The shipping showdown has started.

With Black Friday and Cyber Monday raking in record amounts of online sales this year, according to Adobe, delivery rivals FedEx and UPS are gearing up for a busy holiday season.

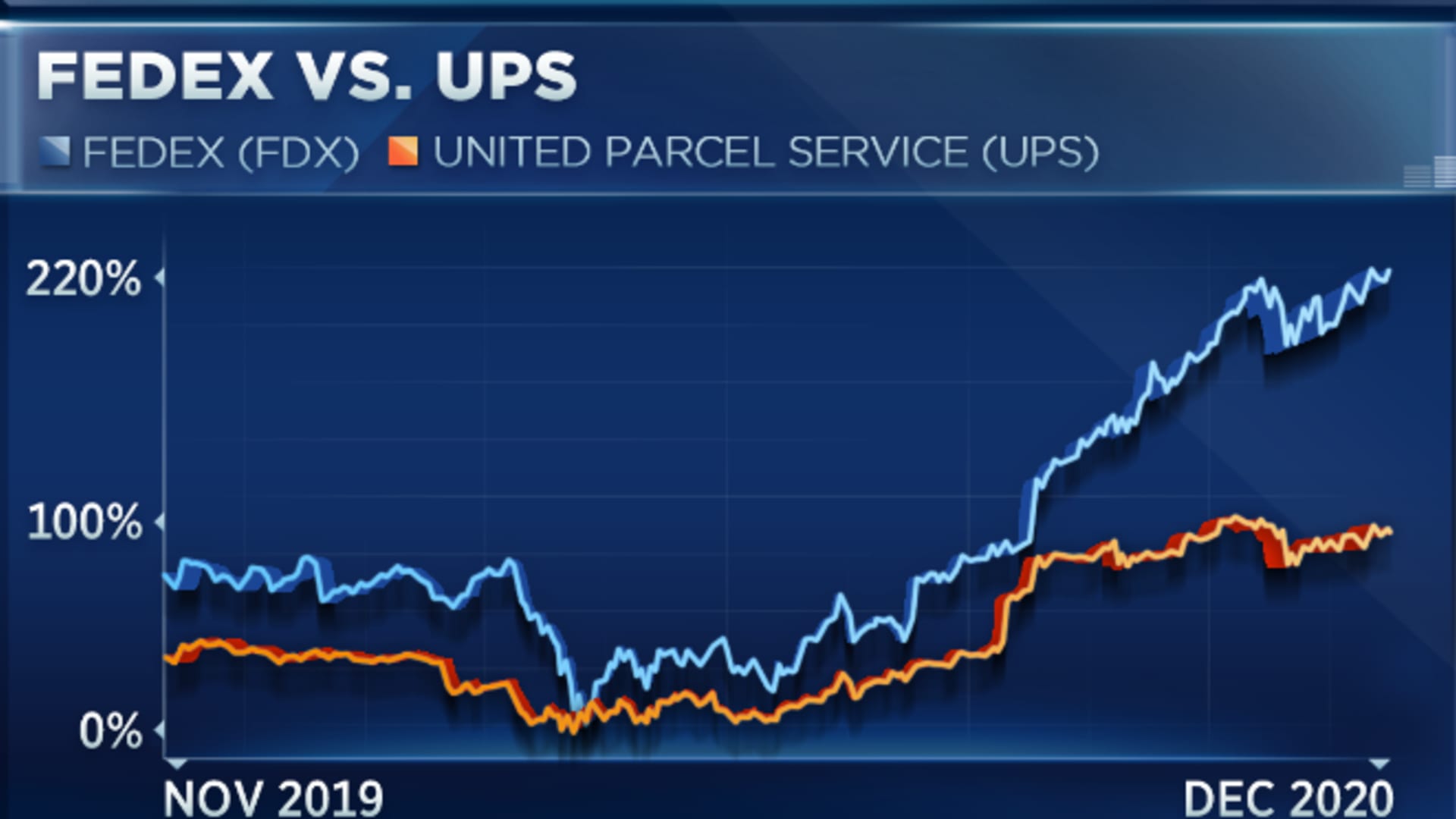

FedEx shares appear to have the upper hand, up almost 28% in the last three months with 71% of analysts rating the stock a buy, according to FactSet. Barclays on Tuesday upgraded the stock to overweight from equal weight, citing "an abundance of growth opportunities" tied to the e-commerce expansion.

UPS is up 3.5% over the same time frame and has Wall Street more divided: 54% of analysts rate that stock a buy, with 27% remaining neutral and 19% in the sell camp. Also, Morgan Stanley warned on Tuesday of "competitive secular threats" facing UPS that could erode its consumer-facing business.

As of Tuesday, two traders were siding with the underdog.

"I prefer UPS over FedEx here," Mark Tepper, president and CEO of Strategic Wealth Partners, told CNBC's "Trading Nation." "FedEx has outperformed as of late, but I think a lot of that is really just a product of mean reversion."

Money Report

After lagging UPS for several years, FedEx shares were "bound to catch up at some point," Tepper said.

"But FedEx, in my opinion, [has] a long history of kind of overpromising and underdelivering," he said. "They were actually on the ropes pre-Covid. ... UPS, in my opinion, just flat-out executes better."

Not only does UPS have "one of the best management teams out there," but the company has more exposure to the consumer, a key relationship in the age of the homebound web surfer, Tepper said.

"I would stick with UPS here. I think that's the better play of the two," he said.

TradingAnalysis.com founder Todd Gordon agreed, but noted that FedEx's life-to-date return has been "much better" than that of UPS.

"FedEx has also done better from the Covid lows," he said in the same "Trading Nation" interview, citing a chart.

FedEx's main problem is its infrastructure, namely the communication lines between its ground and air freight segments, Gordon said.

"They need to sort of get that together," he said. "I think their margins have improved as they've relied on their ground game … and as we go back to the air, I think UPS might pick up. ... So, I agree with Mark. FedEx has been a better performer. I think the UPS trade is where we'd want to stick."

FedEx shares closed less than half of 1% higher on Tuesday after hitting an all-time high. UPS shares fell nearly 2%.

Disclosure: Tepper and Strategic Wealth Partners own shares of UPS.