- Shares of Clubhouse Media, which runs content creator houses, surged this year.

- But the boost comes from a mix-up in names with the Clubhouse social media app.

- Now the company will need to set itself apart and prove running influencer houses is a viable business.

It was a phrase that has been uttered countless times during the era of Zoom meetings. But this time, it inadvertently sent an unknown stock to new heights: "Can you hear me?"

Elon Musk was making his debut on Clubhouse, the audio-only app that has exploded in popularity in recent months, in part because of Musk's participation in that room on the last day of January. Within seconds, the room reached its 5,000-person capacity. Overflow rooms crowded in to listen to the Tesla and SpaceX CEO. In the words of the room's host, Sriram Krishnan, "You've pretty much broken Clubhouse."

Little did anyone know, Musk's participation would also set off massive interest in a completely unrelated company: the publicly traded influencer media and marketing firm Clubhouse Media Group, which isn't affiliated with the private, Andreessen Horowitz-backed audio app that's about a year old.

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

At the end of the interview, Musk called the experience "awesome" and said he hadn't even known about the app a week prior. It set interest in Clubhouse ablaze. Google searches for "Clubhouse stock" reached a peak on Feb. 1, the day after Musk spoke. But instead of buying into shares of the app, retail traders were finding the marketing and media firm for influencers that runs several influencer mansions. That didn't stop many of them, who bought it due to confusion or who wanted to play the confusion.

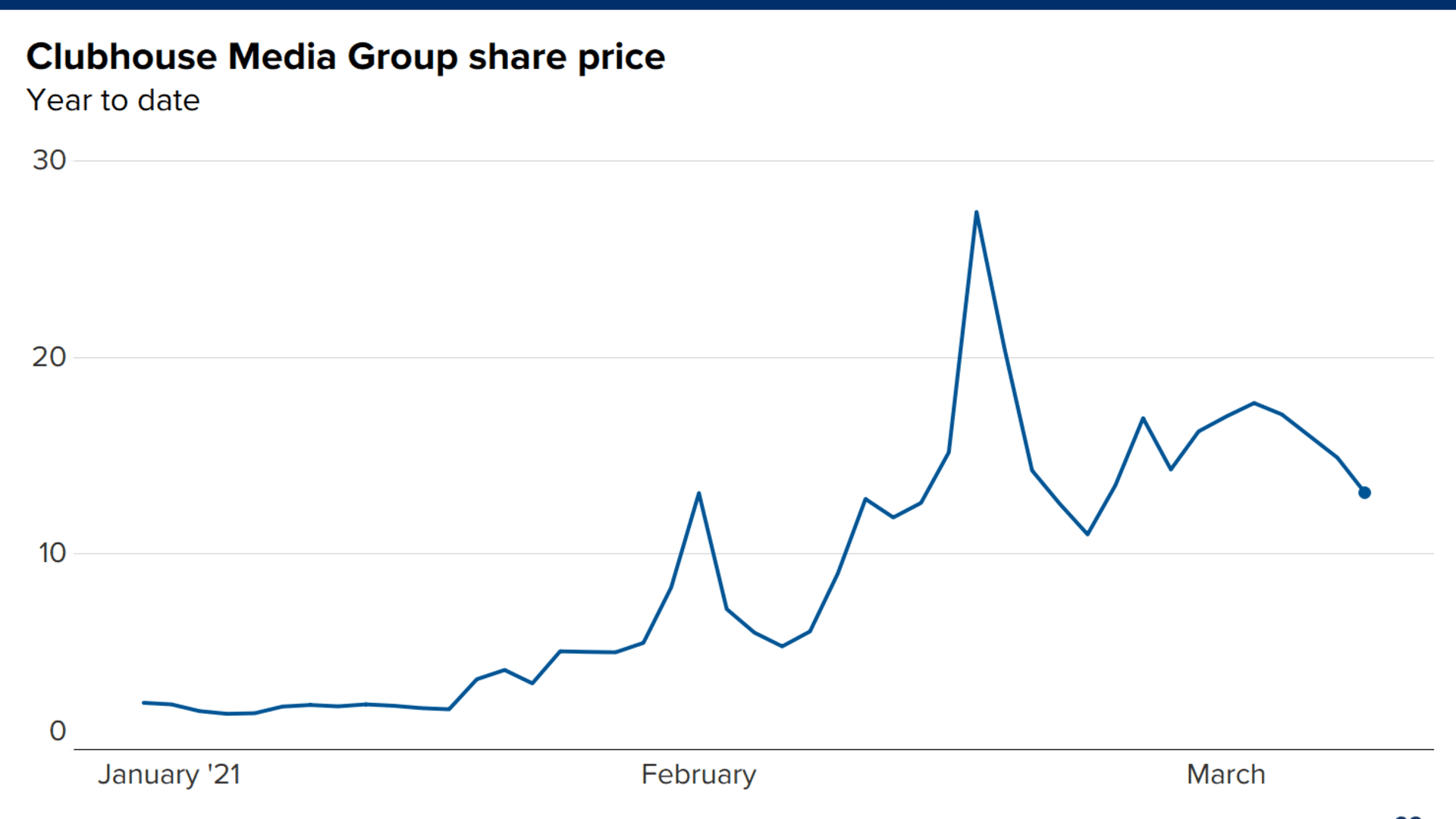

Shares of Clubhouse Media, which is most known for running content creator houses, had already been on the rise by this point, rising on general app interest. As of Monday's close, the stock is up 472% year to date, trading at $13.90 apiece, putting its market cap at $1.3 billion. At its highest, the stock traded at $28.43 per share on Feb. 16. Compare that to its price of $2.50 on Nov. 12, when the company completed its reverse merger to go public.

From health care to managing influencers

Money Report

Clubhouse Media, previously called West of Hudson, was launched last March by CEO Amir Ben-Yohanan, lawyer and company president Chris Young and Daisy Keech, a social media influencer with millions of followers who had just left another high-profile house. The company wanted to launch its own house, where Keech would bring some friends. Keech has since moved out to focus on her own brands.

Creator mansions usually house a handful of influencers at any time, serving as part agency and part elaborate set, so they can make continuous, monetizable content with an opulent background. Instead of paying rent or fees for things like housekeeping, creators often provide promotional content for advertisers or the house itself.

Grouping a handful of influencers together also helps them cross-promote and expand their reach. The company said in a January filing that one of its influencers grew their Instagram followers to 5.2 million from 3.22 million in just four months, while their TikTok followers jumped to 6.2 million from 3.4 million.

Young said Clubhouse Media works with the creators on traditional brand deals, taking a 20% fee. They also create intellectual property they could license and monetize. So, for example, creators would make YouTube videos. In one case, Young said one of their houses makes enough revenue from Google's AdSense to pay for rent.

The company also has a sort-of venture incubator.

"The idea was either to acquire or start companies or hold equity in companies that we could then use our marketing arm, which was our reach of influencers, to go and push top-of-funnel traffic to," he said. So far, the company has only committed to a handful of ventures, including nearly $400,000 to house member Lindsay Brewer's racing career.

The company is also figuring out how to offer shares to its creators. Currently, one creator has stock in Clubhouse Media, while more are being onboarded, Young said.

The company's journey to the market was a bit unusual, especially as it was the first content house to do so. Instead of completing an IPO or SPAC, it went public through a reverse merger. The already-public Tongji Healthcare Group acquired the company in November, and the influencer management company was left in control.

Around the same time, the company applied to change its name to Clubhouse Media Group. It also changed its ticker symbol to "CMGR" from "TONJ." That change didn't go through until Jan. 20, when the confusion over which company was which was well on its way.

"When we did the [reverse takeover] transaction, when we bought that shell, the idea was to always name it to the original name of our house, which was Clubhouse," Young said, referring to the company's first creator house in Beverly Hills.

'It's a little frustrating'

The timing was especially poor, as the Clubhouse social media app was opening up to a wider audience, expanding from its once tight-knit group of Silicon Valley investors and celebrities, such as Oprah Winfrey and Jared Leto. As of March 14, it was downloaded 12.7 million times, according to mobile data and analytics firm App Annie.

"It's a little frustrating," Young told CNBC in a video call earlier this month. "It's a weird situation this year because we were so used to last year being the Clubhouse and no one knew about the Clubhouse app. This year it's kind of turned into everyone's talking about the Clubhouse app and there's confusion."

"We've obviously tried our best to avoid confusion. We've issued public statements. We want to make sure that shareholders are not confused: We have no affiliation with them whatsoever. We're a different company," he added.

Young said that Clubhouse Media still has enough media value and presence to continue with its Clubhouse name despite the confusion. There's also the question of whether the app can survive following the pandemic.

"I believe we were the first ones publicly active on the internet everywhere with a lot of press, and, frankly, I don't know where the Clubhouse app is going to go," he said. "There's going to be a lot of competition in the space. There's 30 other competitors in the audio space coming up; they may survive, they may not."

Spokespeople for the app and Andreessen Horowitz did not respond to requests for comment on the mix-up.

What's next for Clubhouse Media

Creator houses aren't a new concept, as The New York Times reported last January, though it appears as if a new generation is popping up rapidly in tandem with the rise of TikTok.

Still, Clubhouse Media will have to work to persuade investors that backing influencers is a viable business.

For the fiscal years ended Dec. 31, 2020, and Dec. 31, 2019, the company reported net losses of $2,565,409 and $74,764, respectively, and negative cash flow from operating activities of $1,955,239 and $30,488, respectively.

"There is substantial doubt regarding the ability of Clubhouse Media to continue as going concerns as a result of their historical recurring losses and negative cash flows from operations as well as their dependence on private equity and financings," the company said in a March 15 10-K filing. The company expects to continue to report losses and negative cash flow for the foreseeable future, it added.

Young said earlier this month that the company will spend this next year focusing on building a more robust and diverse revenue model. That could mean acquiring companies anywhere from the social media space to software companies, such as digital agencies that run brand deals, or software platforms that would allow for influencers to create additional revenue.

Most recently, Clubhouse Media acquired "The Tinder Blog," a popular meme page with 4.2 million Instagram followers, for an undisclosed amount. In a press release announcing the deal, the company said aggregator accounts such as the blog "make for highly sustainable and scalable businesses that complement our mission and portfolio."

Clubhouse Media may also begin expanding its reach of content houses, saying in a filing this month that it intends to add two to four houses each year. Young said the company is currently looking at Miami; Austin, Texas; Scottsdale, Arizona; and Nashville, Tennessee, though nothing's set in stone. It could also venture internationally to Dubai and Bali. The company now operates five houses total, in California, Las Vegas and Europe, with a variety of residents.

Ultimately, Young said, he wants to move past the confusion and establish Clubhouse Media as its own, successful company.

"It's important to know that we're a business that's been in operation, we've been up and running for a year now and we have great aspirations and I think a platform to really be one of the few companies that's publicly traded that invests in a diverse portfolio in the social media space," he said.