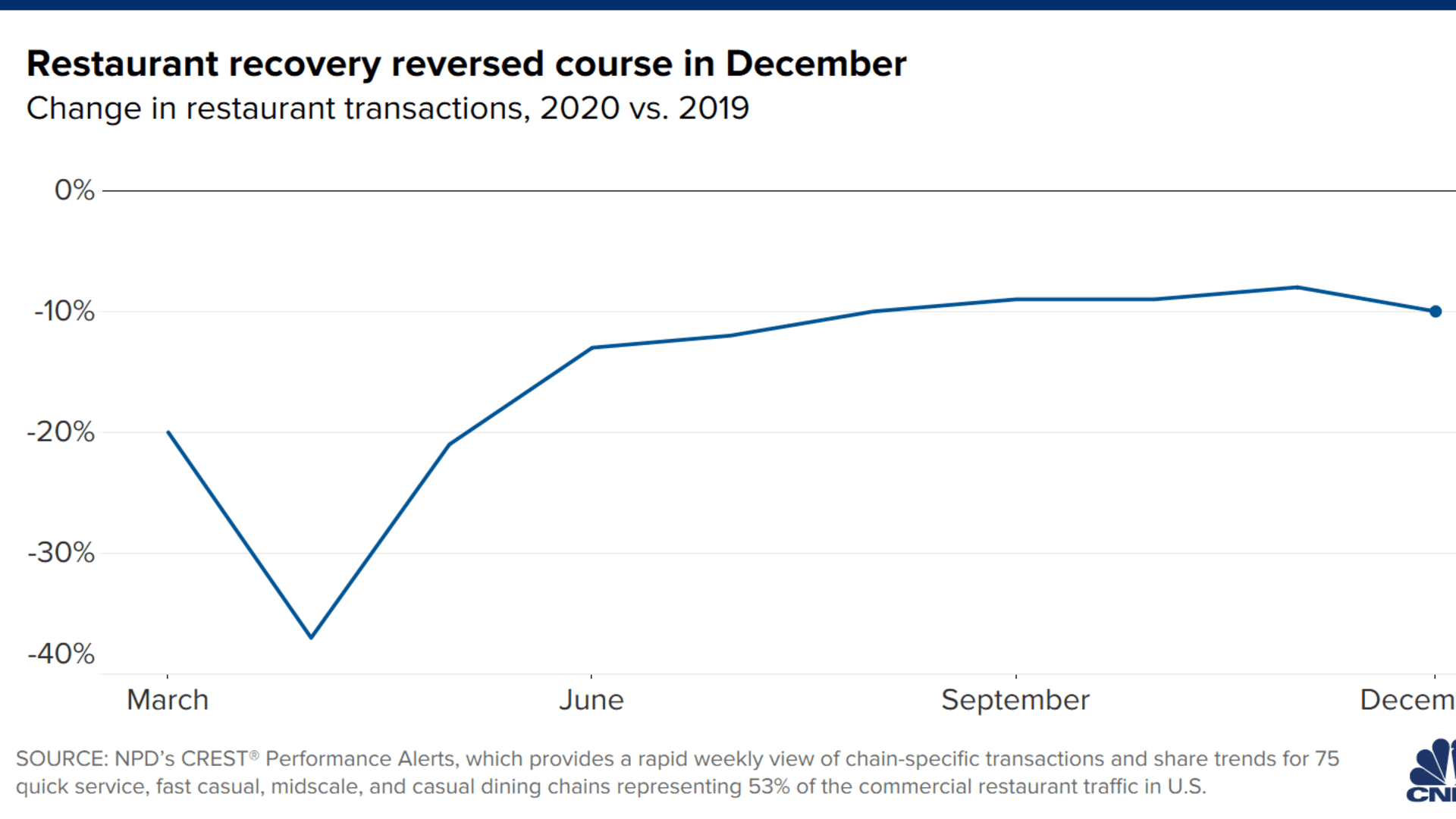

- Restaurant transactions fell 10% in December, according to the NPD Group, which tracks 75 restaurant chains.

- Up until December, monthly restaurant transaction declines had been improving consecutively since April.

- But new dining restrictions and cold weather have hurt customers' willingness to buy their meals from restaurants.

The restaurant industry spent most of 2020 trying to recover from the coronavirus pandemic, but the final month of the year saw weak sales worsen.

In December, transactions at U.S. restaurant chains fell 10% compared with the same time a year ago, according to the NPD Group. The firm tracks transactions at 75 restaurant chains, which make up for more than half of commercial restaurant traffic in the U.S. when combined. Up until December, monthly restaurant transaction declines had been improving consecutively since April. November transactions were down just 8%.

But the industry's recovery has been hampered by another surge in new Covid-19 cases, prompting government officials to reinstate harsh dining restrictions, and winter weather that has dissuaded customers from dining outside.

The full-service restaurant segment has been hardest hit by the pandemic. The sector, which includes the likes of Darden Restaurants' Olive Garden and The Cheesecake Factory, had a tougher time pivoting to delivery and takeout as indoor dining was banned. Unlike fast-food chains, full-service restaurants aren't known for their convenience, and their food isn't engineered with travel in mind.

At its nadir in April, the full-service segment saw transactions plummet 70%. In December, transactions fell just 30%. A new wave of indoor dining bans have hurt in-person sales. And takeout and delivery sales aren't enough to make up for the revenue shortfall stemming from fewer dine-in customers, the UBS Evidence Lab found.

Money Report

On the flip side, the fast-food sector has bounced back much faster. By July, weekly transaction declines were down to the single digits. The segment has benefited from prior investments in drive-thru lanes, digital ordering and speeding up service. And its cheap deals appeal to budget-conscious consumers, whose numbers increase during a recession.

The NPD Group only tracks restaurant chains. Consumer spending data from Bank of America has shown that chain restaurants are recovering at a much faster pace than independent restaurants. Typically, independent establishments lack the same access to capital as chains. And while the Paycheck Protection Program from the federal government was founded to help small businesses during the crisis, large chains like P.F. Chang's and T.G.I. Friday's gobbled up millions of the funds.

The restaurant industry is pushing for more relief targeted at bars and eateries. Before the most recent stimulus package was hammered out, President-elect Joe Biden said that he would support grants over loans for restaurants. The House of Representatives passed a similar bill in October that gave the industry a $120 billion lifeline. After Democrats grabbed two Senate seats in Georgia this week, it's more likely than ever that restaurants could see that kind of aid.