U.S. stocks moved slightly higher on Wednesday as investors pored over the latest minutes from the Federal Reserve.

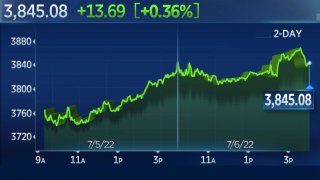

The Dow Jones Industrial Average gained 69.86 points, or 0.23%, to 31,037.68. The S&P 500 added 0.36% to 3,845.08. The tech-centric Nasdaq Composite rose 0.35% to close at 11,361.85.

Stocks bounced after the Federal Reserve released the minutes from its June meeting, showing that the central bank was committed to bringing down inflation. Fed members said the meeting on July 26 and 27 likely also would see another 50- or 75-basis point move, the minutes showed. A basis point is one one-hundredth of 1 percentage point.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

"In discussing potential policy actions at upcoming meetings, participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee's objectives," the minutes stated. "In particular, participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting."

Defensive plays and utilities were some of the best performers on Wednesday. Shares of Northrop Grumman jumped 3.8%, while UnitedHealth Group added nearly 2%. Constellation Energy climbed more than 3%.

High quality tech stocks also performed well, with Cisco Systems and Adobe each adding 1.7% and Microsoft gaining 1.3%.

Money Report

Bond yields extended their gains for the day after the release of the Fed minutes, suggesting that investors may be pricing in a more aggressive central bank. That would be reassuring to some equity investors, who want the central bank to slow inflation so the economy can normalize more quickly.

"I think what markets might be latching onto is the comment about how a more restrictive stance might be appropriate if inflation pressures persist," said Zachary Griffiths, macro strategist at Wells Fargo. "That's probably more hawkish than Powell's comments at his press conference."

"That might be a comment that indicates they would tolerate a mild recession and continue to tighten policy if the inflation data remains too elevated. It's certainly between a rock and hard place but I think they're trying to communicate they are committed to getting inflation under control," Griffiths added.

Energy stocks were some of the worst performers on the day, as oil prices continued their recent slide. Shares of Chevron slipped 1.3%, and Diamondback Energy fell 3.4%.

Investors continued to worry about whether the economy is falling into a recession after the benchmark 10-year U.S. Treasury yield fell below the 2-year yield. The so-called yield curve inversion historically has been a warning sign that the economy may be falling or has already fallen into recession.

Some Wall Street analysts say a recession could be mild. On Tuesday Credit Suisse said it sees the U.S. dodging a recession as it slashed its year-end S&P 500 target to reflect the effect of higher capital cost on stock valuations.

"We're seeing a game of chicken right now, with growth and inflation barreling ... toward each other to see which one is going to flinch first. Ultimately, they're both going to turn over, but which one turns over first is going to be the most critical for the path forward," said Chris Osmond, the chief investment officer at Centura Wealth Advisory.

There were some bright spots in economic reports on Wednesday.

The Institute for Supply Management services PMI data came in better than expected, though the report did show a slight slowdown in growth. Job openings also came in higher than expected, at more than 11 million.

However, mortgage demand fell week over week even as rates declined, according to the Mortgage Bankers Association.

Wednesday's moves follow an intraday reversal in the previous session. The S&P 500 and Nasdaq Composite have now gained ground in three straight sessions. This is the first three-day winning streak for the S&P 500 since late May.

Lea la cobertura del mercado de hoy en español aquí.