Stocks slumped Friday, capping off a volatile week of trading, a day after posting a historic turnaround rally as investors digested inflation expectations.

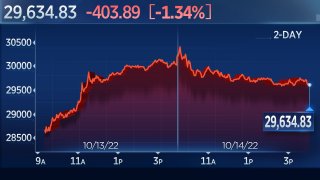

The Dow Jones Industrial Average fell 403.89 points, or 1.34%, to end the day at 29,634.83. Still, the index was up 1.15% on the week. The S&P 500 shed 2.37% to 3,583.07 and notched its seventh negative close in eight days. The Nasdaq Composite slipped 3.08%, ending the day at 10,321.39, weighed down by losses in Tesla and Lucid Motors, which declined 7.55% and 8.61%, respectively.

Both the S&P 500 and the Nasdaq ended the week lower, falling 1.55% and 3.11%, respectively.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

Stocks fell to session lows after a consumer survey from the University of Michigan showed inflation expectations were increasing, a sentiment that the Federal Reserve is likely watching closely. The tech-heavy Nasdaq led declines as growth companies are most sensitive to interest rate hikes.

At the same time, bond yields spiked, with the rate on the 10-year U.S. Treasury topping 4% for the second time in two days as investors react to higher inflation expectations.

Markets whipsawed throughout the week as investors weighed new inflation data that will inform the Fed as it continues to hike interest rates to cool off price increases. On Thursday, stocks staged a major turnaround. The Dow ended Thursday's session up 827 points after being down more than 500 points at the intraday low. The S&P 500 rose 2.6% to break a six-day losing streak, and the Nasdaq Composite jumped 2.2%.

Money Report

Thursday marked the fifth largest intraday reversal from a low in the history of the S&P 500, and it was the fourth largest for the Nasdaq, according to SentimenTrader.

The moves followed the release of the consumer price index, a key U.S. inflation reading that came in hotter than expected for the month of September. Initially, this weighed on markets as investors braced themselves for the Federal Reserve to continue with its aggressive rate-hiking plan. Later, however, they shrugged off those worries.

Still, persistent inflation remains a problem for the Fed and for investors' worries around the central bank's policy tightening.

"With core CPI still moving in the wrong direction and the labor market strong, the conditions are not in place for a Fed policy pivot, which would be one of the conditions for a sustained rally in the equity market," wrote UBS global wealth management chief investment officer Mark Haefele in a Friday note.

"Moreover, as inflation remains elevated for longer and the Fed hikes further, the risk increases that the cumulative effect of policy tightening pushes the US economy into recession, undermining the outlook for corporate earnings," he added.

Lea la cobertura del mercado de hoy en español aquí.

Stocks fall to end a wild week of trading

Stocks fell Friday ending a week of volatile trading on inflation data.

The Dow Jones Industrial Average fell 403.89 points, or 1.34%, to end the day at 29,634.83. Still, the index was up more than 1% on the week.

The S&P 500 shed 2.37% to 3,583.07 and notched its seventh negative close in eight days. The Nasdaq Composite slipped 3.08%, ending the day at 10,321.39, weighed down by losses in Tesla and Lucid Motors, which each declined more than 7%. Both the S&P 500 and the Nasdaq ended the week lower.

—Carmen Reinicke

Oil slumps as recession fears outweigh production cuts

Oil prices fell Friday, pushing the commodity to its worst week since Aug. 5 as worries about a global recession hitting demand outweighed production cuts from OPEC+.

West Texas Intermediate crude settled down 3.93% at $85.61 per barrel on Friday. That brought it down 7.59% for the week, its first negative one in three. Year to date, West Texas Intermediate is up nearly 14%.

Brent crude also slumped, falling 3.11% to $91.63 per barrel Friday, notching a 6.42% loss for the week. It's Brent's first negative week since Sept. 2. The commodity is up nearly 18% year to date.

—Carmen Reinicke

Stocks fall heading into final hour of trading

Stocks continued their declines heading into the final hour of trading of the day and the week.

The Dow Jones Industrial Average slipped 345 points, or 1.10%. The index is still on track to end the week higher, up about 1.43%.

Both the S&P 500 and the Nasdaq Composite are heading towards negative weeks. The S&P 500 fell nearly 2% and the Nasdaq was down 2.46%

—Carmen Reinicke

Albertsons, banks stocks and Delta among Friday's stocks making the biggest moves

Bank stocks and grocery store chain operator Albertsons were among the names making headlines in midday trading on Friday.

Shares of Safeway owner Albertsons dropped 8% after Kroger agreed to purchase the company in a deal valued at $24.6 billion, or $34.10 a share, while Kroger's stock dipped 4.8%.

Delta Air Lines's stock gained about 3% after Cowen upgraded shares amid a recovery in travel.

Several bank stocks including JPMorgan Chase and Morgan Stanley moved in midday trading amid mixed earnings reports from a slew of bank stocks.

— Samantha Subin

Markets may be heading for a relief rally, Hackett says

Stocks have whiplashed in volatile trading this week as investors weigh new inflation data. The choppy movement may be a sign that a relief rally is in the works.

"This week provided additional evidence that equity markets may be heading for a relief rally," said Mark Hackett, chief of investment research at Nationwide. "Thursday's action was driven by a disappointing report on CPI, with an initial decline of more than 3% quickly reversed to finish the session with a gain of nearly 3%."

"Institutional investors remain extremely conservative, with Goldman Sachs data showing net equity positioning was at a five-year low ahead of the CPI report," he added. "This, along with fund manager cash being at the highest since 2001, drove the sharp recovery, and reflect the potential for upside to expectations."

In addition, the Bank of America bull and bear indicator is flat for the fourth week, Hackett noted. That shows that retail investors are in buy the dip mode - funds have seen positive inflows for seven consecutive weeks.

"Markets have attempted a rally several times in recent weeks with no success, though the impressive reversal on Thursday is an indication that a relief rally may be near given the excess degree of pessimism priced into markets," he said.

—Carmen Reinicke

10-year U.S. Treasury yield tops 4%

The yield on the 10-year U.S. Treasury bond topped 4% for the second time in two days as traders weighed inflation data and a slump in UK gilts after the government pivoted yet again on parts of its budget.

Yields on the 10-year gained seven basis points to trade at 4.025%. A day earlier, the yield briefly rose above the 4% level after a key consumer inflation report was hotter than expected. Bond yields move inverse to price and one basis point is equivalent to 0.01%.

—Carmen Reinicke

Traders see regulatory hurdles ahead for Albertsons-Kroger deal

Kroger's plans to buy Albertsons for $34.10 a share make a lot of sense strategically but it appears traders are anticipating pushback from regulators.

Albertsons stock is trading down 7% at about $26.61. When the deal closes, shareholders will receive $6.85 as a special dividend. Even if you add that into the stock price, there's still a wide gap, which is a telltale sign that investors a worried about the companies' chances of sealing the deal.

The grocery business is very fragmented. Walmart is the largest player with a market share of just over 20%, according to researcher Numerator. Kroger's market share ranks next at just under 10%. Albertsons trails Costco, with a 5.7% share.

But grocery prices have been soaring, and regulators might not like the optics of the combination. Ordinary people may assume that the merger will give the grocers too much control over the price of everyday necessities.

—Christina Cheddar Berk

Stocks on pace for negative week

Despite Thursday's historic rebound, stocks are still on pace to close in negative territory this week.

Losses on Friday pushed all three major indices towards negative weekly closes. Nearing midday, the Nasdaq Composite is on pace to close down 1.64%.

The Dow and the S&P 500 are also on pace for a negative week. The Dow is on pace to close nearly 2% lower, and the S&P is on track for a 0.50% lower close.

—Carmen Reinicke

Delta leads airlines higher after analyst upgrade

Airlines outperformed Friday and led the transportation sector in the S&P 500 after Delta Air Lines received a big upgrade earlier in the morning.

Cowen upgraded shares of Delta to outperform from market perform, citing increased business travel as a reason the stock will boom going forward. The firm also said that shares can surge another 80% from where they currently trade. Shares of the airline jumped more than 3% on the news.

Other airlines followed Delta higher. American Airlines, United Airlines and Southwest all gained more than 1%.

—Carmen Reinicke, Samantha Subin

Fed's George notes risks around moving too quickly with rate hikes

Kansas City Federal Reserve President Esther George expressed some caution Friday about the pace of interest rate increases.

While she said she understands the need for higher rates to battle surging inflation, she said the Fed needs to be consistent with the pace and mindful of the lagged effects of tighter monetary policy.

"I do see risks around moving too abruptly to this new higher level. Moving too fast can disrupt financial markets in the economy in a way that ultimately can be self defeating," she told S&P Global Rankings in a webcast.

George, a voting member this year of the rate-setting Federal Open Market Committee, said the Fed's policy poses risks to financial stability that should be monitored closely.

"The pace at which that policy unfolds is going to need to be carefully balanced against the state of the economy and the condition of financial markets particularly at a time of heightened uncertainty," she sad.

The Fed has instituted a series of rate hikes totaling 3 percentage points, with markets expecting increases of 0.75 percentage points in both November and December.

—Jeff Cox

Inflation expectations rise among consumers

The University of Michigan's latest consumer sentiment report showed one-year inflation expectations rose to 5.1% from a previous reading of 4.7%.

"Last month, long run inflation expectations fell below the narrow 2.9-3.1% range for the first time since July 2021, but since then expectations have returned to that range at 2.9%. After 3 months of expecting minimal increases in gas prices in the year ahead, both short and longer run expectations rebounded in October," Surveys of Consumers director Joanne Hsu wrote.

The overall consumer sentiment index rose slightly to 59.8 from 58.6 in September. However, the index of consumer expectations fell to 56.2 from 58.

— Fred Imbert

Stocks rise Friday, look to continue Thursday's historic rebound

Stocks opened higher Friday as the market looked to build on Thursday's historic rebound rally.

The Dow Jones Industrial Average increased 215 points, or 0.72%. The S&P 500 gained 0.63%, and the Nasdaq Composite ticked up 0.87%.

The Nasdaq led gains, with the consumer staples sector outperforming.

—Carmen Reinicke

Citigroup shares rise despite profit decline

Shares of Citigroup ticked up 1% in premarket trading after the bank's third-quarter revenue topped analyst expectations.

Profits, however, fell 25% year over year as Citigroup bulked up its credit loss provisions. It is unclear if Citi's earnings per share of $1.63 was comparable to analyst estimates.

The bank continued its restructuring under CEO Jane Fraser, with a gain on the sale of its Philippines consumer business a primary driver of revenue growth. Personal banking revenue also climbed 10% year over year.

— Jesse Pound

Stock futures rise ahead of market open

Stock futures rose ahead of the market open Friday, after wavering on mixed bank earnings results.

The move higher looks to continue a historic rebound rally that took place in markets Thursday.

Futures tied to the Dow Jones Industrial Average increased 314 points, or 1.05%. S&P 500 futures gained 1.10%, and Nasdaq 100 futures ticked up 1.20%.

—Carmen Reinicke

Retail sales flat in September

Retail sales in September were flat after ticking up 0.4% in August, the U.S. Census Bureau reported Friday. On the year, retail sales were up 8.2%.

Stripping out the price of automobiles, the measure of consumer spending rose 0.1% in September, its first increase since June.

"Bottom line, the strength in the US dollar is helping to keep import prices more subdued and as seen in yesterday's CPI figure, the rate of price increase in core goods continues to moderate," said Peter Boockvar, chief investment officer at Bleakley Financial Group. "Yesterday's figure was the lowest since May 2021. So, the inflation debate from here is how much quicker does this slow and how much is it offset by the continued acceleration in services prices, mostly led by rents."

—Carmen Reinicke

Kwarteng fired as U.K.'s finance minister

Kwasi Kwarteng was sacked as the United Kingdom's finance minister on Friday after just six weeks in the role.

"The economic environment has changed rapidly since we set out the Growth Plan on 23 September," he wrote in his resignation letter, confirming that Prime Minister Liz Truss asked him to step down. "In response, together with the Bank of England and excellent officials at the Treasury we have responded to those events, and I commend my officials for their dedication."

The announcement came as Kwarteng made an early exit from the International Monetary Fund's meetings held in Washington.

Kwarteng has been criticized in recent weeks for his controversial mini-budget, which included a slew of unfunded tax cuts that rattled markets and pushed the British pound to hit a record low.

It also sparked a sell-off of long-dated government bonds that forced the Bank of England to intervene with an emergency bond-buying plan to prevent pension funds from collapsing.

The pound last traded down more than 1% against the dollar at $1.12 following news of the firing.

— Elliot Smith, Samantha Subin

Higher interest rates smack Wells Fargo mortgage business

Wells Fargo said its home lending revenue fell 52% in the third quarter as the pace of mortgage originations slowed. Home lending originations were down 59% from the year-ago period to $21.5 billion.

The Federal Reserve has been hiking interest rates in a bid to tame stubbornly high inflation. The effort has pushed the average 30-year fixed mortgage rate to a 20-year high of 6.92% — more than doubling in the past year.

Wells Fargo is the most mortgage-dependent of the six biggest banks. The company's stock was up more than 1% in premarket trading after its third-quarter results.

—Christina Cheddar Berk, Yun Li

Near-term pain to remain for investors, Subramanian says

Though today's bear market represents attractive opportunities for long-term investors, there will likely be more pain ahead, according to Savita Subramanian, equity strategist at Bank of America.

"While the S&P 500 fell below our year-end target of 3600, we continue to expect volatility in the market," she wrote in a Friday note. "Our bull market signposts continue to suggest that the market hasn't yet bottomed, with only 20% triggered today vs. 80%+ before prior market bottoms."

At the same time, there is hope in the long-term. The Bank of America long-term valuation model is forecasting 6% annual price returns for the next decade, the highest since May 2020. With 2% dividends, this implies roughly 8% in total returns.

In the meantime, Subramanian recommends high quality stocks with strong free cash flow.

—Carmen Reinicke

JPMorgan Chase, Wells Fargo rise after earnings

Shares of JPMorgan Chase and Wells Fargo rose in the premarket after the banking giants posted their latest quarterly figures.

JPMorgan Chase earned $3.36 per share on revenue of $33.49 billion, topping a Refinitiv forecast of $2.88 per share. The company's revenue was above an estimate of $32.1 billion. Read more here.

Wells Fargo, meanwhile, posted third-quarter revenue of $19.51 billion, beating a forecast of $18.78 billion. Read more here.

JPMorgan traded more than 2% higher in the premarket, while Wells Fargo rose 1.6%.

— Fred Imbert

S&P 500's Thursday reversal a signal of what's to come

The S&P 500 staged a major rebound along with the Dow and Nasdaq on Thursday, surging more than 2% after being down more than 2% at intraday lows. At the close, the index had jumped more than 5% from lows of the day.

That's a clue for how markets will trade going forward. A similar pattern was seen in the S&P 500 in March 2009, December 2018 and March 2020, all dates that represented lows before rallies out of a bear market, according to Ryan Detrick, chief market strategist at Carson Group.

It also signals how the index may trade today. In its own analysis, Bespoke Group points out that Thursday's rally was just the fifth time since 1993 that the index has posted a turnaround of such magnitude.

The next day, the S&P 500 fell three out of four times. But, for the next week and month, the index was up all four times.

—Carmen Reinicke

UnitedHealth earnings and revenue beat, shares rise

Shares of UnitedHealth rose nearly 1% in the premarket after the health insurance giant posted earnings and revenue that beat expectations.

UnitedHealth earned $5.79 per share on revenue of $80.89 billion. Analysts expected earnings of $5.42 per share on revenue of $80.5 billion.

— Fred Imbert

European markets rise on UK fiscal U-turn hopes

European markets jumped on Friday as speculation abounded that the U.K. government could be about to U-turn on its controversial fiscal policies.

The pan-European Stoxx 600 was up 0.8% in early trade, having more than halved its opening gains. Utilities added 2% while tech stocks were the only sector in the red, shedding 0.7%.

U.K. Finance Minister Kwasi Kwarteng flew home early from the International Monetary Fund in Washington on Thursday night as ministers convened to address the nation's economic chaos.

- Elliot Smith

U.S. unemployment will overshoot on continued rate hikes, economist

With the Federal Reserve expected to undertake more aggressive interest rate hikes, unemployment in the U.S. will rise higher than forecast, RBC Capital Markets chief U.S. economist Tom Porcelli says.

Porcelli expects three more 75 basis-point hikes and predicts the Fed will get to a terminal rate of 4.75%.

"But I do not believe that, you know, putting three additional 75 basis point hikes in the system is going to sort of quell near term inflationary dynamics," he said on CNBC's Squawk Box Asia on Friday.

"What it will do is raise the unemployment rate meaningfully higher than what they're forecasting for next year, which is to say, 4.4%," he said. "There's no way you will have a 4.4% unemployment rate with a Fed that aggressive."

At 4.75%, unemployment would be at 5% which equates to about 2 million job losses, Porcelli adds. The current U.S. unemployment rate is 3.5%.

— Su-Lin Tan

China's September consumer price index grows at fastest pace since April 2020

China's September consumer price index grew annually at 2.8%, the fastest pace since April 2020, pushed higher by food costs. Food prices rose by 8.8% annually.

The nation's CPI rose by 0.3% in September from August, missing estimates of 0.4% in a Reuters poll.

The producer price index for the month grew 0.9% compared to a year ago, also missing expectations of 1% that economists surveyed by Reuters predicted.

— Jihye Lee

CNBC Pro: Stocks in this key market are outperforming the S&P 500 — and it's not where you might expect

The S&P 500 has lost 25% of its value so far this year, but could still fall by "another easy 20%," JPMorgan Chase CEO Jamie Dimon predicted on Monday.

Its sharp decline is a familiar story around the world, as investors flee stocks. But one "surprising" index is bucking the trend and beating the S&P 500 this year.

Pro subscribers can read more here.

— Zavier Ong

Economically-sensitive areas of the market are performing well, says Truist's Lerner

Truist predicts a recession over the next six to 12 months but maintains its view that it's not a time to be short-term negative, according to analyst Keith Lerner.

"Indeed, the markets are the most oversold, or stretched to the downside, since mid-June prior to that rally and sentiment suggests any good news could go a long way on short-term basis," he said. "Thus, we do not view this as a time to press a negative view after such a sharp selloff, at least not short term."

"It is also notable that we are starting to see some better action from some of the more economically-sensitive areas of the market, such as industrials and financials, alongside energy and health care, which are clear market leaders," he added.

— Tanaya Macheel

Hit to corporate earnings could be 'mild,' says Baird's Mayfield

While the economy has shown early signs of cooling, it's nowhere near what the Federal Reserve needs to reach 2% to 3% inflation, says Ross Mayfield, investment strategy analyst at Baird.

"The Fed is likely skittish about pausing too early and repeating the mistakes of 1970s, but in being so, risks overtightening and inducing a recession sometime in 2023," he said. "The good news is that the consumer and labor market have plenty of cushion that past slowdowns have not been afforded. We'd expect a milder recession by historical standards and think the hit to corporate earnings could be equally mild."

— Tanaya Macheel

Stock futures open flat

Stock futures were little changed Thursday night as investors turned their attention to big bank earnings. Dow Jones Industrial Average futures added 20 points, or 0.07%. S&P 500 futures inched higher by 0.08%. Nasdaq 100 futures were lower by 0.04%.

In regular trading, the Dow ended up 827 points after being down more than 500 points earlier in the day. The S&P 500 rose 2.6% to break a six-day losing streak. The Nasdaq Composite jumped 2.2%.

— Tanaya Macheel