urging of the California Public Utilities Commission, which, along with the California Energy Commission, are probing the causes of massive fluctuations in natural-gas prices.

More promising in the long term, however, is the news that the federal government is forecasting a 47% price drop this year and next.

Last week, SDG&E, which has once again applied to the CPUC to raise its rates by nearly $5 a month, announced that the price of natural gas was dipping again, down to $2.25 a therm for March, a drop from January's sky-high $5.11 a therm, 30 cents lower than December's rates.

Finally, up in Sacramento, California Gov. Gavin Newsom is urging federal officials to investigate the massive spike in natural-gas costs that occurred this winter.

Those who want to take a more participatory approach will want to watch a livestream of an SDG&E rate hearing public forum scheduled for March 15 by the CPUC.

"The California Public Utilities Commission (CPUC) will hold several public forums to provide an opportunity for customers of San Diego Gas & Electric (SDG&E) to offer perspective and input about the company’s rate requests," the CPUC says on its website regarding the public forums.

There will also be an in-person location for the forums at Sherman Heights Community Center at 2258 Island Ave. in San Diego. Public comments are welcomed. "You can also make your voice heard in the proceedings, and read the comments of others, on our online Docket Card comment section for the proceeding" here, according the CPUC. More information about the hearings can be found here.

This article originally reported that SDG&E charged $1.80 per therm, when, in fact, it charges $1.56 and then adds 9 cents for the public purpose program on top of that — Ed.