-

How much money you need to retire in every U.S. state — it's at least $1 million in 16 places

You’d need $2.05 million to cover 25 years of retirement in Hawaii, more than twice the U.S. average.

-

Setting aside $20 a day could help you save $1 million for retirement—if you start early

Aiming to save $1 million for retirement may seem like a lofty goal, but the process doesn’t have to feel overwhelming. How to get there by saving $20 a day.

-

Here's how long $1 million in retirement savings lasts in every state – and where it runs out the fastest

If you manage to save $1 million for retirement and plan to spend your post-work years in the U.S., here’s how long that would last in every state.

-

Are you a Social Security recipient? Here's how much more you'll get in 2024

Tens of millions of older Americans will see a modest increase in benefits in January when a new cost-of-living adjustment is added to Social Security payments.

-

‘Retirement isn't that easy': 3 people on working into their 90s and 100s

CNBC Make It asked three people who have continued to work into their 90s to share their best advice for building a long, happy career. Here’s what they shared.

-

Social Security cost-of-living adjustment: How much will recipients get in 2024?

Tens of millions of older Americans will see a modest increase in benefits in January when a new cost-of-living adjustment is added to Social Security payments

-

Biden administration to crack down on ‘junk fees' in retirement plans

The U.S. Department of Labor proposed rules Tuesday to rein in financial conflicts of interest in 401(k) plans and individual retirement accounts.

-

Retirement withdrawal rules are ‘crazy' this year, IRA expert says. Here's what you need to know

Here’s how to know if you need to take a required minimum distribution in 2023, according to an IRA expert.

-

The Netherlands named the best place to retire — here's how other countries compare

A new report assesses and ranks different retirement income systems around the world. Here’s how the U.S. compares.

-

53-year-old early retiree moved his family from the U.S. to Portugal—here's why they're happier than ever

Alex Trias retired early and in 2015 moved with his family to Lisbon. Here’s why he says they’re happier now than when they lived in the United States.

-

Here's the most expensive state to retire in 2023

Although California is known for its high cost of living, it’s not the most expensive state to retire, according to a recent Bankrate study.

-

This 22-year-old earns $194,000 at Google and aims to retire by 35—how he spends his money

Ethan Nguonly could afford a pretty luxurious life on his nearly $200,000 income. But here’s why he tries to live ‘as frugally as possible.’

-

More people are dipping into their retirement accounts. Why experts say it's a terrible idea

High inflation is having people dip into their retirement accounts in order to make ends meet.

-

More people are dipping into their retirement accounts. Why experts say it's a terrible idea

Financial experts say withdrawing from your 401k should be a last resort.

-

68-year-old who ‘un-retired' shares the 4 biggest retirement myths ‘more people need to talk about'

After an unfulfilling retirement, 68-year-old George Jerjian unretired and started his own company. He shares the most important lessons that most retirees don’t talk about.

-

Here's How Much Americans Have in Their 401(K)S at Every Age

Americans’ average 401(k) balances grew in the first quarter of 2023, per Fidelity’s latest report. Here’s how much they have saved by generation.

-

Millionaire Who Retired at 35: These Are the 3 ‘Stupidest Lies' I've Heard About Early Retirement

Steve Adcock retired in 2016 at age 35. In the years since, he says he’s heard every myth about the pitfalls of early retirement. These are the most common.

-

These Are the Best—and Worst—U.S. States for Retirees Based on Health Care, Wellness, Safety and More

A recent list of the best states to retire in explores not just affordability, but also health care and wellness. Here’s which states made the top 10.

-

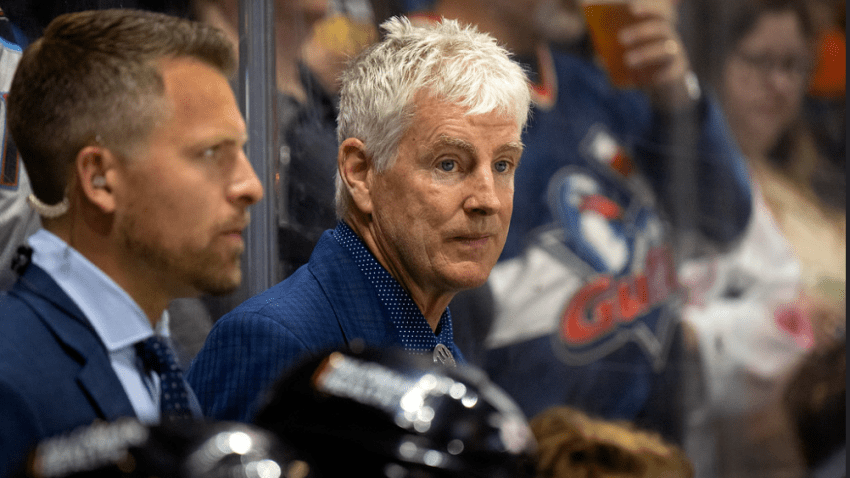

After 60 Years in Hockey, Gulls Head Coach Roy Sommer Announces Retirement

When people refer to Roy Sommer as a hockey lifer, it’s almost literally true. “I started this career when I was six years old, and I have been in it ever since,” says Sommer. “It’s probably a time in my life to try other things.” San Diego’s final game of the season in Colorado on Saturday night will be...

-

The 10 Best States to Retire in—and Florida Isn't No. 1

Florida no longer ranks as the best state to retire in and a new location has taken the top spot, according to WalletHub’s latest study. Check out the top 10.