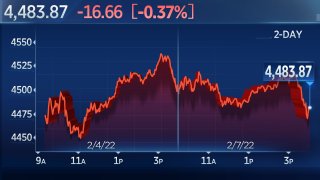

Stocks slipped on Monday to start the week as traders weighed the latest quarterly earnings reports and awaited key U.S. inflation data.

The tech-heavy Nasdaq Composite fell 0.58% to 14,015.67, leading to the downside. The S&P 500 dropped 0.37% to 4,483.87, while the Dow Jones Industrial Average ticked up just 1.39 points to 35,091.13. The major averages alternated between gains and losses for most of the session before retreating in the final hour.

Corporate earnings were again a source of volatility for stocks on Monday. Tyson Foods gained more than 12% after beating earnings expectations, while medical device maker Zimmer Biomet fell 9% after its report.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

Meanwhile, shares of Facebook-parent Meta fell more than 5%, continuing a post-earnings slide. The stock has now dropped 30% since the company's quarterly report last Wednesday. And shares of Netflix, still struggling after the media giant issued weak guidance in January, fell another 2% on Monday after investment firm Needham said the company's current strategy could not win the streaming wars.

"Investor psychology is shifting almost week-to-week, meaning sticking to one's investment convictions is about as hard (or painful) as ever, but also never more important in driving outperformance," Raymond James strategist Tavis McCourt said in a note to clients. "Our conviction remains that economic strength will keep EPS keeps going higher along with interest rates, as we suspect we remain a long way from higher rates materially slowing demand in the economy."

So far 56% of S&P 500 companies have posted quarterly earnings, with 77% beating earnings estimates and 76% topping revenue expectations, according to FactSet. However, there have been some disappointing results from high profile companies, including Meta and PayPal, that have sparked major pullbacks for some stocks.

Money Report

There are more than 70 S&P 500 companies set to post results this week. Three Dow components will provide quarterly updates, including Disney and Coca-Cola. Amgen, Take-Two Interactive and On Semiconductor are among the names that will report earnings on Monday evening.

Elsewhere, shares of Spirit Airlines jumped 17% after Frontier Airlines announced a deal to merge with its low-cost competitor. The news appeared to boost sentiment among airlines generally, with shares of United rising more than 3%.

Peloton shares surged nearly 21% on reports that Amazon and Nike are lining up as possible suitors for the interactive fitness equipment maker. Shares of Snowflake jumped more than 6% after an upgrade from Morgan Stanley.

Stocks were coming off a strong week, following the release of stronger-than-expected U.S. jobs data, while Big Tech names posted their latest quarterly results. The S&P and Nasdaq Composite posted their best week since December.

"We see volatility moderating and expect strong equity inflows from systematic investors (e.g. risk parity, volatility targeting), as well as corporate buybacks that are increasing after recent earnings-related blackout periods," JPMorgan strategist Marko Kolanovic said in a note to clients on Monday.

Big inflation news also is on the horizon, with the Labor Department on Thursday set to release consumer price index data for January. The report is expected to show that inflation rose at a 7.2% pace from a year ago, which if accurate would be the fastest gain since February 1982.

"With an eye on this week's CPI inflation report Thursday, investors may be returning from the weekend with renewed commitment to avoiding the longer duration stocks today," Chris Hussey from Goldman Sachs said in a note to clients on Monday.

Markets have been bracing against the fallout from inflation and are now pricing in about a 35% chance that the Federal Reserve will hike its benchmark short-term borrowing rate by half a percentage point, or 50 basis points, in March.

Government bond yields were little changed Monday after racing higher following Friday's unexpectedly strong nonfarm payrolls report for January. The benchmark 10-year note most recently yielded 1.92%.