With Americans now owing more than $1.7 trillion in student loans, it appears that more than ever, lawmakers are getting serious about canceling at least a portion of that debt.

Congressional leaders have put forward a number of proposals around reducing in some form or fashion the student loan debt held by roughly 45 million Americans. The measures include forgiving up to $50,000 in student loans, canceling up to $10,000 in debt, simply making it easier to repay loans by reducing interest rates on refinancing and allowing loans to be discharged in bankruptcy.

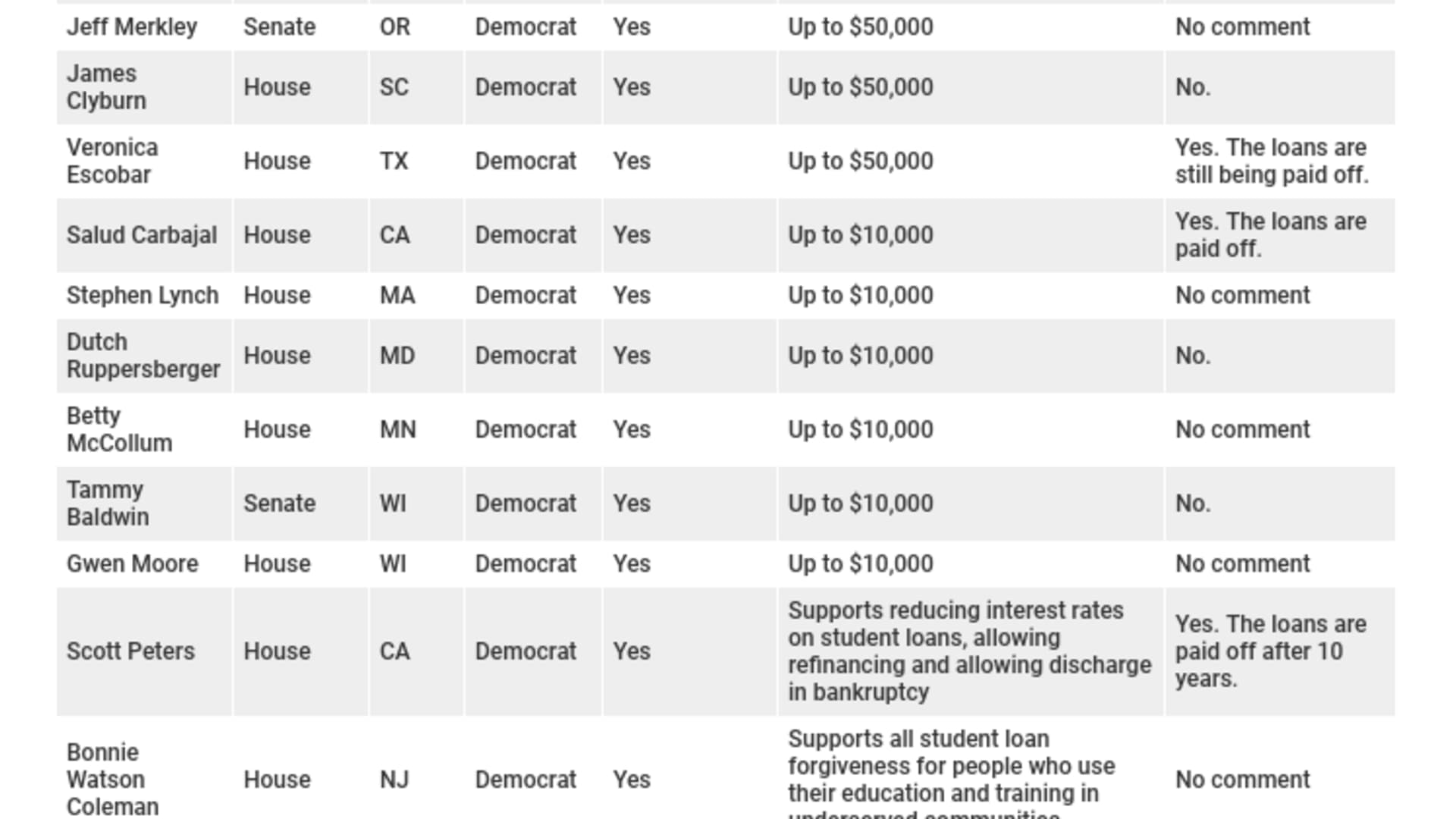

With so many options on the table, where do members of Congress stand on student loan forgiveness? CNBC Make It emailed members of Congress from every state to ask which proposals around student loan forgiveness they supported.

Of the more than 500 members of Congress Make It attempted to contact, 66 responded.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

Here's how it breaks down:

- 10 members of Congress, all Republican, do not support a flat rate of student loan forgiveness.

- 9 members did not specify whether they support forgiveness or not.

- 1 Democrat supports student loan forgiveness, but not a plan tied to an "arbitrary amount."

- 37 Congressional Democrats — in both the House and the Senate — support measures that would forgive up to $50,000 in student loans.

- 6 Democrats who responded say they support student loan forgiveness at a lower, $10,000, threshold.

- 27 members of Congress reported taking out student loans.

- 5 members are still paying off their loans.

While many members of Congress did not respond to CNBC Make It's requests, some lawmakers have already made their opinions public. Senator Bernie Sanders, I-Vt., and Reps. Alexandria Ocasio-Cortez, D-N.Y., and Maxine Waters, D-Calif., for instance, have joined a resolution calling for President Biden to cancel up to $50,000 in student loans. Senator John Thune, R-S.D., has said he does not believe blanket student loan forgiveness is the answer, saying the Democrats' plan to forgive $50,000 is "incredibly, fundamentally unfair."

Money Report

'Student loan debt is crushing millions'

About 36 million borrowers would have their student loan debt wiped out if the U.S. government cancels $50,000 in student loan debt, according to data from the U.S. Department of Education shared by Sen. Elizabeth Warren, D-Mass. About 15 million borrowers would have their debts wiped out under a plan to forgive up to $10,000 in student loans.

"I got my degree at a public commuter college that cost $50 a semester. This was a quality, public education that I could afford on a part-time waitressing salary — and it opened a million doors for me. It's how the daughter of a janitor got to become a teacher, a law school professor and a U.S. Senator," Warren said in a statement to CNBC Make It.

But it's virtually impossible for college students to find that kind of opportunity today, she says. "Student loan debt is crushing millions, especially during this pandemic. It's an anchor dragging down our struggling economy." That's why Warren is leading the charge to have President Biden immediately cancel up to $50,000 in federal student loan debt, she says.

But not everyone will benefit. Private student loans are not included in the any of student loan forgiveness proposals put forward so far. Regardless, many believe student loan forgiveness would help close wealth gaps and lift a massive burden from millions of Americans.

"Across-the-board student debt cancellation is a racial and economic justice issue, and is precisely the kind of bold, high-impact policy that President Biden has a mandate to deliver," Rep. Ayanna Pressley, D-Mass., tells CNBC Make It.

Black college graduates owe an average of $52,726, compared to their white counterparts who owe an average of $28,006, according to 2016 estimates from The Brookings Institution.

"Canceling $50,000 in federal student debt by executive action is one of the most effective ways we can stimulate our economy and reduce the racial wealth gap," Pressley says.

Support for cancelling $50,000 in student loans is far from universal

But for some, simply cancelling $50,000 in student loans is not the right solution. President Joe Biden, for instance, has repeatedly shot down suggestions that he use executive orders to forgive $50,000 in student loan debt. He's on the record supporting $10,000 of debt forgiveness and noting that Congress should provide a legislative solution.

Rep. Steve Stivers, R-Ohio, tells CNBC Make It he does not support the blanket forgiveness of student loan debt for a couple of reasons. "Our national debt is over $28 trillion and rising. That's over $85,000 per every citizen, far higher than the $32,731 that the average student borrower has," he says.

Stivers is also concerned blanket forgiveness could create unintended consequences. "[Students] may be more willing to take on unsustainable amounts of debt if they think that the government may wipe it away later, or they may not take the time to understand the decision that they are making," he says.

Rep. Scott Peters, D-Calif., supports student loan forgiveness, but believes it should be tied to income, rather than "a specific arbitrary amount," he tells CNBC Make It.

"I support reducing interest rates on student loans, allowing refinancing and allowing discharge in bankruptcy," he says, adding he's also in favor of incentivizing employer-provided student loan repayment.

What happens next?

Although Warren and others have recently called for President Biden to use his executive powers to cancel federal student loan debt, there is some debate over whether that would be legal. If Biden does opt for that route, forgiveness could happen relatively quickly.

Otherwise, Democrats would likely need to employ the same budget reconciliation process they did with the $1.9 trillion American Rescue Plan to push a blanket student loan forgiveness measure through Congress. And right now, they're more than a few votes shy of having complete support for it.

In the meantime, those with federal loans are still getting a reprieve. Until at least the end of September, the Education Department is continuing to suspend loan payments, forgo collections on defaulted loans and implement a 0% interest rate on all federal student loans.

Check out: Meet the middle-aged millennial: Homeowner, debt-burdened and turning 40