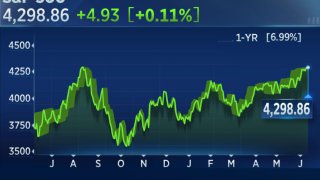

The S&P 500 rose slightly Friday, touching the 4,300 level for the first time since August 2022 as investors looked ahead to upcoming inflation data and the Federal Reserve's latest policy announcement.

The broad-market index gained 0.11%, closing at 4,298.86. The Nasdaq Composite rose 0.16% to end at 13,259.14. The Dow Jones Industrial Average traded up 43.17 points, or 0.13%, closing at 33,876.78. It was the 30-stock Dow's fourth consecutive positive day.

For the week, the S&P 500 was up 0.39%. This was the broad-market index's fourth straight winning week — a feat it last accomplished in August. The Nasdaq was up about 0.14%, posting its seventh straight winning week — its first streak of that length since November 2019. The Dow advanced 0.34%.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

Investors were encouraged by signs that a broader swath of stocks, including small-cap equities, was participating in the recent rally. The Russell 2000 was down slightly on the day, but notched a weekly gain of 1.9%.

"It's the first time in a while where investors seem to be feeling a greater sense of certainty. And we think that's been a turning point from what had been more of a bearish cautious sentiment," said Greg Bassuk, CEO at AXS Investments.

"We think that as we walk through these next few weeks, that will be increasingly clear that the economy is more resilient than folks have given it credit for the last six months," said Scott Ladner, chief investment officer at Horizon Investments. "That will sort of dawn on people that small-caps and cyclicals probably have a reasonable shot to play catch up."

Money Report

The market is also looking toward next week's consumer price index numbers and the Federal Open Market Committee meeting. Markets are currently anticipating a more than 71% probability the central bank will pause on rate hikes at the June meeting, according to the CME FedWatch Tool.

Tesla shares on pace to match longest winning streak

Tesla's stock is on track to match its longest winning streak of 11 straight positive days, should it end the day positive Friday.

The last time the stock sustained as long of a consecutive rally in January 2021. The stock was up about 4% as of Friday afternoon.

— Hakyung Kim, Lauren Feiner

Corporate profits expected down 6.4% in Q2

Corporate earnings for the S&P 500 are expected to post a third consecutive decline in the second quarter, according to an estimate Friday from FactSet.

Profits are projected to decline 6.4% from a year ago during the April-through-June period. That would be the biggest drop since the pandemic-scarred second quarter of 2020 and worse than the 2.1% decrease from the first quarter.

On March 31, FactSet was expecting a 4.8% drop for the quarter. Since then, 66 companies have issued negative earnings guidance while 44 have issued a positive outlook.

FactSet's John Butters said the firm expects earnings to turn around in the second half of the year, increasing 0.8% in the third quarter and a robust 8.2% to close the year.

—Jeff Cox

Market bears are 'capitulating,' Wolfe Research says

The bulls clearly have the upper hand in this market, Wolfe Research's Rob Ginsberg wrote.

"The bears are capitulating," he wrote. "Persistently negative since early '22, the bulls exploded this week to levels last seen in late '21, right around the market's peak. Add into the mix the collapse in the VIX, explosion in IWM call volumes and a drop in put/call ratios, and it's evident that complacency is rapidly building."

— Fred Imbert, Michael Bloom

How home improvement stocks are faring with higher interest rates

Investors will be watching next week to see how the Federal Reserve moves on interest rates.

One way higher rates has impacted consumers is inside their homes, as the higher borrowing costs change the purchasing equation on everything from decking to solar panels to furniture. CNBC Pro subscribers can dive in to see how these companies and their stocks are faring.

— Alex Harring

These semiconductor stocks could keep rising, Wall Street says

Semiconductor stocks are on pace for a record year as investors rotate back into the sector and bet on artificial intelligence.

With the VanEck Semiconductor ETF on pace for its best half ever, CNBC Pro screened for some names Wall Street expects to keep surging.

Read more on the four companies that made the cut.

— Samantha Subin

S&P 500 could go to as high as 5,000 by next year, Bank of America says

Bank of America technical strategist Stephen Suttmeier said a rebound in the Farrell Sentiment indicator could mean even more gains for the stock market going forward. More specifically, he noted the jump "favors SPX 4750 to 5000 in 1H 2024."

Suttmeier said that the indicator — which tracks the 10-week average of investor sentiment, as gauged by the AAII survey — has recovered from its lowest levels since the savings and loan crisis that ran from the 1980s through the 1990s.

"Last year's lows for Farrell Sentiment coincided with the June and October lows on the S&P 500 (SPX). These lows preceded bullish signals for Farrell Sentiment on moves above the oversold threshold of 0.5 on 2/17 and as of 6/8," Suttmeier said. "The SPX tends to have strong returns from four weeks to two years after Farrell Sentiment moves above 0.5. The average and median 52-week SPX returns for these signals near 16.3%-16.7% do not rule out SPX 4750 into February 2024 and SPX 5000 into June 2024."

— Fred Imbert, Michael Bloom

Stocks making the biggest moves midday

Check out the companies making headlines in midday trading.

- Braze — Shares of the consumer engagement platform rallied more than 18%. On Thursday, Braze posted a non-GAAP loss of 13 cents on revenue of $101.8 million. Analysts called for a loss of 18 cents per share and revenue of $98.8 million, according to FactSet. Goldman Sachs reiterated its buy rating on the stock following the report, noting that artificial intelligence should help the company gain market share.

- Joby Aviation, Archer Aviation — On Friday, Canaccord Genuity initiated coverage of Joby Aviation and Archer Aviation with a buy rating, saying the urban air mobility firms are positioned for the long term. Joby shares jumped about 9%, while Archer shares rose 3.3%.

- Adobe — Shares popped 3.5% after Wells Fargo upgraded the software stock to an overweight rating, saying that artificial intelligence should drive continued upside for the stock.

Read the full list here.

— Sarah Min

Walmart is a 'place to hide,' says Morgan Stanley

Morgan Stanley likes Walmart as a place for investors to hide right now.

The retail giant, which has seen a shift towards consumables and away from discretionary, is well equipped for the current consumer backdrop, the Wall Street firm said in a note on Thursday. Critical to its thesis is the upside expected to Walmart's fiscal-year 2024 estimates and margin inflection in 2025, analyst Simeon Gutman wrote after the firm hosted investor meetings with Walmart management.

"An inflection point is being reached in the model following years of e-commerce investments, international rationalization, and alternative revenue ramping," he said. "These attributes should push margins higher (4% average top-line growth with possible 8% EBIT growth, implying ~15 bps of annual EBIT margin expansion)."

— Michelle Fox

A 25-basis point increase from the Federal Reserve in July would be 'too high,' Jeremy Siegel says

Wharton School of Business professor Jeremy Siegel thinks Wall Street expectations that the central bank will hike with a 25-basis point increase in July is elevated.

"July is still pricing in 25 basis-points, I think that that's going to be too high," Siegel told CNBC's 'Squawk on the Street' on Friday.

He noted that next week will be key for investors with initial jobless claims date due out on Thursday.

"The initial claims is a very early, sensitive indicator," he said. "I believe, you know we're going into political season, they've [the Federal Reserve] got to be sensitive to what's going on in employment [and] if we see any faltering on that labor market, they are going to give up their rate hikes."

— Brian Evans

UBS indicates slight portfolio shifts in light of a reduced recession outlook

Keith Apton, managing director at UBS, said that the bank initially estimated a recession in the first half of 2023. But as the economy demonstrates more resilience, UBS has adjusted its outlook for a recession to happen either in the fourth quarter to the first half of next year — to even the possibility of no recession. In light of this changed outlook, Apton said the bank is adding slight changes to its portfolios.

"We are slightly adding to equities where we've been underweight in the past. We're going to start buying cyclicals. The cyclical should do well in this kind of a market, which get into the industrials, financial energy, small- and mid-caps," Apton said.

He added that UBS is started to look towards overseas growth as it expects the U.S. dollar to start to decline in value.

"So rather than chasing the tech trade for the seven major names that have really carried the market. ... We're looking for our growth overseas versus domestically."

— Hakyung Kim

All three indexes on track for weekly gains

With just hours left in the trading day and week, the three major indexes remain on track to post winning weeks.

The Dow and S&P 500 were on pace to end the week up 0.1% and 0.3%, respectively, shortly after 12 p.m. ET. If the S&P 500's gains hold, it would be the broad index's longest weekly winning streak since August at four.

Meanwhile, the Nasdaq Composite was just a hair above its flatline on the week. If the technology-heavy index can finish the week higher, it will mark seven straight winning weeks — the longest weekly streak for the Nasdaq since November 2019, when it last notched seven.

— Alex Harring

South Korea ETF hits new 52-week high

The iShares MSCI South Korea ETF reached a new 52-week high on Friday. LG Energy Solutions, Samsung Electronics, Kia and Posco Holdings led the gains.

The South Korea KOSPI also reached its highest level since June 2022.

— Hakyung Kim, Gina Francolla

Needham calls these stocks the biggest A.I. beneficiaries in e-commerce

As generative artificial intelligence continues its market-wide disruption, Needham views these e-commerce stocks as some of the best names to benefit over the long run.

Analyst Bernie McTernan highlighted Etsy, eBay, Shopify and fashion retailer Revolve as the potential big winners. AI enhancements should help personalize the shopper experience by narrowing search results, and improving efficiencies and conversion rates, he wrote.

"Most of our companies have been experimenting with AI/ML techniques for some time already--and we think Generative AI initiatives will take some time to develop and pay dividends," McTernan said.

He labeled Etsy as the "leading beneficiary" within the firm's coverage. Shopify, recently launched a personal shopping assistant that could be a "game changer" in improving conversion for small and medium sized business, McTernan added.

— Samantha Subin

Nasdaq Composite on pace for longest weekly win streak since 2019

If the Nasdaq Composite holds its week-to-date gains through close, it will mark the seventh straight winning week. That's the longest streak length since the seven-week stretch end Nov. 15, 2019.

That 2019 streak was broken when the index finished the week ending Nov. 22 down 0.25%.

The current rally comes as investor excitement around artificial intelligence has boosted technology stocks.

— Alex Harring

AbbVie could regain ground as bone marrow cancer drug trial shows 'blockbuster potential'

Bank of America said AbbVie could be due for a bounce as its possible myelofibrosis treatment Navitoclax showed "blockbuster potential."

Myelofibrosis is a rare type of bone marrow cancer that has a "high unmet need," the firm said.

Analyst Geoff Meacham said the drug could be "treatment-paradigm changing" and said phase-two data looked "promising." His price target of $158 implies the stock, which has fallen more than 14.8% this year, could regain 14.8% in the next 12 months.

He reiterated his neutral rating and price target ahead of another part of a trial, noting he doesn't anticipate approval until 2024 and that risks still remain.

Meacham said Navitoclax could have a risk-adjusted sales peak in 2030 at around $500 million, assuming there's an addressable patient population between of 9,000 and 11,000 and a 60% probability of success. That statistic also reflects a cost per patient that would be in line with the medication Venclexta and a peak penetration of around 40%.

— Alex Harring

Tesla's deals with GM, Ford will boost green energy transition, Cathie Wood says

The newly announced partnerships between Tesla and Ford and GM to open up Tesla's charging network will be a positive for the electric vehicle industry broadly, according to Ark Invest chief investment officer Cathie Wood.

"I think it's great for America and our transition to the electric future. ... I do think it increases the probability of our forecast of 60 million electric vehicle sales by '27," Wood said on CNBC's "Squawk Box."

Check out the full interview with Wood on CNBC Pro.

— Jesse Pound

Wood says Coinbase buy is a bet on 'checks and balances'

Cathie Wood has doubled down on Coinbase this week, buying up more than 300,000 shares of the crypto exchange for her Ark Innovation ETF (ARKK) on Tuesday despite a lawsuit from the Securities and Exchange Commission that threatens the core functions of Coinbase's business.

Wood said Friday on "Squawk Box" that purchasing more Coinbase stock was "betting on the checks and balances inherit in our government."

""We now have the judicial system and the legislative system studying and getting involved in this topic, and I think it's great. I think we're going to end up in the right place," Wood said.

— Jesse Pound

Stocks tick higher Friday

U.S. stocks rose slightly Friday.

The S&P 500 rose 0.2%, while the Nasdaq Composite advanced 0.5%. The Dow Jones Industrial Average lagged, falling 28 points, or 0.08%.

— Hakyung Kim

Adobe adds 3% following Wells Fargo upgrade

Adobe shares rose more than 3.5% in premarket trading after Wells Fargo said artificial intelligence should boost the stock.

Analyst Michael Turrin upgraded the software stock to overweight from equal weight and raised his price target to $525 from $420. Turrin's new target implies a 19.6% upside from where the stock closed Thursday.

"The AI debate continues to drive ADBE," he said in a note to clients Friday. "We come away from recent work more confident Gen AI is a tailwind to ADBE as we expect much of the early value to accrue to established platforms & see potential for further break-out as products are monetized."

CNBC Pro subscribers can read more about his call here.

— Alex Harring

Corning rises 3% following Morgan Stanley upgrade

Corning added more than 3% before the bell after Morgan Stanley got bullish on the glass materials maker stock.

Analyst Meta Marshall upgraded shares to overweight from equal weight and raised her price target by $3 to $38. Marshall's new target implies a 19.9% upside over Thursday's close.

"We now see opportunity for positive estimate revisions over the next twelve months, setting up an attractive risk reward," she said in a note to clients Friday, calling many of Corning's businesses "derisked."

CNBC Pro subscribers can click here to read more.

— Alex Harring

Target shares down 1% as Citi moves to sidelines

Target dropped more than 1% in Friday's premarket after Citi downgraded the retail giant to neutral from buy.

Analyst Paul Lejuez dcut his price target to $130 from $177, with his new target implying the stock will fall nearly 1% in the next year from where shares finished Thursday. He said the company's recent sales data is concerning and could show a peak.

A key question: just how far can sales fall?

"This is not a new concern," he said. "It is the primary reason TGT has been our lowest ranked Buy-rated stock for some time, but we are concerned now more than ever, and we can no longer recommend that investors Buy TGT."

CNBC Pro subscribers can read the full story here.

— Alex Harring

Stocks making the biggest moves premarket

Check out some of the companies making headlines in premarket trading.

Adobe — Shares of the software company gained more than 3% after Wells Fargo upgraded the stock Friday morning to overweight, according to StreetAccount.

Nio — Shares of the electric vehicle company dipped 2% in premarket trading after it reported that vehicle sales decreased 0.2% year over year. The company's vehicle margin and net loss also worsened year over year.

Target — The retail giant slipped 1.3% after Citi downgraded the stock over concerns that sales may have peaked.

Read the full list here.

— Brian Evans

Tesla shares jump 6% Friday premarket

Shares of electric vehicle maker Tesla gained more than 6% Friday morning.

General Motors announced Thursday that the company would partner with Tesla to use its electric vehicle charging network and technologies. Shares of GM were up 4.2%.

— Hakyung Kim

UBS names Ulta one of its top ideas

Ulta is a good pick despite a post-earnings selloff, UBS said.

Analyst Michael Lasser named the buy-rated beauty stock a top idea exiting second-quarter earnings season. "After ULTA's shares have pulled back by 20% in the last month, we think the risk-reward is firmly tilted to the upside," he said in a note to clients Thursday.

Shares of Ulta were up 0.8% Friday during premarket trading.

The full call can be found here.

— Hakyung Kim

U.S. Treasury yields climb as investors prepare for Fed policy meeting

U.S. Treasury yields rose on Friday as investors looked ahead to the Federal Reserve monetary policy meeting on June 13 and 14, where officials will announce a fresh interest rate decision.

Uncertainty about whether the central bank will continue or pause its rate-hiking campaign has spread recently, but jobs data released on Thursday prompted investors to believe the Fed will not increase rates again next week.

At 4:24 a.m. ET, the yield on the 10-year Treasury was up by almost four basis points to 3.7529%. The 2-year Treasury yield was trading more than three basis points higher at 4.5556%.

— Sophie Kiderlin

European equity markets open marginally higher

European markets opened marginally higher at the end of a choppy week of uncertain global sentiment.

The pan-European Stoxx 600 index was up 0.2% at the start of trading, with most sectors seeing minor gains. Mining stocks and retail were both up 0.6% respectively, while chemicals dropped 0.4%.

— Hannah Ward-Glenton

Retail and industrial stocks lead Nikkei rebound on Friday

Retail and industrial stocks powered the Nikkei 225 to a 1.97% gain on Friday, leading gains among major indexes in the Asia-Pacific region.

The top gainer on the index was video game company Konami, which climbed 5.79%. Konami is known for creating the Metal Gear and Silent Hill series of games.

Other names on the top gainers list were retail giant Fast Retailing, chemicals company Mitsui and Co, and Daikin Industries, the world's largest air conditioner manufacturer.

— Lim Hui Jie

China's consumer prices rise 0.2%, producer prices fall

China's consumer price index rose 0.2% in May compared to a year ago, government data showed.

Economists surveyed by Reuters expected to see a 0.3% rise, ticking up after marking a two-year low of 0.1% in April. Month-on-month, prices fell 0.2% — economists predicted a 0.1% decline.

China's producer deflation continued in May, with the producer price index dropping 4.6% for the month, a further decline from -3.6% in April and marking the steepest drop since June 2016.

A Reuters poll of economists expected to see a decline of 4.3% in producer prices.

— Jihye Lee

Philippines' trade deficit narrows in April, but both exports and imports tumble

The Philippines' trade deficit in May narrowed to $4.53 billion, down from a $4.93 billion deficit in March.

The country's exports and imports both slid sharply compared to April 2022, with exports falling 20.2% and imports sliding 17.7% year-on-year.

In comparison, March saw a 9.1% fall in exports and 2.7% drop in imports compared to a year ago.

Government data revealed that the commodity group with the highest annual decline in export value in April was electronic products, which dropped by $582.6 million.

Electronic products were also the second highest contributor to the fall in imports, only surpassed by mineral fuels, lubricants and related materials, which fell by $927.86 million.

China still remained as the Philippines top trading partner, contributing to 15.8% of its export value and supplying 23.9% of its imported goods in April.

— Lim Hui Jie

S&P 500 is on pace for a four-week winning streak

The S&P 500 is headed for a fourth straight week of gains for the first time since last August. As of Thursday's close, the broader index was higher by nearly 0.3%.

Meanwhile, the Dow Jones Industrial Average is on pace for a second consecutive week of gains, or its best streak since its four straight weeks of gains ending in April. The benchmark is higher by 0.2%.

On the other hand, the Nasdaq Composite is on pace to break a six-week winning streak. The tech-heavy index is just slightly down for the week, by 0.02%.

— Sarah Min, Chris Hayes

Stocks making the biggest moves after hours

Check out the companies making headlines after hours.

- DocuSign — DocuSign jumped 5.6% in extended trading after the electronic agreements firm beat analysts' first-quarter expectations on the top and bottom lines. DocuSign posted first-quarter adjusted earnings of 72 cents per share, topping consensus estimates of 56 cents, according to Refinitiv. It reported revenues of $661 million, exceeding expectations of $642 million.

- Vail Resorts — Shares fell 3.9% after Vail Resorts missed third-quarter earnings expectations. The mountain resort company posted earnings of $8.18 per share, while analysts polled by Refinitiv expected $8.84 per share. It reported revenue of $1.24 billion, lower than the estimate of $1.27 billion.

- General Motors — General Motors advanced 3% after CEO Mary Barra and Tesla CEO Elon Musk said the automaker will join Ford Motor in partnering with Tesla to use the electric vehicle maker's charging network in North America. Tesla shares also popped 3% in extended trading.

Read the full list here.

— Sarah Min

Stock futures open little changed

U.S. stock futures were little changed on Thursday night.

Dow Jones Industrial Average futures fell by 38 points, or 0.11%. S&P 500 futures dipped 0.05%, while Nasdaq 100 futures rose 0.05%.

— Sarah Min