The cost of property insurance seems to be getting out of control in certain parts of California.

The risk is just too hot in the Golden State, according to a national insurance company that has decided to do less business in California.

State Farm is saying they’re done with California when it comes to "new" property and casualty insurance for homeowners, but what does this mean to you?

Get San Diego local news, weather forecasts, sports and lifestyle stories to your inbox. Sign up for NBC San Diego newsletters.

According to the company's announcement, they will "cease accepting new applications including all business and personal lines property and casualty insurance.”

The company explains this is “due to historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging and reinsurance market...”

“We certainly never want to hear that an insurance company is having to stop writing new business,” said Karen Collins with the American Property Casualty Insurance Association.

NBC 7 Responds

Collins said the increase in wildfires has made it difficult, if not impossible, for companies to cover the risk.

“It may not necessarily come as a surprise in just the sense that insurance companies are having a very difficult time just navigating what is a very turbulent marketplace," Collins said.

Including in the reinsurance market, she says, which is insurance for insurance companies. Collins says on top of that are state regulations that limit rates to what the California Department of Insurance approves, a process that could take more than a year.

“So as a result, insurers may be experiencing significant rate inadequacy, which the California Department of Insurance is now working with insurers to try to address those issues," Collins said.

In a statement to NBC 7 Responds the California Department of Insurance responded to State Farm’s announcement saying in part:

“While insurance companies prioritize their short-term financial goals, the long-term goal of the department of insurance is protecting customers.”

The department says that current State Farm policy owners and renewals are not impacted, and adds that more than 115 insurance companies currently offer California homeowners’ insurance.

The state also mandates companies to offer discounts for fire mitigation efforts by their policyholders.

Both CDI and home insurance industry groups encourage homeowners to look at these incentives not only for the discounts but as a way to bring down overall home, property and casualty insurance costs throughout the state. Also don’t forget to shop around for the best policy for you and your home, even if it means raising your deductible.

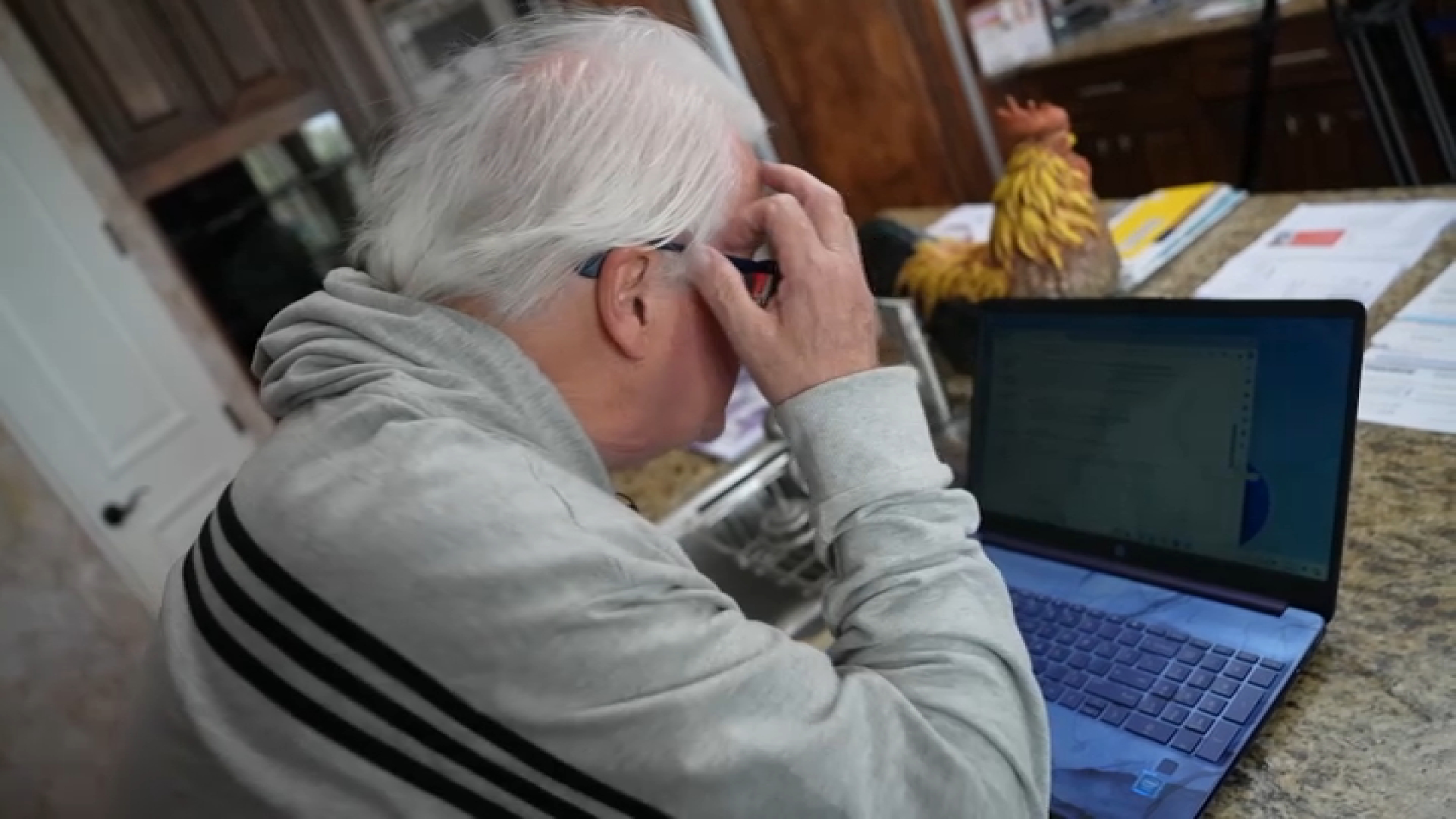

Sharon Rabell of Santee reached out to NBC 7 Responds desperate for answers. Her HOA was unable to renew its property insurance. They finally found a policy, but the cost went from about $50,000 to more than 500,000 a year, passed on down to the homeowners.

Rabell's HOA was not a State Farm customer.

This is an example of how a lot of families and communities are struggling to find affordable coverage, thanks to wildfire risks.

Rabell said she and her HOA have no choice but to keep looking.

“I don’t want to lose the equity in my home, I don't want to borrow against it, I've worked too hard," she said.

In its announcement, State Farm Insurance makes it clear that this decision does not affect its auto insurance policies and that it’ll continue to evaluate its approach based on California's market conditions.