It’s a rule of the road in California: You can’t drive your car without auto insurance. Most would hope the prices that insurance companies charge are based on the right factors, especially because, to many drivers, the most important factor in picking an insurance policy is cost.

“I usually go for the cheapest one I can get,” Salena Thai said. “The most affordable one for me!”

In California, insurance companies are prohibited from setting prices for auto policies based on gender or credit score. They are allowed to consider a driver's age, marital status, address, driving record, details about their automobile and the estimated yearly mileage driven, however.

NBC 7 Investigates discovered that some insurance companies are using other factors to set prices, though, including a driver’s job title and their level of education.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

Doug Heller, the insurance director for the Consumer Federation of America, said that’s wrong.

“If we can prove we’re safe on the road, we should get the best rate,” Heller said.

Heller said those kinds of pricing policies result in wealthier drivers getting better rates than less-affluent ones. He walked NBC 7 Investigates through it on websites for Geico and Progressive.

Local

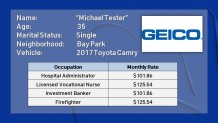

On Geico’s website, Heller created a fictitious driver named Michael Tester who just turned 35, is single, lives in Bay Park and drives a 2017 Toyota Camry, which he finances.

“It's a very common car,” Heller said.

Heller then gave him a perfect driving record and a job as a hospital administrator. He selected $50,000/$100,000 as the bodily injury coverage limit, which resulted in a policy costing $101.86 per month.

Next, Heller went back and changed that man’s job to be a licensed vocational nurse. Instantly, the price changed to $125.54 per month. Heller illustrated this pricing methodology two more times. When he changed the occupation to an investment banker, the price returned to $101.86. But when he made that same man a firefighter, the price went back up to $125.54 per month.

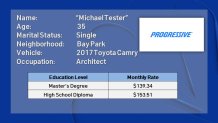

Heller also demonstrated similar effects on the Progressive website but used education level. In this instance, he made the test shopper an architect with a master’s degree. The monthly price was $139.34 per month. He then went back and altered the education portion so that man only had a high school degree. The cost jumped to $153.51 per month.

Heller had an explanation for why the insurance companies set prices this way.

“The insurance companies know that if they can lure in a driver that they prefer because of their ability to buy lots of more products with a low-priced auto insurance, then they can sell them lots more products,” Heller said.

"More products" include home, boat and jewelry insurance. The problem with that, said Heller, is lower-income drivers end up subsidizing auto-insurance discounts for wealthier drivers.

“That’s unfair,” Heller said. “It makes no sense. And consumers have a right to a fair price, and the thing that makes it all the worse is that those people who are getting charged the most are those in the most financial straits. They’re the ones who have the least income, the least ability to afford to buy the insurance the government makes us buy.”

NBC 7 Investigates spoke with drivers outside the DMV in the Hillcrest neighborhood who weren’t aware this was happening.

“I think that’s absolutely unfair,” Steven Bohna said.

Jeff Jones agreed.

“You're trying to pull money from people who don’t have it, can’t afford the increase," Jones said. "They’re lucky if they can afford gas.”

Salena Thai told us: “That’s definitely not fair! If anything it should be the other way around!”

California Deputy Insurance Commissioner Bryant Henley told NBC 7 Investigates that the state has spent years studying how much drivers are spending, and it’s clear: The less you make, the more likely you are to pay more for car insurance.

“The impact is clear and the impact is inequitable,” Henley said, “and that’s something [Insurance Commissioner of California Ricardo] Lara wants to fix.”

Henley said the state is working on regulations that would prohibit insurance companies from giving out discounts based on a job title or level of education.

Some insurance companies are fighting those proposed regulations. NBC 7 Investigates reached out to both Geico and Progressive and, instead of responding directly, they connected us with Steve Maviglio with Forza Communications, who also speaks for a coalition named Californians United to Protect Insurance Discounts, or CUPID.

“There’s a lot of things that go into setting people’s insurance rates,” Maviglio said.

NBC 7 Investigates asked Maviglio to explain why prices changed during Heller’s experiment when only one factor was changed.

“Because you weren’t provided with the full array of factors like an insurance company does and what the department does,” Maviglio said, “and that’s where you’re being hoodwinked. You have to get the full range, every little thing that goes into that, and the only way to do that is go back to the department’s files, look at how these rates for affinity groups are determined, and look at all those factors — go through that. It’s an enormously complex job — actuarial tables, driving records, all kinds of information. I don’t even know if you can get access to it, quite frankly.”

NBC 7 Investigates asked Maviglio five more times, but instead of explaining why monthly rates changed every time Heller changed the tester’s occupation or education level, Maviglio focused on group discounts. Those discounts are available to people who are part of an organization like a workers’ union or a big-box store like Costco. Memberships to those groups are not the same thing as a job title or education level.

Maviglio then claimed any new state regulation on that kind of pricing would eliminate group discounts.

“Restricting the definition is what’s going to cost an average driver 200 bucks or more,” Maviglio said.

Henley directly refuted that.

“That kind of statement couldn’t be farther from the truth…," California Deputy Insurance Commissioner Henley said. "Insurers have engaged in scare tactics to tell them they will lose their discounts.”

Henley said group discounts would stay in place. He credits the California Department of Insurance for studying the issue but says drivers can’t afford to keep waiting.

“Starting the conversation is fine,” Heller, the insurance director for the Consumer Federation of America, said, “but getting it done is essential. And it’s not getting done.”

In conversations with Heller, NBC 7 asked what could happen to a person who lies about their job or education level to get a better insurance rate. He said that was risky for drivers, not only because it’s fraud but also because insurers could drop coverage or refuse to pay out a claim if the lie is discovered.

There are programs in California to help low-income drivers afford car insurance. Drivers can learn who qualifies and apply here.