High Inflation Hurting San Diego Gig Workers Impacted By High Gas Prices

-

North County Bus-Driver Shortage Leads to Months of Canceled Trips, Frustrated Riders

Bus boss says NCTD will likely have to hike starting pay higher to get drivers on board.

-

ArcLight Cinemas and Pacific Theatres to Close Permanently

Pacific Theatres and ArcLight Cinemas announced late Monday that the chain of movie theaters would be closing permanently after closing doors more than a year ago due to the pandemic.

-

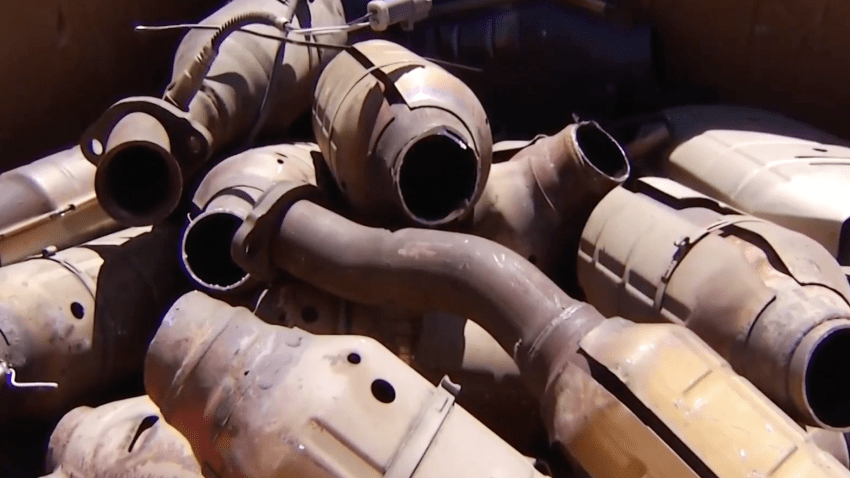

Thieves Continue Targeting Catalytic Converters After Precious Metals Inside Soar in Value

Thieves are targeting a very valuable device under your car, the catalytic converter. In January, Oceanside Police warned people about the thefts. Almost four months later, they say those thefts have ... -

Art Attack: San Diego Airport Hires Famed Designer for Terminal Makeover

Officials from the San Diego International Airport announced this week that they hired a lead artist with an international resume to create a facade for the building to be constructed to replace Termi...