- The U.S. lags behind other developed countries relative to unemployment benefits, according to researchers in a new paper published by the Massachusetts Institute of Technology.

- Duration, weekly pay and number of recipients are a few areas of concern, according to the paper.

- Covid-19 is highlighting these flaws as millions turn to the unemployment system for help.

The safety net meant to protect unemployed workers from financial devastation is defective, and the coronavirus pandemic has starkly exposed its many shortcomings, economists argue in a new paper published by the Massachusetts Institute of Technology.

The pandemic, which triggered the deepest economic downturn since the Great Depression in the 1930s, has pushed more than 1 million Americans to file for unemployment benefits each week since March. The surge is unprecedented both in volume and duration.

However, the system has broken down for workers in many respects.

More from Personal Finance:

Unemployment is falling. Long-term unemployment is ballooning

What Biden's student loan forgiveness plan would mean

They lived paycheck to paycheck. Then the pandemic hit

Even before the pandemic, the U.S. ranked as one the worst performers among developed countries relative to metrics such as benefit pay, duration and number of recipients, according to the paper.

"The crisis really shined a bright light on [its] inadequacies," said Susan Houseman, research director at the W.E. Upjohn Institute for Employment Research and a co-author of the MIT report.

Money Report

(Houseman wrote the paper with Katharine Abraham, an economics professor at the University of Maryland, and Christopher O'Leary, a senior economist at the Upjohn Institute.)

Here are some of the issues they identify.

Duration

Widespread failures of the unemployment system stem, in large part, from policy decisions among some states following the Great Recession.

That downturn, just over a decade ago, depleted the trust funds states use to pay jobless benefits, leading states to borrow from the federal government to cover shortfalls, according to the researchers.

Instead of raising business taxes to replenish the coffers, some states — especially those in the Southeast — cut benefits in a few ways.

Among them was the duration of benefits.

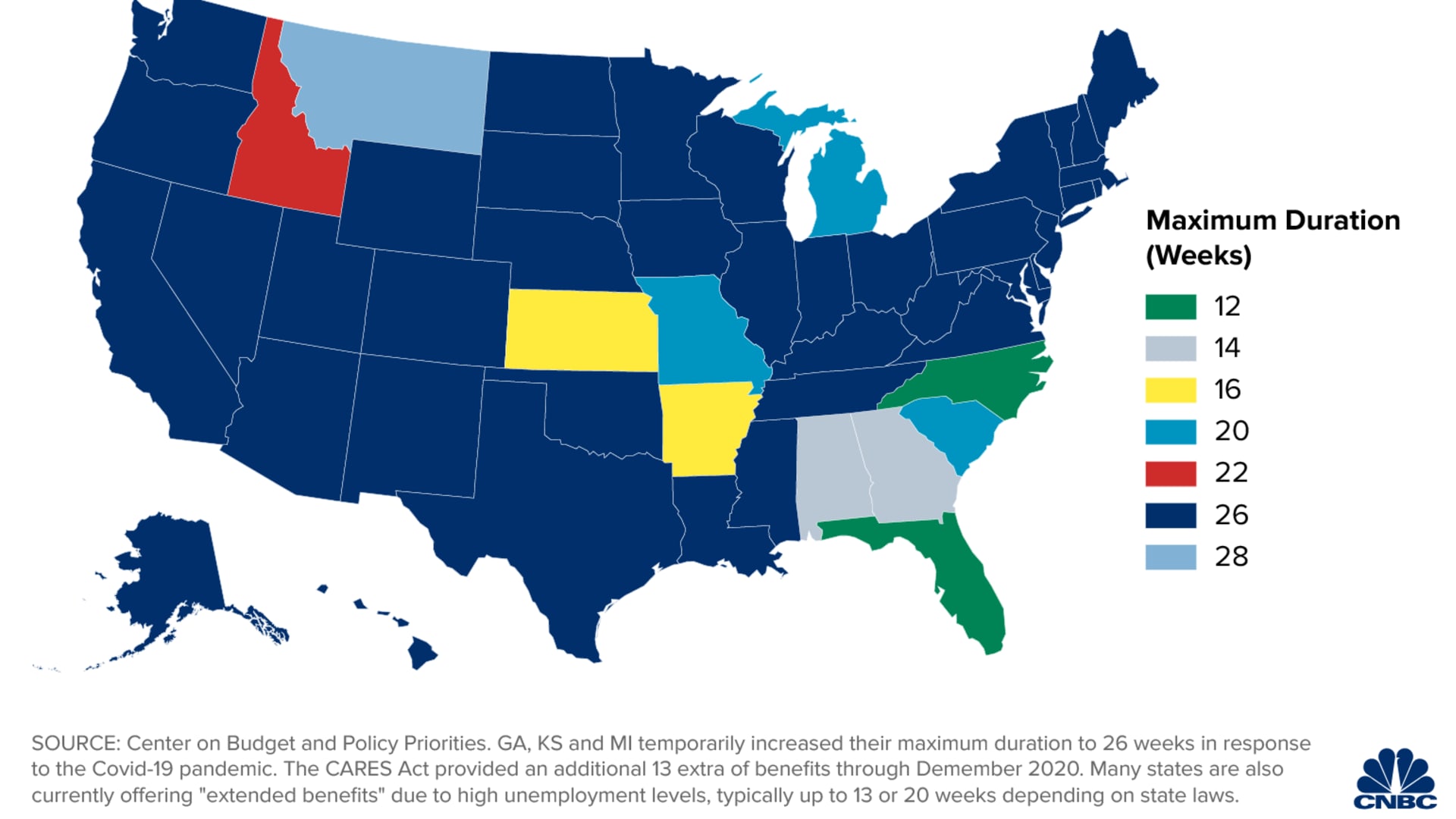

Since the 1950s, the common minimum standard was to pay benefits for up to 26 weeks, or six months.

By the start of 2020, a fifth of states had cut that duration, some by more than half. Florida and North Carolina, for example, pay aid for up to 12 weeks.

The U.S. ranked 33rd out of 34 developed countries relative to the maximum duration of unemployment benefits, ahead only of Hungary, according to research conducted by the Organization for Economic Co-operation and Development as of 2014.

Congress swiftly passed a relief law, the CARES Act, in the early spring to temporarily plug some gaps in the unemployment system. The law offered workers an extra 13 weeks of benefits, among other enhancements, though it's scheduled to end after December.

Low pay

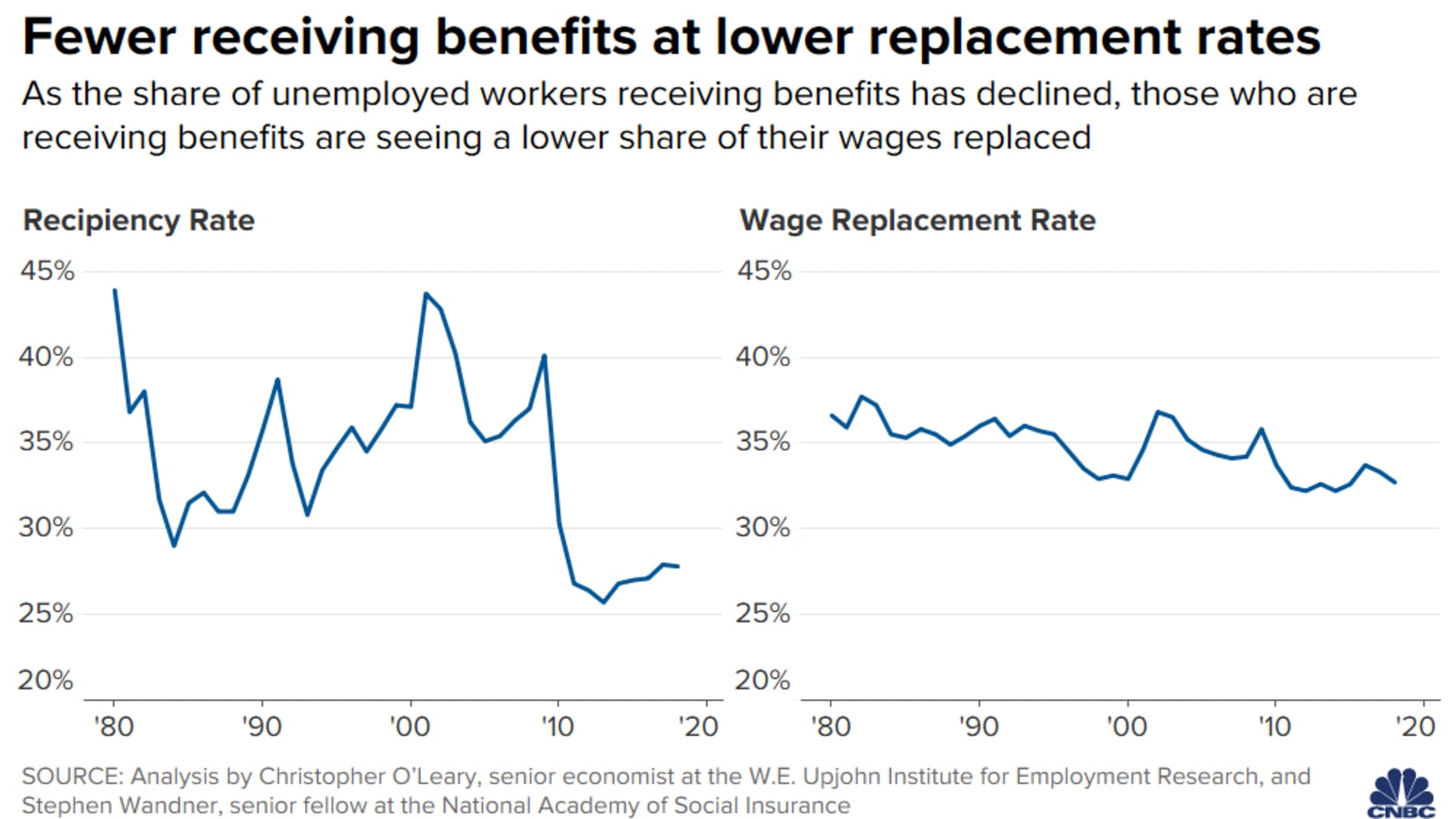

Historically, the goal of the unemployment system was to replace about half of workers' lost wages.

However, the share of recipients getting half their prior pay has fallen — even as research suggests "a higher replacement rate may be socially optimal," according to the MIT paper.

In 2018, the average "wage replacement rate" had dipped to less than a third.

That's partly due to a cap states place on weekly benefits. Those caps haven't kept pace with wage growth in most states, researchers said.

Mississippi pays the lowest maximum benefit — $253 a week. Massachusetts pays the most — up to $1,234 a week.

In September, states paid $312 a week (about $1,250 a month) to the average worker, according to the Labor Department.

The CARES Act paid an extra $600 a week through July. An executive measure then offered an extra $300 a week through early September.

Difficult to qualify

Some states have made it more difficult to qualify for aid.

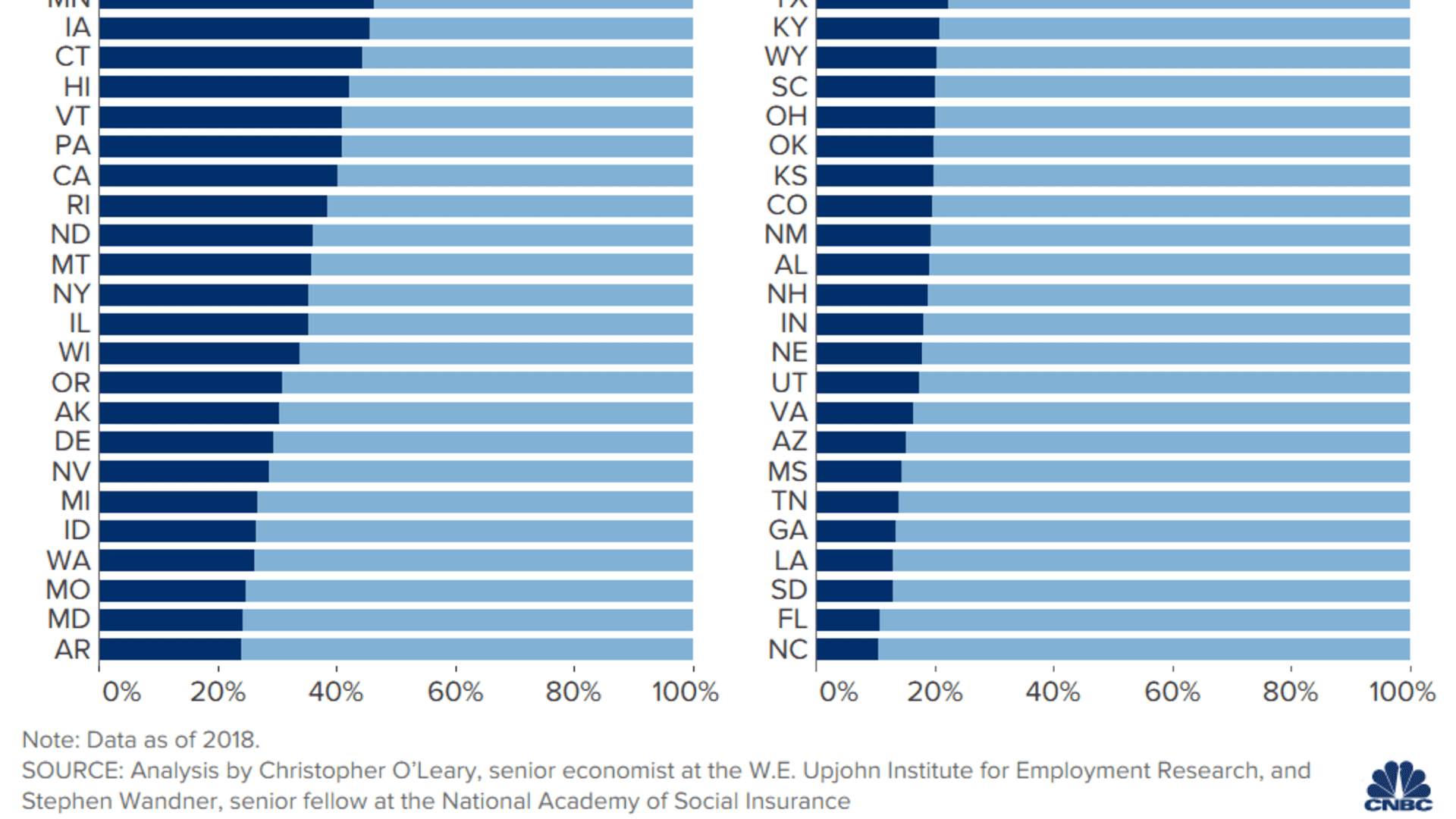

Over the last decade, the share of jobless workers receiving benefits fell to historic lows, according to researchers. Nationwide, fewer than 1 in 3 receive benefits, on average.

But that masks wide variation among states. For example, in 2018, a year when all states' economies were relatively strong, eight states paid benefits to between 10% and 15% of unemployed workers, according to the MIT paper. Conversely, nine states paid benefits to more than 40% — three to four times as many people.

Low wages and part-time work

Low-wage and part-time workers have an especially difficult time qualifying for benefits.

They're less likely to meet the earnings thresholds states set to be eligible for benefits.

For example, a worker in Arizona, Indiana, Michigan, Ohio or South Carolina who worked 20 hours per week at the state's minimum wage for a half-year would have had insufficient earnings to qualify for unemployment benefits in 2019, according to the researchers.

In many states, workers must be available for full-time work to qualify. Therefore, a worker who loses a part-time job and seeks a new part-time job may not qualify — even if their availability is limited due to family obligations like child or elder care, researchers said.

Self-employed

The self-employed are the largest group of workers typically ineligible for unemployment insurance, researchers said.

Congress extended benefits to this group as part of the CARES Act. Their aid is scheduled to end after December.

The ranks of the self-employed are likely to grow, partially as Covid-19 pushes companies to automate more functions and displaces workers into non-traditional work arrangements, researchers said.