Target will be the latest big-box retailer to release quarterly results when it announces earnings before the bell Wednesday.

That report comes on the heels of a blowout quarter from Walmart. Grocery and e-commerce sales helped that company beat on its top and bottom line. Earnings of $1.69 a share surpassed forecasts for $1.21.

There's good news and bad news for Target heading into the report, according to Matt Maley, chief market strategist at Miller Tabak.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

The bad? Maley said the stock is prone to sell-offs when it gets this overpriced.

"On a historical basis, the stock is definitely expensive. At one times sales, it's the same level it saw in 2005 and 2000, which was just before it saw a pretty significant sell-off," Maley told CNBC's "Trading Nation" on Tuesday.

In 2005, the last time the stock traded above 1.1 times trailing sales, it fell from a peak of $60 to a trough below $45 in 12 months, a more than 25% decline. It currently trades at 1.12 times trailing sales.

Money Report

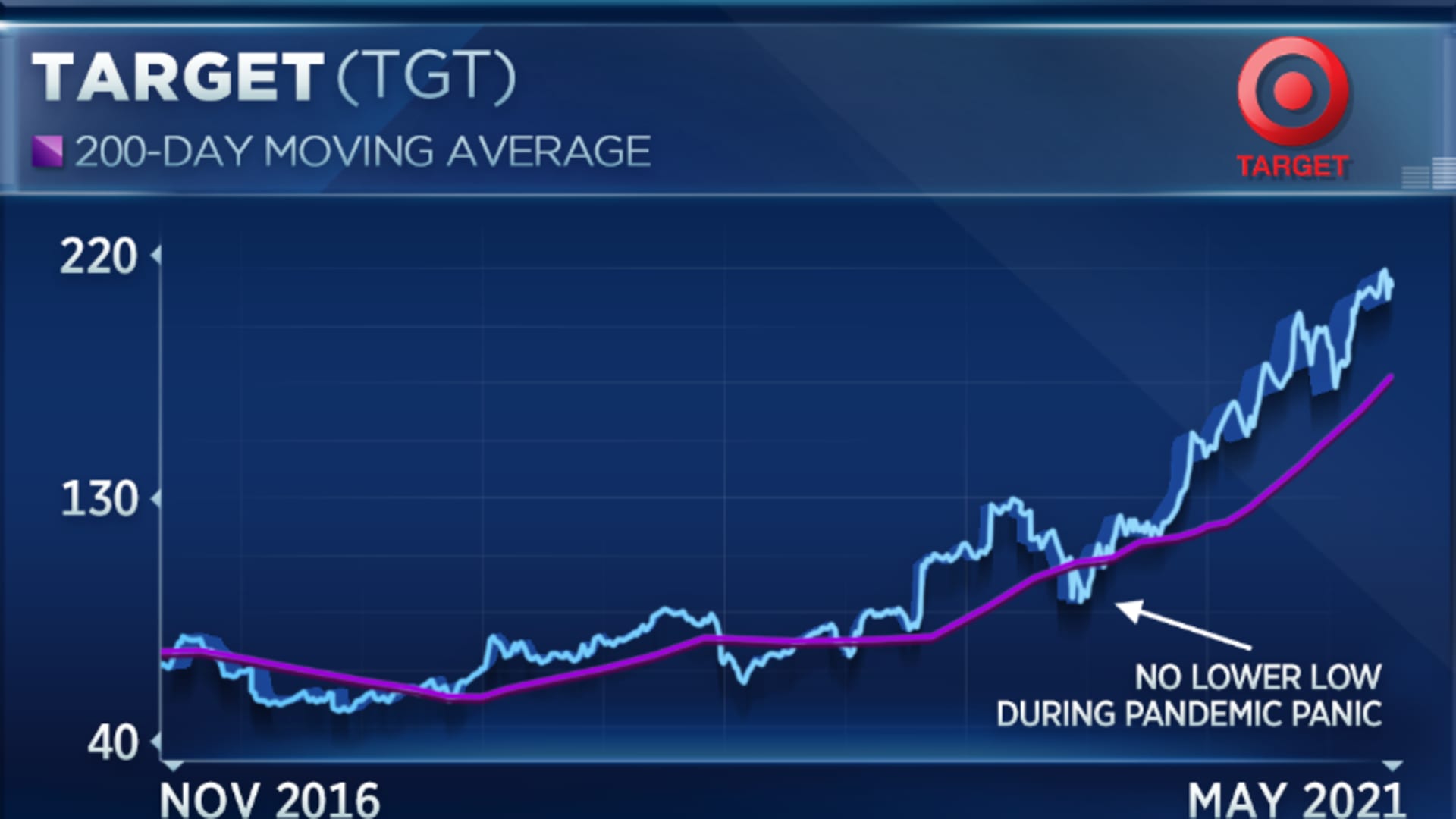

"The good news, though, is that you can't get a much better looking chart than this one. I mean, a lot of different stocks have made higher highs and higher lows for a year now since the pandemic of March of 2020. This one's been making them for four years," Maley said.

In fact, unlike most stocks, Target did not make a lower low during the coronavirus pandemic panic sell-off last March.

"My point is if it's a disappointing number or even in line, it's going to be a problem," he said. "If it's a good number, though, the chart still looks good and the line of least resistance seems to be higher, at least over the near term."

Quint Tatro, president of Joule Financial, is long-term bullish on Target, holding it in the firm's dividend portfolio. However, he would not be a buyer here.

"We've been trimming the name as it continues to rise. There's an old saying 'you buy the sizzle and sell the steak.' I think Target probably blows the [estimate] number away. … That being said, my guess is the stock sells off. The trade here is to sell Target into the report," Tatro said during the same interview.

Target has outperformed the market this year – the stock is up 17% compared with the S&P 500's 10% gain.

Analysts surveyed by FactSet anticipate $2.21 a share in profit for its April-ended quarter, up from 59 cents a year earlier. Sales are forecast to have risen to $21.7 billion, up from $19.6 billion.

Disclosure: Joule Financial holds TGT.